6 minutes read

Homebuyer's Ultimate FAQ on Closing Costs

A guide answering all your questions about closing costs when buying a home.

KB

Kyler Bruno

08/13/2025

Why Closing Costs Matter More Than You Think

When you're buying a home in Washington State, most of your focus (understandably) goes into saving for a down payment, securing financing, and finding the right property. But just when you think you're home free, an unexpected hurdle arrives: closing costs.These seemingly small percentages can add up to thousands of dollars, and for many first-time buyers, they’re a complete surprise.

In this guide, we break down every component of closing costs, how to negotiate them, what’s legally required in Washington State, and how to strategically offset these costs using commission rebates.This is your comprehensive FAQ, specifically tailored for Washington homebuyers in 2025 and beyond.

What Are Closing Costs?

Closing costs refer to all the fees and expenses incurred during the transfer of property ownership, which must be settled before the buyer gets the keys to their new home.

These costs are in addition to your down payment and vary by location, lender, and property type. In Washington State, they typically range from 2% to 5% of the home’s purchase price. For example:

- On a $600,000 home, closing costs might range from $12,000 to $30,000 depending on several variables.

📌Pro Tip: While these fees are unavoidable, many are negotiable or can be offset using modern commission rebate models. More on that soon.

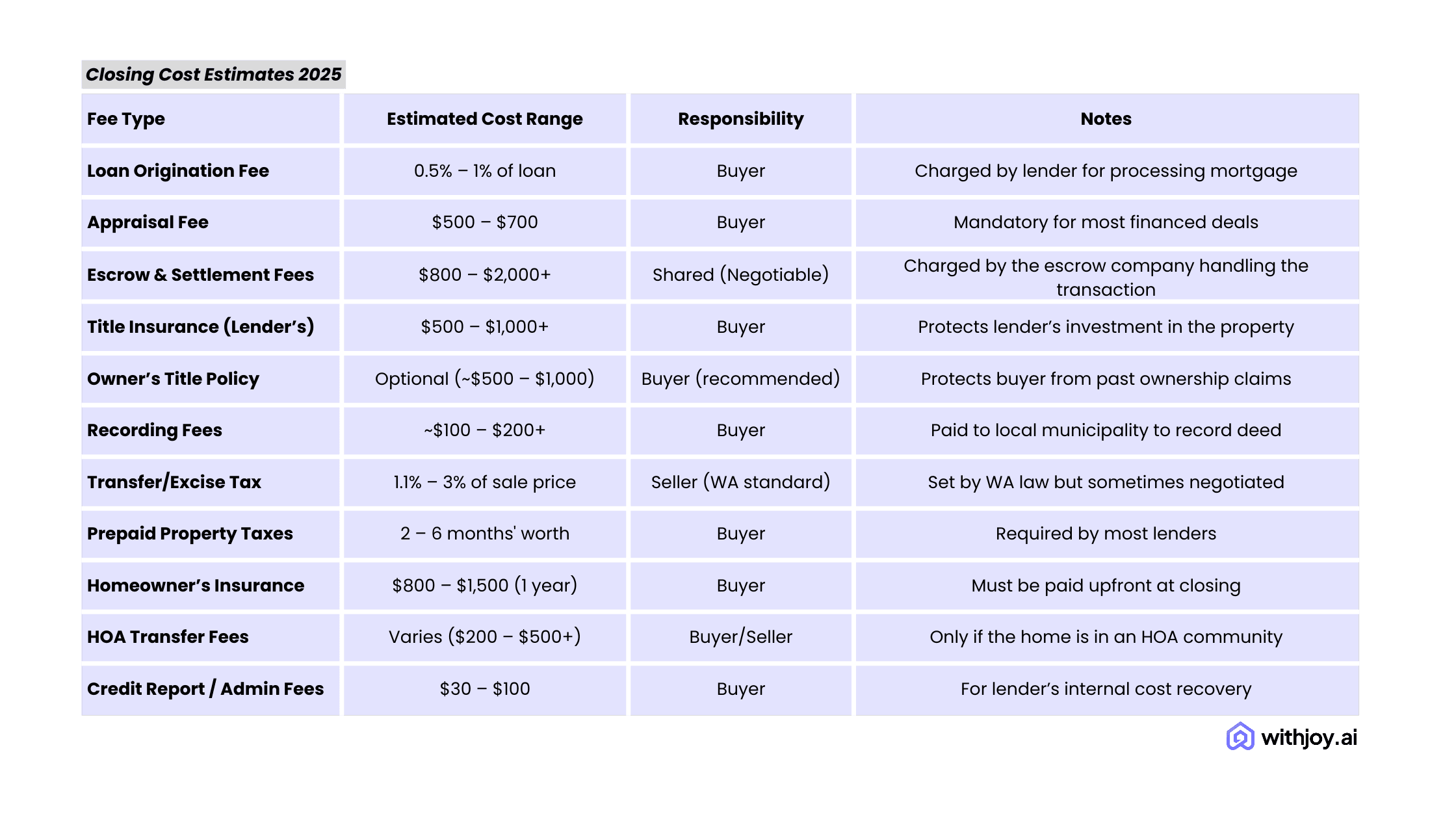

📊 Typical Closing Costs in Washington State (2025)

Here's a detailed breakdown of what Washington buyers can expect.

