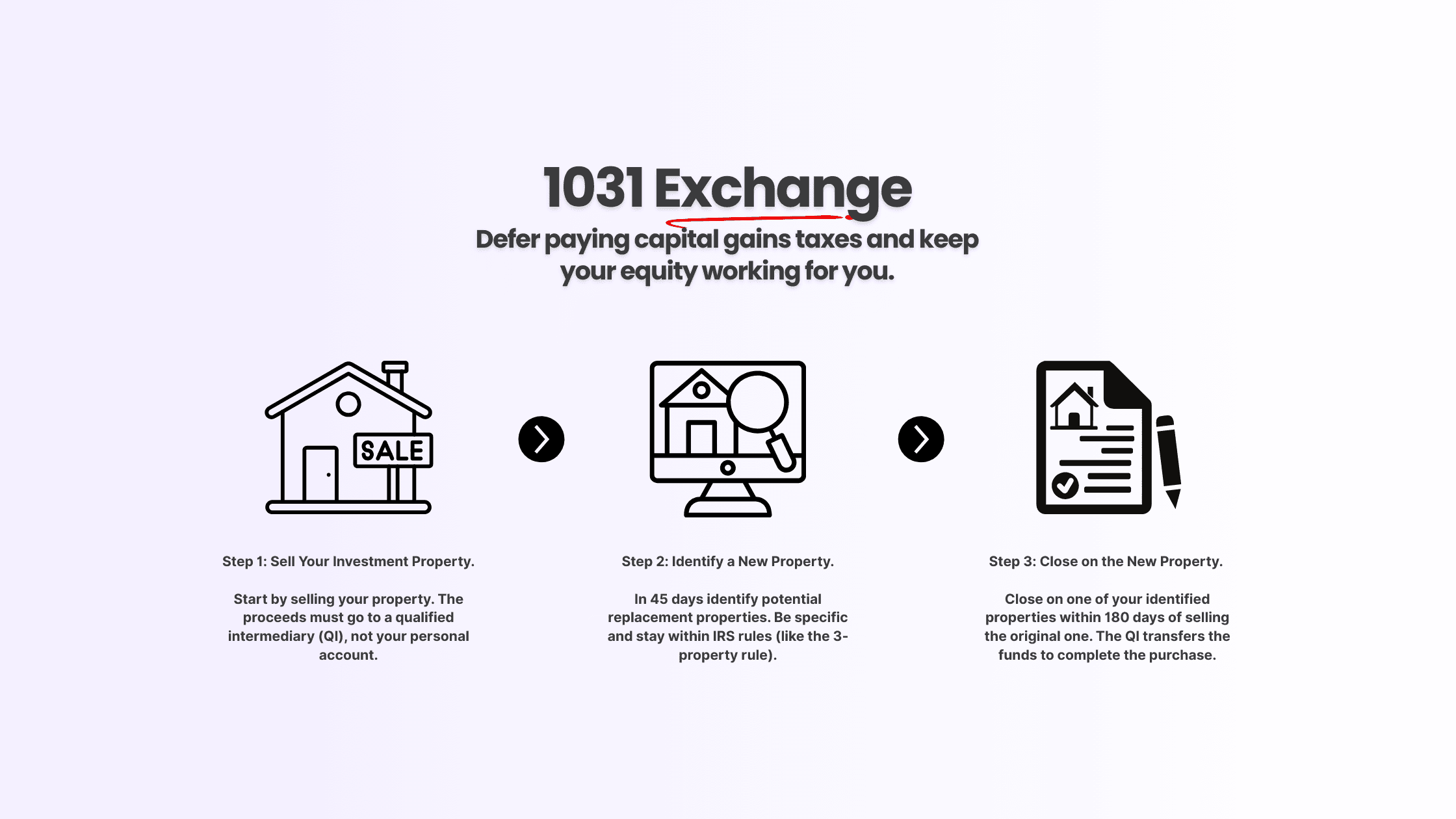

What Is a 1031 Exchange?

A 1031 exchange allows a real estate investor to defer capital gains taxes on the sale of an investment or business-use property by reinvesting the proceeds into another “like-kind” property. This tax deferral mechanism can be used repeatedly, allowing for portfolio growth and capital preservation over time.

