3 minutes read

Can You Buy a House with a Credit Card?

Can you buy a house with a credit card? Learn the risks, expert tips, and real alternatives.

KB

Kyler Bruno

07/11/2025

“What if I just charge the down payment?”

It’s a question more buyers are asking as home prices rise and savings struggle to keep up.

At first glance, using a credit card to buy a home might sound like a clever workaround. After all, cards are convenient, fast, and accepted almost everywhere. But when it comes to real estate, what’s easy isn’t always wise or even allowed.

Let’s break it down clearly with smart storytelling, expert insight, and better options for today’s homebuyers.

Why You Technically Can’t Buy a House with a Credit Card

You can’t just walk into closing and swipe your Visa. Sellers, lenders, and title companies require certified funds usually from a bank account, not a plastic card. But some buyers have tried workarounds like:

- Taking a cash advance to cover a portion of the down payment

- Charging appraisal or closing fees to their card

- Using a credit card for last-minute moving or inspection costs

It might seem like a harmless shortcut until the consequences hit.

The Hidden Risks of Using a Credit Card to Fund Home Buying

Let’s be clear: charging your way into a house is rarely a smart financial move. Here’s why:

1. Cash Advance Fees & Immediate Interest

Credit card cash advances often come with:

- A 3-5% fee per transaction

- No grace period interest starts immediately

- 20 - 30% APRs, compounding fast

So even a $10,000 cash advance could cost you $500 upfront plus hundreds per month in interest.

2. Credit Score Damage

Maxing out your credit card raises your credit utilization ratio, one of the biggest factors in your score. That drop can:

- Hurt your mortgage approval chances

- Raise your interest rates

- Reduce your loan size

3. Lender Rejection

Lenders look closely at your debt-to-income (DTI) ratio. High credit card balances = higher DTI = higher risk in their eyes.

In some cases, your approval can get revoked mid-process if your financial picture changes too drastically.

4. No Guarantee from Sellers or Lenders

Even if you can piece together the funds, you’re still up against industry rules. Sellers expect proof of funds or financing, not high-interest credit sources.

Realistic Alternatives to Using a Credit Card for Home Buying

Instead of risking long-term damage, try these smarter paths forward:

Build Your Credit, Don’t Break It

Even a 50-point boost in your score can qualify you for better mortgage rates. Use your card strategically pay on time, keep balances low, and don’t open new accounts before applying for a mortgage.

Save Strategically

Set up a dedicated high-yield savings account and automate transfers. Add windfalls like tax refunds or bonuses.

Explore First-Time Buyer Programs

Many offer:

- Low down payments (as little as 3%)

- Closing cost assistance

- Flexible credit requirements

📌 Example: FHA, VA, USDA, and local state programs.

Use Buyer Rebates to Offset Costs

Platforms like WithJoy.AI are redefining how people buy homes. WithJoy gives you back up to 70% of the buyer agent commission, often equaling $5,000–$15,000 or more.

Use that cash back to:

- Cover your down payment

- Pay moving or closing costs

- Reduce mortgage stress

🏷️ Ready to buy smart? Check your rebate amount at WithJoy.AI.

