2 minutes read

What is a Financing Contingency

A financing contingency lets buyers cancel and recover earnest money if they lack financing.

KB

Kyler Bruno

07/26/2025

The Ultimate Guide to Financing Contingencies in Real Estate

Buying a home is one of the biggest financial commitments most people will ever make. That’s why it’s crucial to protect yourself throughout the process and one of the most powerful tools at your disposal is a financing contingency.

In this guide, we’ll unpack what a financing contingency is, how it works, why it matters, and what you need to know to use it wisely in today’s housing market.

What Is a Financing Contingency?

A financing contingency (also called a mortgage contingency) is a clause in a real estate contract that protects a homebuyer if they’re unable to secure financing. Simply put, it allows the buyer to back out of a contract without penalty and get their earnest money deposit back if their mortgage falls through.

This clause is especially vital for buyers relying on a loan or mortgage to finance the purchase. It serves as a safety net, offering legal and financial protection during a potentially turbulent loan approval process.

Keywords in Context:

- Mortgage contingency clause

- What is a loan contingency?

- Contingency mortgage explained

How a Financing Contingency Works?

When a buyer submits an offer on a home, they can include a financing contingency in the purchase agreement. This clause typically outlines:

- The type of financing (e.g., 30-year fixed mortgage)

- The amount of the loan

- The interest rate range the buyer is comfortable with

- A specific deadline by which financing must be secured

If the buyer fails to secure a loan by the agreed-upon deadline, the contract becomes void, and the buyer is entitled to a refund of their earnest money.

Example Scenario:

Imagine you’re buying a home in Seattle and have been pre-approved for a mortgage. You include a financing contingency in your offer. But just before closing, your lender declines the final approval due to a low appraisal. Because of your contingency, you can walk away from the deal without losing your deposit.

Why a Financing Contingency Is Crucial in 2025

In the current 2025 market, where interest rates are fluctuating, lender requirements are tightening, and property appraisals are more scrutinized, a financing contingency is more than a formality it’s a must-have.

Key Benefits for Buyers:

- Protection from financial loss: If your financing collapses, you don’t lose your deposit.

- Time to shop for the best loan: You can explore multiple lenders and secure favorable mortgage terms.

- Peace of mind: Knowing you can walk away reduces emotional and financial stress.

Risks Without It:

Buyers who waive the financing contingency often to compete in a hot market risk losing thousands in earnest money if financing fails. Worse, they could be legally obligated to purchase the home without a loan in place.

What Happens If Your Financing Falls Through?

Let’s break it down:

If You Have a Financing Contingency:

- You can exit the contract without penalty.

- Your earnest money is refunded.

If You Don’t Have a Financing Contingency:

- You could lose your earnest money.

- The seller may sue for breach of contract.

When You Might Still Lose Your Deposit:

Even with a contingency, if your financing fails due to your own actions (e.g., new debt, job loss, or dishonesty on your loan application), the seller may challenge your right to a refund.

Pro Tip: Stay financially stable during the homebuying process. Don’t open new credit cards or make large purchases until after closing.

Common Financing Contingency Deadlines

Most contracts include a contingency period ranging from 10 to 21 days. During this time, buyers must:

- Secure a formal loan approval

- Submit required documents to their lender

- Schedule and complete the appraisal

Missing this deadline without an extension can void the protection of your contingency.

Should You Ever Waive a Financing Contingency?

In competitive markets, some buyers are tempted to waive contingencies to make their offer more appealing. But this is a high-risk move.

Only consider waiving your financing contingency if:

- You’re paying all cash

- You’ve already secured a fully underwritten loan

- You’re financially capable of proceeding without the loan

Always consult your agent or legal advisor before removing this protection.