- Governed under IRC Section 1031

- Applies only to real property held for productive use in a trade or business, or for investment

- Must satisfy strict procedural rules regarding timelines, identification, and use of intermediaries

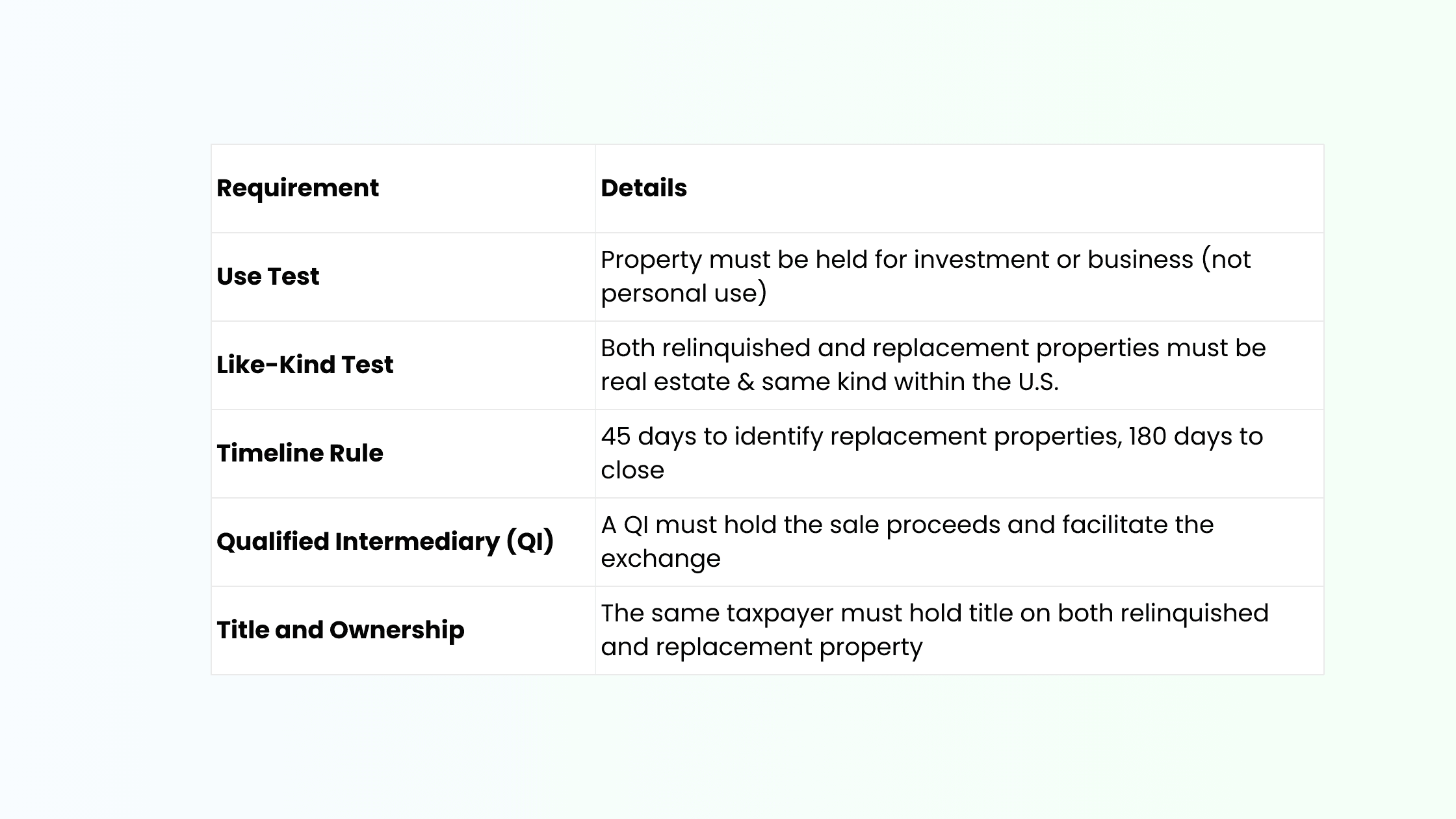

Core Legal Requirements Under IRS Code

The foundation of a 1031 exchange lies in timing, property use, and third-party handling. Here are the minimum federal requirements that apply in Washington as well.