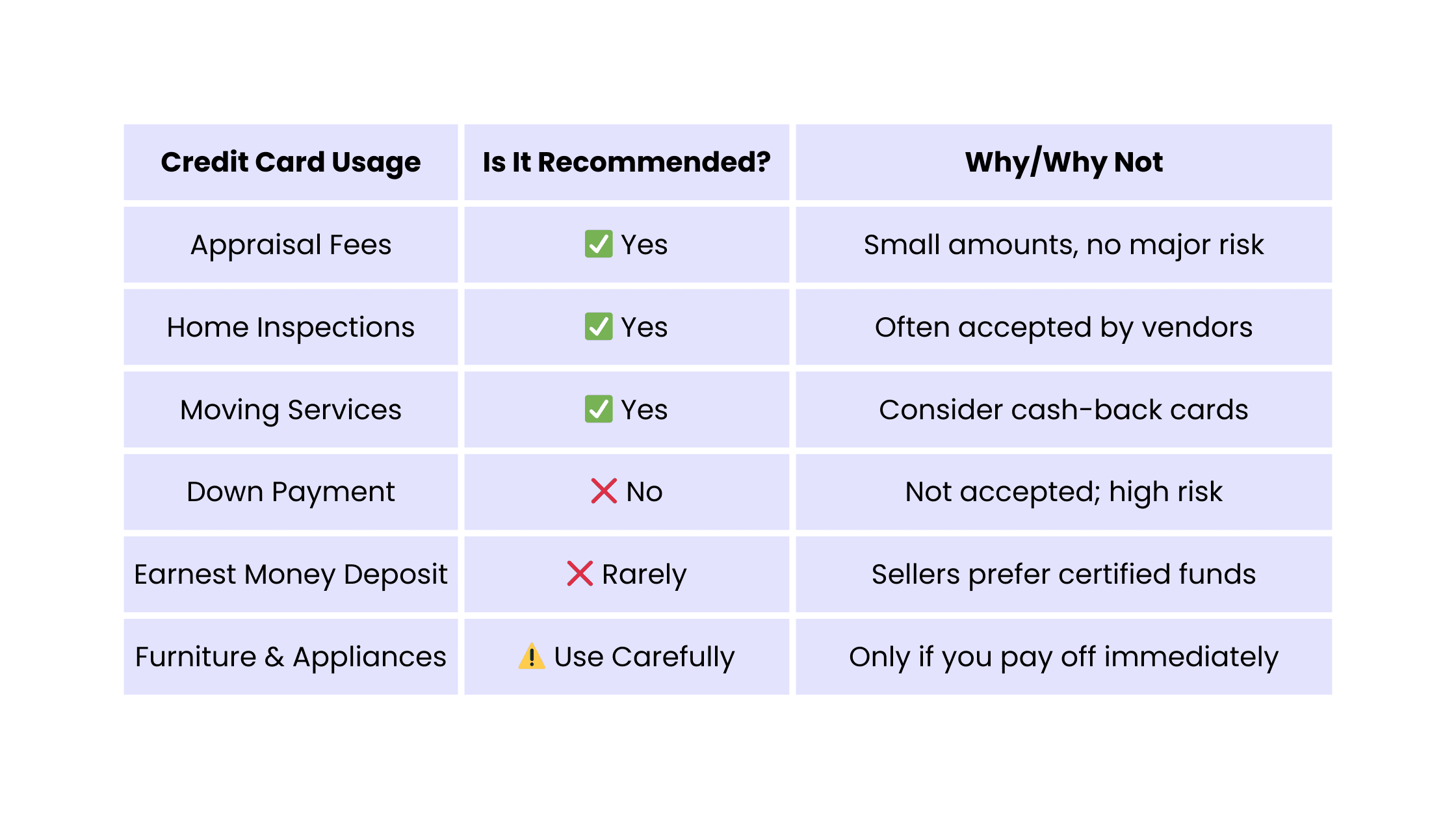

When Can You Use Credit Cards During the Buying Process?

You can’t use a credit card for your mortgage or down payment but there are places it can help if used wisely:

📌 Tip: If you’re using a card for purchases post-closing, choose one with intro 0% APR offers and cash-back rewards but only if you have a clear payoff plan.

Watch This Before Swiping Anything

Want a better understanding of how to budget, save, and buy smart without risky debt? Learn:

- Why credit misuse kills deals

- Better funding options for down payments

- Real stories from first-time buyers who almost swiped wrong

✅ Watch it before you apply it could boost your credit score.

✉️ Subscribe for Homebuyer Strategies That Actually Work

Get tips, tools, and insider strategies delivered weekly:

- How to save faster for a home

- Loan programs you didn’t know existed

- Real math for real buyers

- And of course ways to buy without debt traps.

Final Thoughts: Credit Cards Don’t Belong in Closings

So, can you buy a house with a credit card? Technically maybe. But realistically and financially you shouldn’t.

Homeownership is a milestone worth approaching with strategy, not shortcuts. It’s about long-term stability, not short-term swipes.

Use the tools that empower not endanger your financial future. Let your first step into homeownership be one you’ll feel proud of not regret later.

Full Service Home Buying - WithJoy.AI

Find Your Home Today

The future is here. Buy your next home WithJoy.AI

Trending Neighborhoods

Best Places to Retire

Best Affordable Areas Near Seattle

Best for Young Professionals

Best Family Neighborhood Seattle