Overview of the Seattle Housing Market in 2025

The housing market in Seattle, Washington, remains one of the most competitive and expensive in the United States. Driven by a robust economy, particularly in tech sectors with giants like Amazon and Microsoft, Seattle attracts professionals seeking high-paying jobs.

However, this demand has pushed home prices in Seattle to levels that challenge affordability for many residents.

Key Metrics (As of May 2025):

- Median Home Price in Seattle: $898,000 (up 1.5% year-over-year)

- Average Home Value: $886,741 (up 0.1% year-over-year)

- Cost of Living: 45% higher than the national average, with housing costs 112% above the U.S. average

- Zillow Home Value Index (ZHVI): Reflects typical home values, showing slight growth but recent month-over-month declines

Seattle’s market is characterized by low inventory, high demand, and rising housing costs in Seattle.

Despite national trends showing a slowdown in home price growth (1.2% year-over-year nationally), Seattle’s real estate market remains resilient, though recent data suggests softening in some areas.

Current Median Home Prices

The median home price in Seattle, WA, stands at $898,000 as of May 2025, a 1.5% increase from the previous year. This is significantly higher than the national median of $367,969. The average home price in Seattle is slightly lower at $886,741, indicating a market where high-end properties skew the median upward.

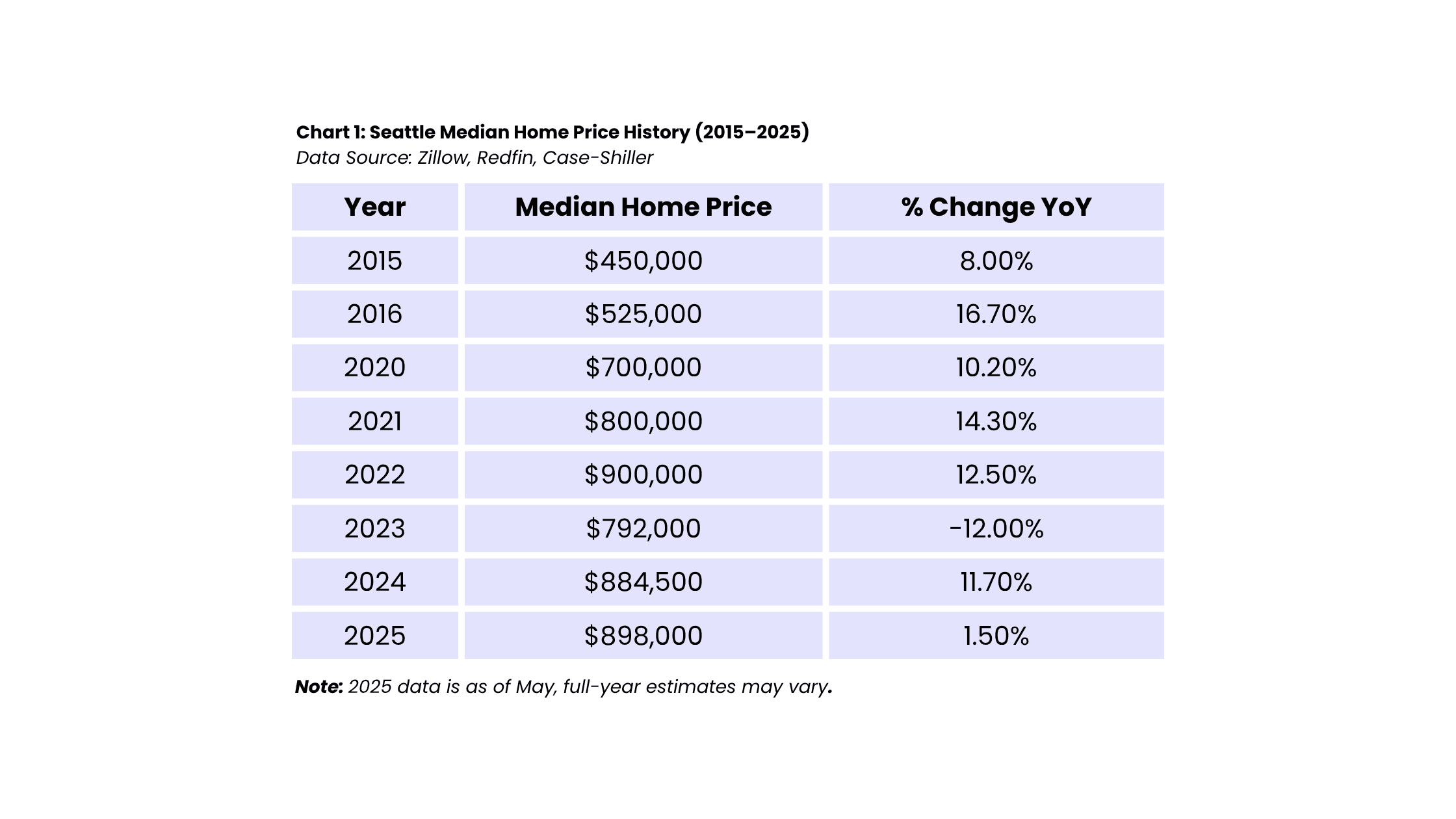

Historical Context

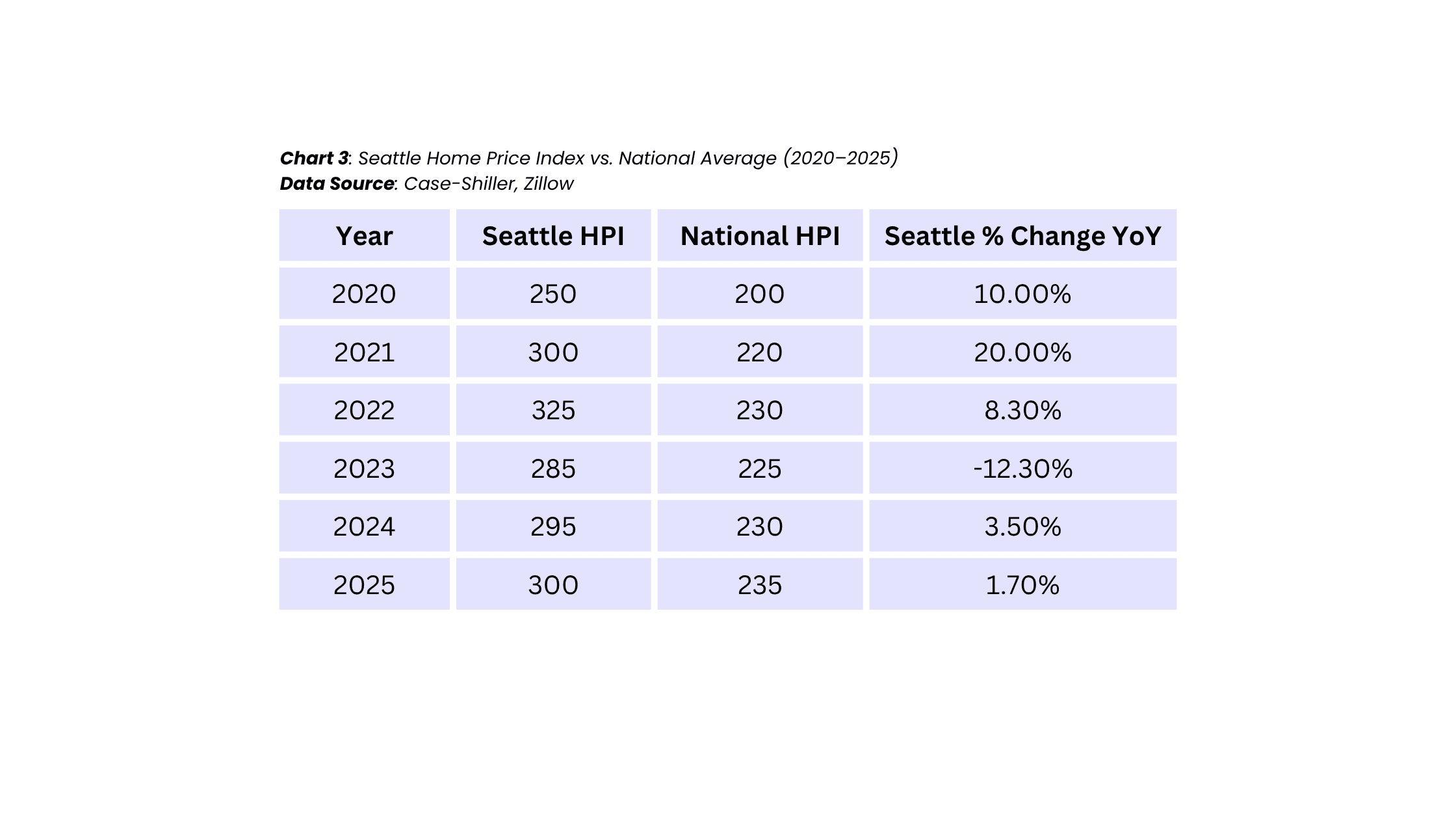

Seattle’s house prices have seen substantial growth over the past decade, fueled by tech-driven migration and limited housing supply. According to the Case-Shiller Home Price Index for Seattle, home prices peaked in 2022 but experienced a 12% year-over-year decline in 2023. By 2025, prices have stabilized, with some neighborhoods reaching 2022 peaks again.