Failing to meet any of these conditions results in disqualification and tax liability.

Washington-Specific Considerations

While 1031 exchanges are federal, Washington presents a few unique challenges and opportunities:

- No state income tax: Unlike California or New York, Washington investors avoid additional state-level income tax on capital gains. However, local excise and real estate taxes still apply.

- Real estate excise tax (REET): WA imposes this tax at the time of property transfer this is not deferred by a 1031 exchange.

- High-demand markets: Areas like Seattle, Bellevue, and Kirkland often involve properties with rapid appreciation and low inventory requiring careful planning to meet identification deadlines.

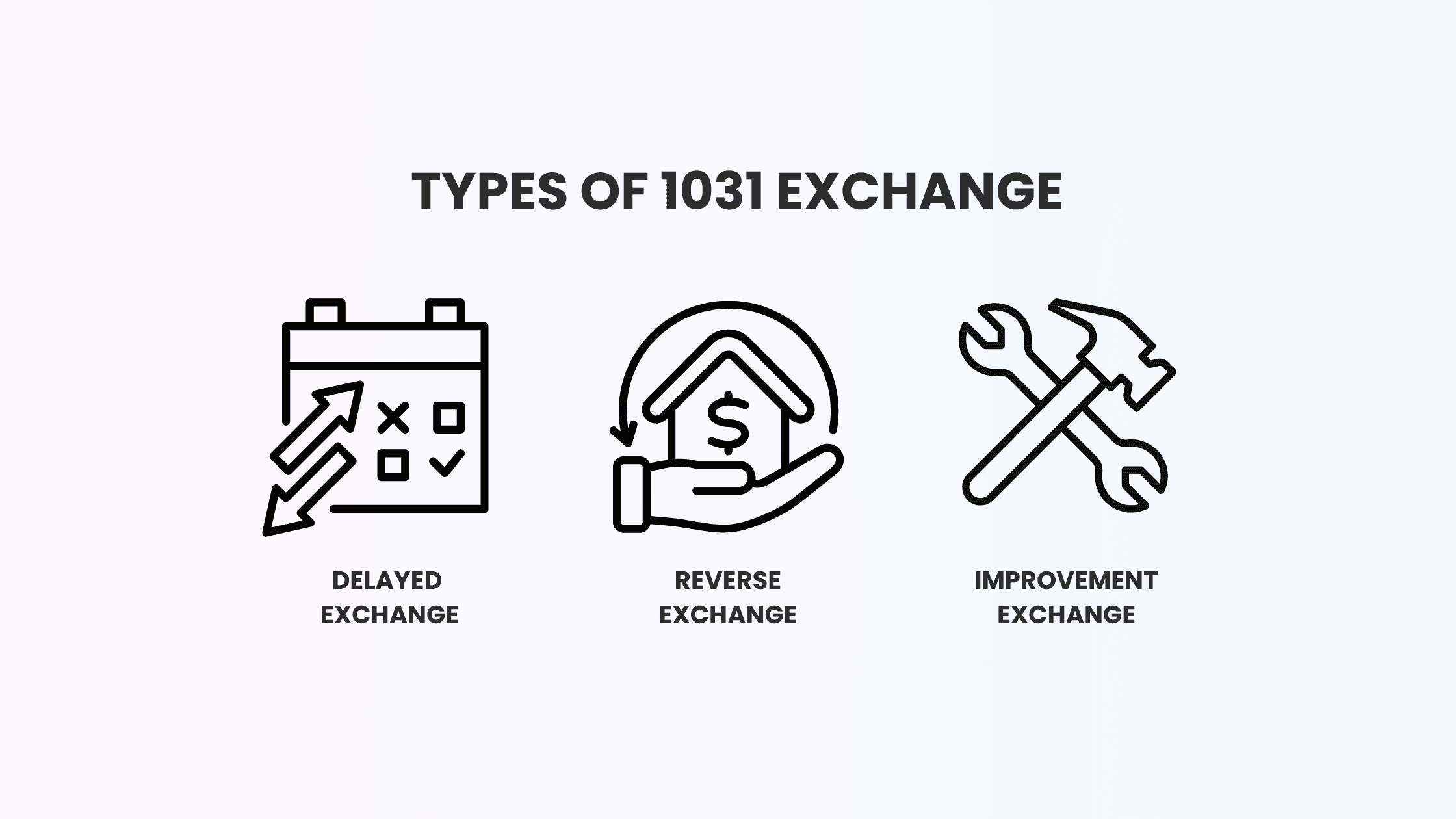

Types of 1031 Exchanges in WA

Washington investors may utilize several types of exchanges

- Delayed Exchange (Standard): Sell one property and acquire a replacement within 180 days. This is the most common format.