These numbers reflect typical pricing in 2025 and may fluctuate by lender, title company, and region (Seattle, Tacoma, Spokane, etc.).

What Fees Are Required vs. Optional?

Required Fees:

- Title insurance (lender’s policy)

- Recording fees

- Appraisal (if using a mortgage)

- Homeowner’s insurance (paid upfront)

- Escrow fees (unless waived)

Optional or Negotiable Fees:

- Owner’s title policy (highly recommended though not mandatory)

- Survey fees (if not already available)

- Processing/document fees (often padded by lenders)

What Can Buyers Do to Reduce Closing Costs?

While some fees are fixed, smart buyers actively reduce their closing costs by:

1. Negotiating Seller Concessions

You can request the seller to cover part (or all) of your closing costs as part of the offer. This is more common in a buyer’s market.

2. Shopping Around for Escrow and Title Services

Washington law allows you to choose your own provider. You don’t have to go with whoever the seller recommends.

3. Avoiding Junk Fees

Some lenders add padded “administrative” or “underwriting” fees. Request a Loan Estimate and scrutinize each line item.

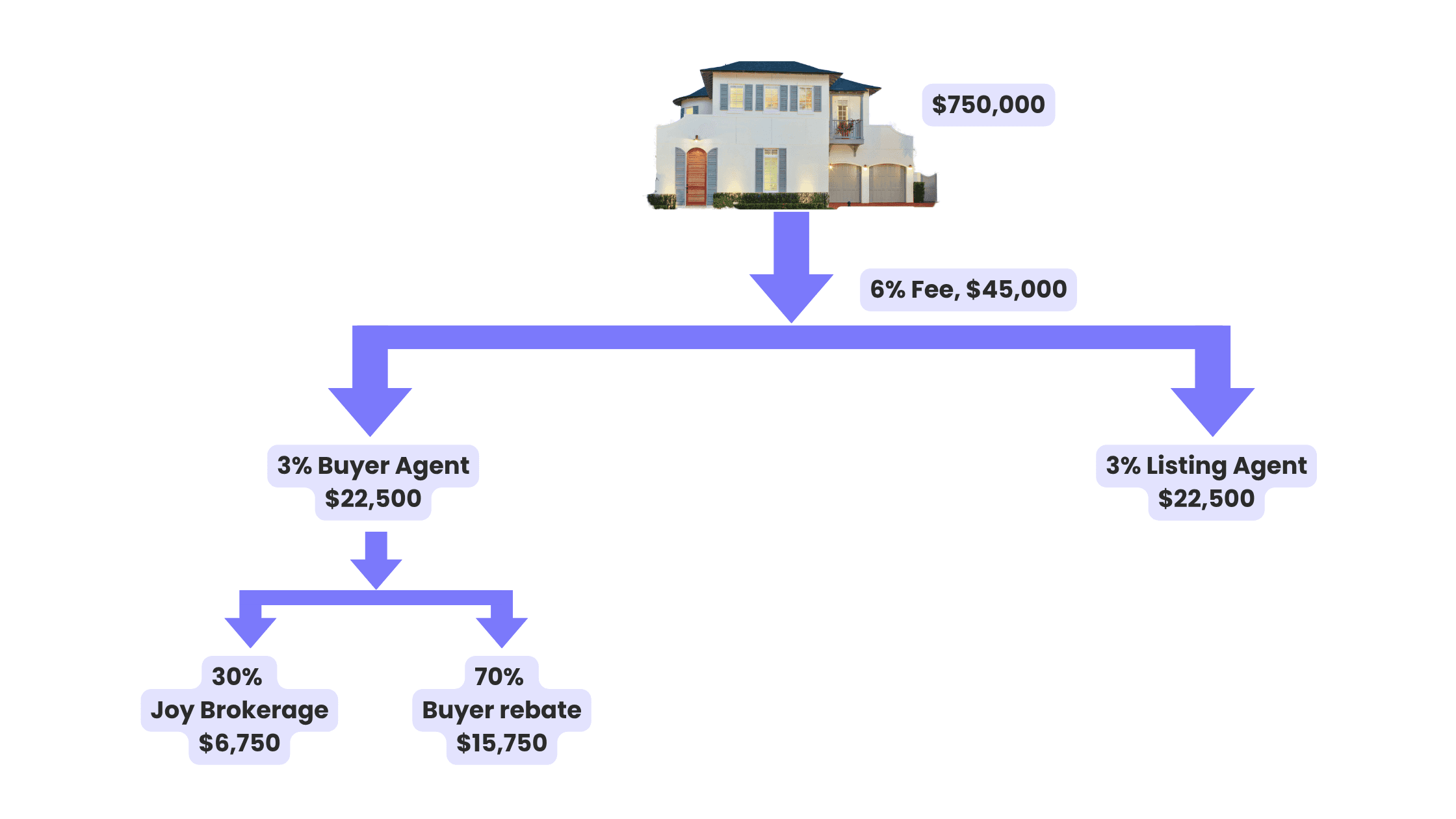

4. Using a Commission Rebate Brokerage

This is the most underutilized savings method. By choosing a real estate brokerage that offers a commission rebate, buyers can receive up to 70% of the buyer agent’s commission back at closingoften covering their entire closing costs

Frequently Asked Questions (Buyer Closing Costs)

❓ Q: Can I Roll Closing Costs into My Loan?

Yes, only with certain lenders and if the appraised value allows for it. This increases your monthly mortgage payments.

❓ Q: What’s the Difference Between Buyer and Seller Closing Costs?

Sellers typically pay:

- Real estate commission (5 - 6%)

- Excise tax (1.1 - 3% in WA)

- Half of the escrow fee

- Some transfer fees

Buyers pay:

- Loan-related fees

- Title insurance