Price Per Square Foot

The price per square foot in Seattle averages around $550, though this varies by neighborhood. For example, downtown areas like Belltown command higher rates ($700–$800/sq.ft.), while suburbs like Renton are more affordable ($400–$500/sq.ft.). This metric is critical for understanding property values in Seattle and comparing homes across different sizes.

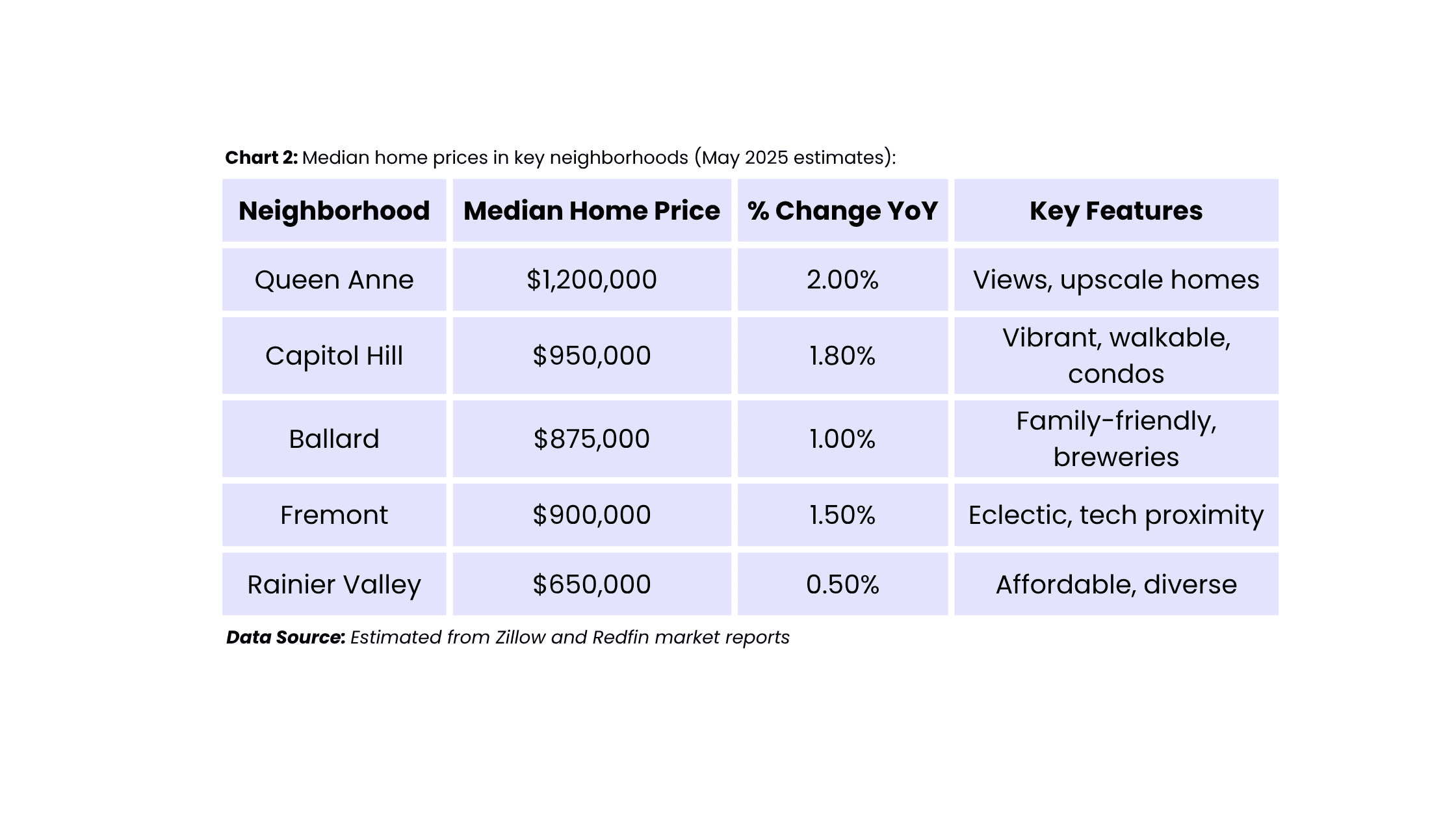

Neighborhood-Level Analysis: Seattle Home Prices by Neighborhood

Seattle’s housing prices by neighborhood vary significantly, reflecting diverse lifestyles, amenities, and proximity to employment hubs. Below is a breakdown of median home prices in key neighborhoods (May 2025 estimates)

Zillow Seattle Home Prices show that high-demand areas like Queen Anne and Capitol Hill continue to appreciate, while more affordable neighborhoods like Rainier Valley see slower growth. Zillow Zestimate Seattle data suggests that homes in premium neighborhoods often sell above estimated values due to bidding wars, though Zillow estimates can sometimes lag behind actual sale prices.