- Reverse Exchange: Acquire the replacement property before selling the original. Requires a more complex structure and often uses Exchange Accommodation Titleholders (EATs).

- Improvement Exchange: Also called a construction exchange, this allows investors to use exchange funds for capital improvements on the new property during the 180-day window.

Role of Qualified Intermediaries (QIs)

Investors are not allowed to touch or control the sale proceeds. A qualified intermediary (also known as an exchange facilitator) must hold the funds and document the process.

Washington requires:

- Licensed QIs or companies operating in compliance with state law

- Clear written exchange agreements

- Segregated escrow or trust accounts

Many Seattle-based 1031 exchange companies specialize in this service, and it is critical to vet their experience, bonding, and legal compliance.

Identification and Closing Timelines

The IRS enforces two critical deadlines:

- 45-Day Identification Window: From the date of sale, the investor must submit a written identification of one or more replacement properties.

- a. Up to 3 properties of any value

- b. Or any number of properties as long as their combined value does not exceed 200% of the relinquished property

- 180-Day Exchange Period: The investor must complete the acquisition of the replacement property within 180 days from the sale.

These deadlines are calendar-based and non-negotiable.

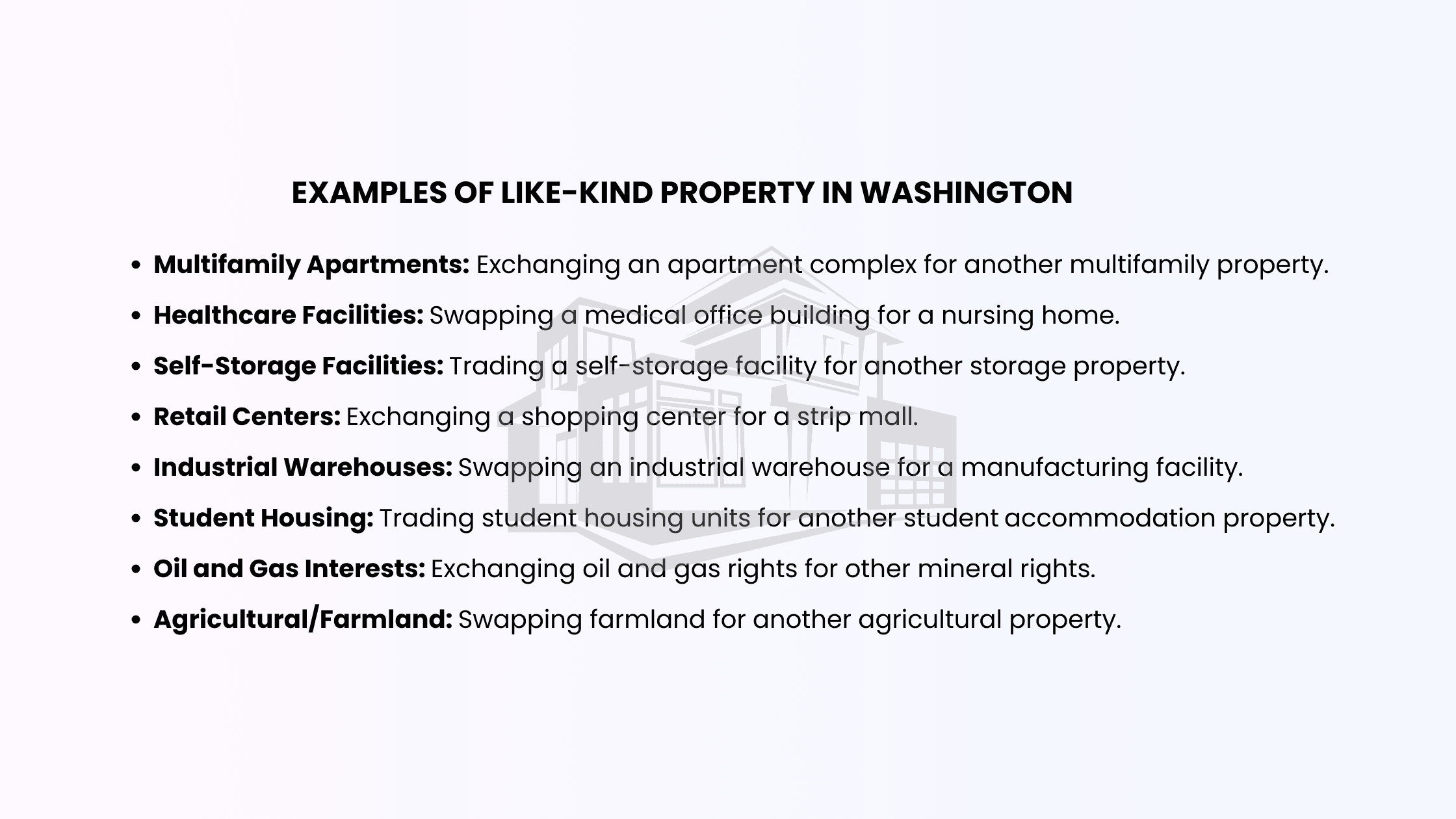

Like-Kind Property Interpretation

In Washington, “like-kind” is interpreted broadly, However:

- Primary residences, second homes, or properties for personal use do not qualify

- Foreign property is not eligible for 1031 exchange

- You cannot exchange into a real estate investment trust (REIT) unless structured through Delaware Statutory Trusts (DSTs)

Reverse & Improvement Exchanges

Increasingly used in competitive markets like Seattle

Reverse Exchange:

- Investor acquires the new property first

- The old property is “parked” by a title-holding company until it is sold. Complex but offers more flexibility in tight inventory markets.

Improvement Exchange:

- Use part of the exchange funds to renovate or build on the replacement property. All improvements must be completed before the 180-day deadline.

Both require expert structuring and experienced facilitators.