- Escrow fees

- Recording & HOA fees

- Prepaid taxes and insurance

❓ Q: Are Closing Costs Tax-Deductible?

Some are. For instance, prepaid property taxes and mortgage interest may be deductible. However, consult with a licensed tax advisor for clarity.

❓ Q: If I’m Paying Cash, Do I Still Have Closing Costs?

Yes, though they’ll be lower. You still pay escrow, title insurance, transfer fees, and taxes.

🧾 Sample Closing Cost Scenario

Let’s assume:

- Home price: $650,000

- Buyer uses a conventional loan

- Buying in Seattle, WA

With a 70% buyer rebate from a tech-powered brokerage, you could receive:

Rebate = $650,000 × 2.5% buyer agent commission × 70% = $11,375

➡️ Your net closing cost = $12,800 – $11,375 = $1,425

Get in touch with our expert agents to learn more about cash rebate on home purchase.

📩 Subscribe & Stay Ahead of the Market

Join hundreds of Washington homebuyers getting smarter with each email. Weekly hacks, rebate alerts, rate trends & closing cost insights!

Final Thoughts: Think Beyond the Sticker Price

Too often, buyers focus solely on their monthly payment or purchase price and then get blindsided by closing costs.But with preparation, negotiation, and the right partners (like withjoy.ai), you can drastically reduce or even eliminate most of these fees.

You’ll walk away with more money in your pocket, more flexibility after closing, and a smoother buying experience. Closing doesn’t have to be expensive. It just has to be smart.

📘 Download: Free Handbook

Our downloadable guide includes:

- Closing cost checklist for homebuyers.

- Smart scripts to negotiate seller concessions.

- Real buyer testimonials who paid near-zero closing costs

📺 Watch: How to Slash Closing Costs in WA.

This short video walks you through common closing cost myths and how Washington buyers are beating the system with smart discount brokerage choices. Chat with our expert today!