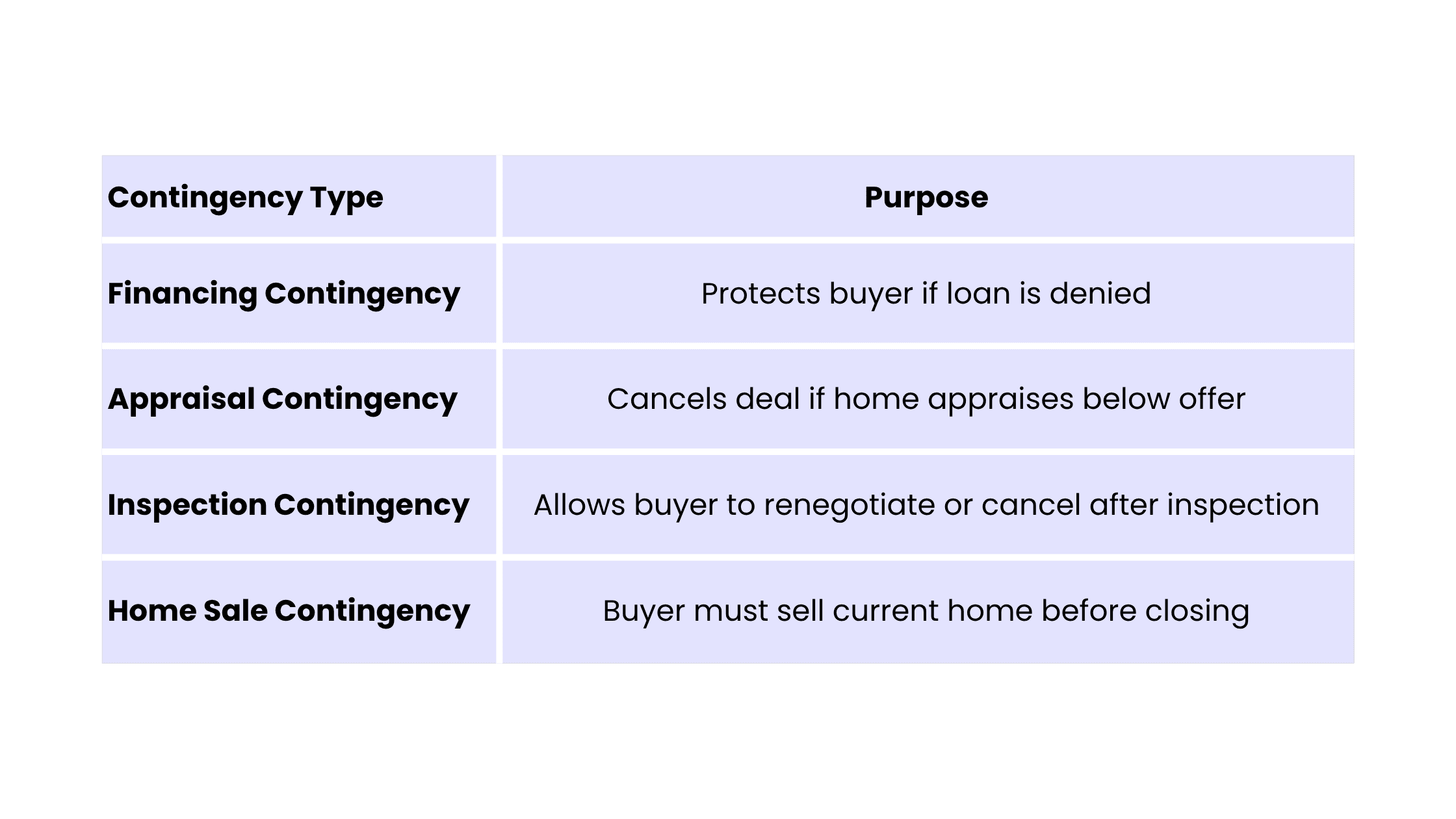

Financing Contingency vs. Other Contingencies

There are several types of real estate contingencies. Understanding the differences can help you build a more flexible contract. Each contingency adds a layer of protection and negotiation power.

📩 Stay Informed: Subscribe for Smart Home Buying Tips

Want more buyer-friendly guides like this one? Get the latest real estate insights, financing tips, and money-saving tools straight to your inbox.

Watch: How Financing Contingencies Protect Buyers

Visual learners? Watch our breakdown of how financing contingencies protect you in a real estate deal and what happens when you waive one.

Download Our eGuide - Winning Offers Blueprint

Want to learn more? Our free e-guide covers everything from pre-approval to final closing plus bonus tips on how to negotiate like a pro with contingencies.

Don’t Skip This Step

If you’re planning to buy a home in 2025, the financing contingency is a non-negotiable safeguard unless you can afford to gamble thousands of dollars.

From unpredictable loan approvals to shifting interest rates, real estate deals can fall apart at any moment. Including a financing contingency ensures that if financing becomes a problem, it doesn’t become your problem.

How WithJoy.AI Helps Smart Buyers Navigate Financing

At WithJoy.AI, we’re redefining how buyers approach real estate. Our AI Home Search Assistant goes beyond filters you can simply chat with it, just like ChatGPT. And voila your personalized home picks are ready. But it doesn’t stop there:

- 🧠 Lighting Fast Home Tours

- 💬 Fast Support: Get answers from licensed agents.

- 💰 Commission Rebate: Get up to 70% cashback at closing.

Ready to experience real estate search powered by AI? Try WithJoy.AI now.

Related Guides

RTO Rumble in Seattle? Joy Makes Home Buying Brighter (and More Affordable!)

Ease that RTO pain with a whopping 70% commission rebate back to you!

KB

Kyler Bruno

02/07/2025

Things to Look for When Buying an Older Home

When buying an older home, inspect thoroughly to avoid costly repairs.

KB

Kyler Bruno

07/29/2025

Can I get a Real Estate Commission Rebate on a New Build?

For new builds, request the builder's custom paperwork early in the sales process.

KB

Kyler Bruno

07/28/2025

Full Service Home Buying - WithJoy.AI

Find Your Home Today

The future is here. Buy your next home WithJoy.AI

Trending Neighborhoods

Best Places to Retire

Best Affordable Areas Near Seattle

Best for Young Professionals

Best Family Neighborhood Seattle