Risks, Limitations, and Best Practices

Risks:

- Timeline violations invalidate the exchange

- Failure to reinvest all proceeds results in taxable “boot”

- Improper use of intermediaries could trigger disqualification

- Changing tax code interpretations (especially at the federal level)

Best Practices:

- Start planning before selling your property

- Pre-identify target markets and replacement options

- Engage licensed 1031 advisors and facilitators

- Maintain detailed records and file IRS Form 8824

📬 Get Email Updates!

Stay ahead with insider tips on tax-saving moves, investment tactics, and Washington market updates.

Working with 1031 Exchange Advisors in Washington

The right advisor can ensure full compliance, minimize risk, and help structure your exchange strategy in a way that aligns with long-term investment goals.

You may need:

- 1031 exchange attorneys

- Tax CPAs with real estate focus

- 1031 exchange facilitator companies in Seattle or Spokane

- AI-powered search tools to identify qualifying properties

WithJoy.AI can connect you to trusted advisors and investment listings already flagged as 1031-eligible.

Getting Started with WithJoy.AI

Our experts help investors handle residential real estate exchanges.

- Identify 1031-eligible investment properties across Washington.

- Access to qualified intermediaries & legal professionals.

- AI-driven timelines, documentation, & deadline tracking.

- Smart offers and streamlined closing workflows.

- Cash Rebate at Closing.

- Get in touch & start touring properties in Washington.

- Start Your Exchange Plan with a Custom Timeline.

Frequently Asked Questions

Check out our explainer video for an overview of Joy

Rated by satisfied customers

Reviews from our Homebuyers

Conclusion

Executing a 1031 exchange in Washington State is a strategic way to defer taxes and scale your portfolio, but it demands precision, knowledge of local law, and expert support.

From urban centers like Seattle and Bellevue to suburban or rural holdings across the state, understanding Washington’s unique tax and legal environment can position you for long-term success.

For Residential investors, with the right partners and technology like WithJoy.AI you can turn your next 1031 exchange into a seamless, profitable transition.