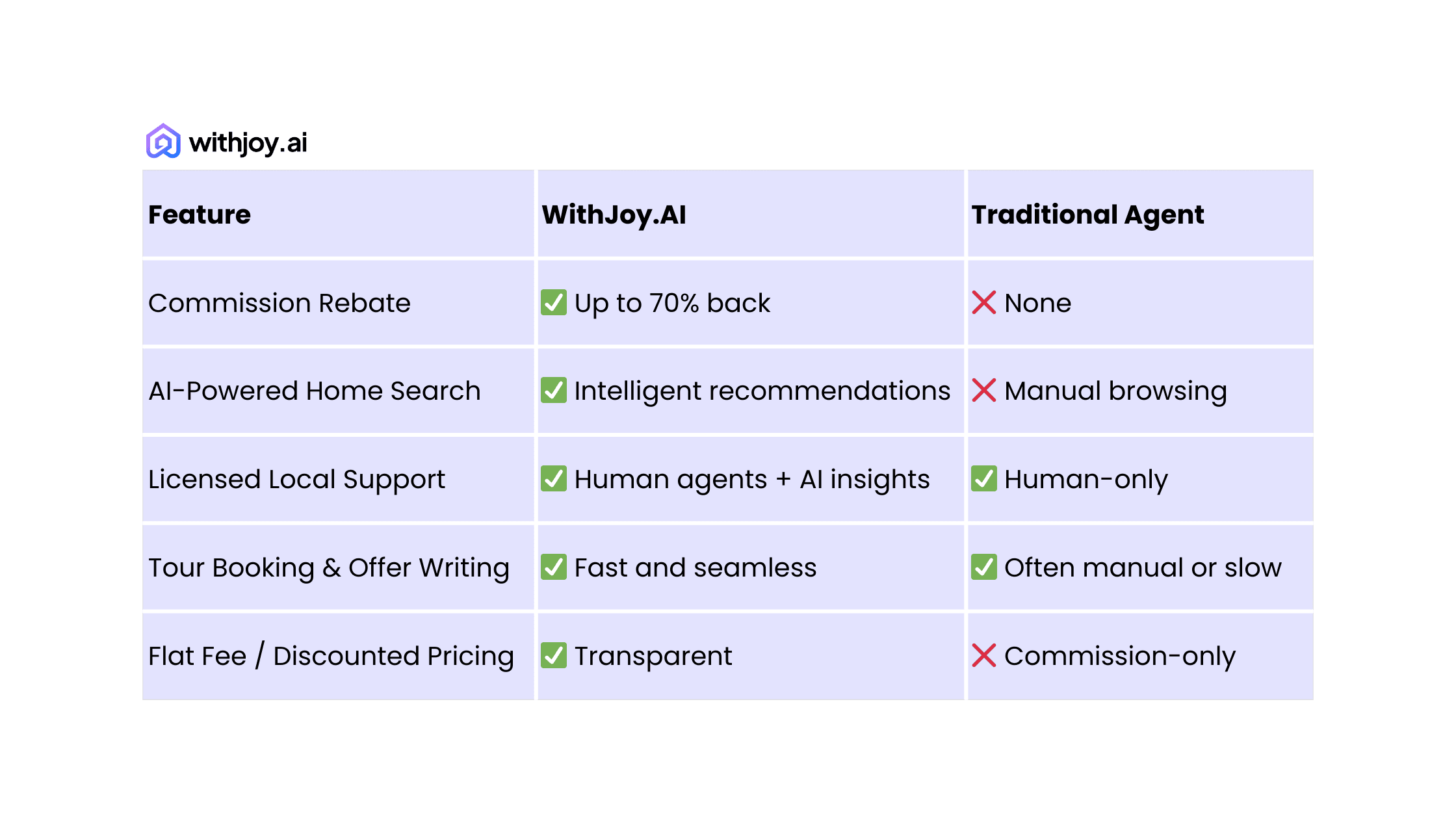

Why More Washington Buyers Are Choosing WithJoy.AI

If you're looking to save thousands on your next home purchase, there's a smarter way to buy: WithJoy.AI.

🏡 A Discount Real Estate Agent That Works for You.

WithJoy.AI is a next-gen platform offering discount real estate services in Washington without cutting corners on expertise or service quality. Our technology connects you with expert, local agents while drastically reducing your commission costs.

💸 Real Estate Commission Rebates That Put Cash in Your Pocket

Unlike traditional brokerages, WithJoy.AI offers one of Washington's best home buyer rebate programs, helping you get a significant cashback on home purchase. You can get up to 70% of your buyer agent's commission refunded that’s thousands of dollars back to you.

🤖 Smart, Streamlined HomebuyingOur AI platform helps you

Discover properties faster, Schedule instant home tours, Craft smarter offers with confidence

💬 Why Buyers Are Making the Switch

Whether you're searching for a discount real estate agent, need a real estate commission rebate, or simply want a better way to buy, WithJoy.AI gives you everything you need without the unnecessary costs.

✅Save Money. Buy Smarter. Washington’s top discount real estate brokerage is just a click away.

Related Guides

What to Check When Buying a New Home

Consider location, size, features, efficiency, and resale value for a smart home investment.

KB

Kyler Bruno

10/06/2024

Real Estate Commission Rebates Explained

Almost all homebuyers leave money on the table.. don’t be one of them!!

KB

Kyler Bruno

07/11/2025

What Are the Steps to Buying a House

Five key steps to buy a home, from financing to closing, for a smooth process.

KB

Kyler Bruno

10/10/2024

Full Service Home Buying - WithJoy.AI

Find Your Home Today

The future is here. Buy your next home WithJoy.AI

Trending Neighborhoods

Best Places to Retire

Best Affordable Areas Near Seattle

Best for Young Professionals

Best Family Neighborhood Seattle