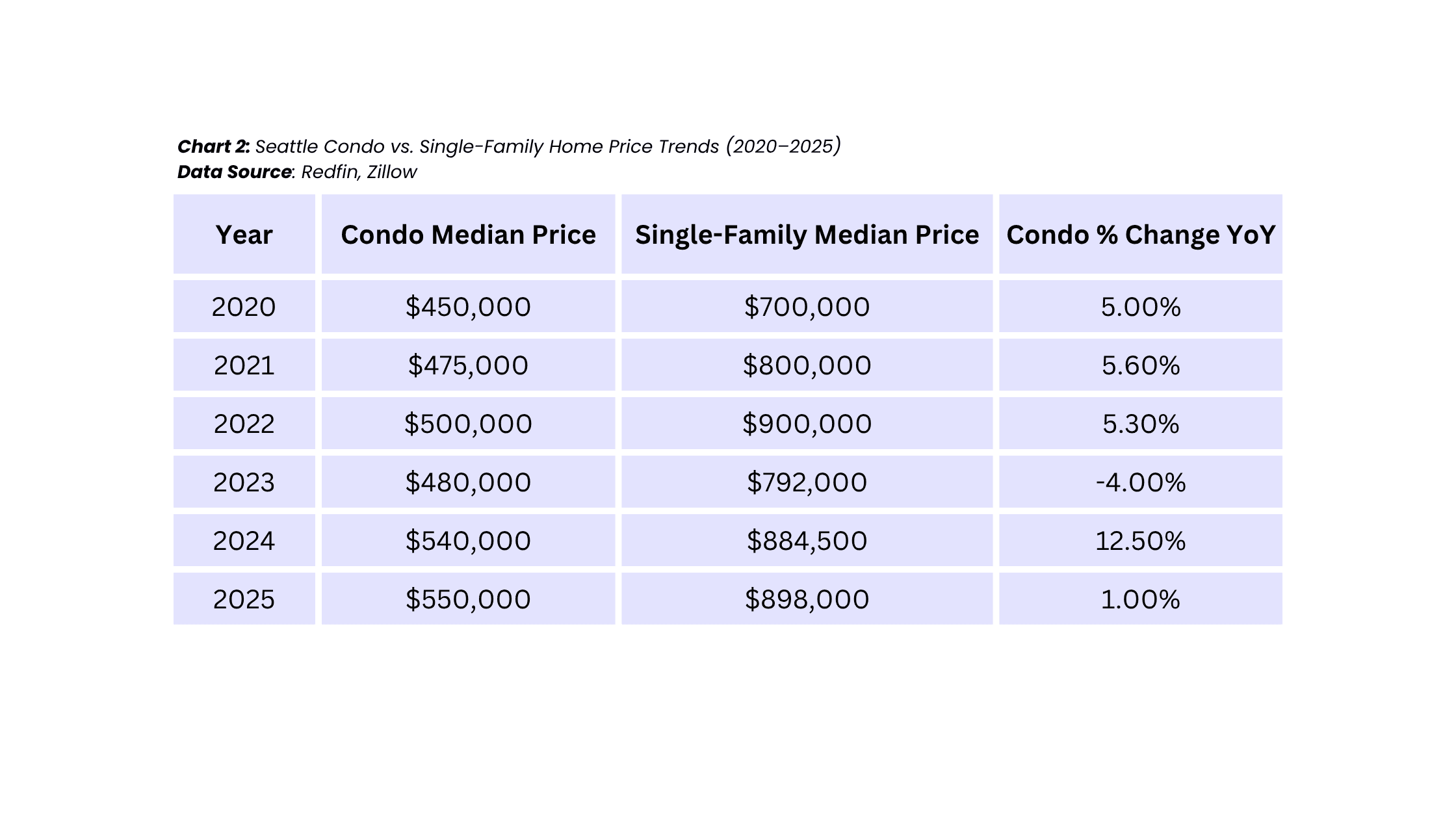

Condo Market in Seattle

The Seattle condo market is a vital segment, especially for young professionals and downsizers. In 2025, the median condo price is approximately $550,000, with downtown high-rises like Belltown fetching $807,000 per unit, a record for high-rise housing.

Condo Market Trends

- Inventory: Condo supply is slightly higher than single-family homes, easing price pressure.

- Demand: Strong among tech workers seeking urban lifestyles.

- Price Trends: Condo prices have risen 1.0% year-over-year, slower than single-family homes.

- Challenges: High HOA fees (averaging $500–$1,000/month) impact affordability.

The condo market in Seattle offers a more accessible entry point but faces challenges from rising interest rates and maintenance costs.

Housing Affordability and Cost of Living in Seattle

Seattle’s housing affordability is a pressing issue. The cost of living in Seattle, Washington, is 45% above the national average, with housing being the primary driver. The Seattle cost of living index ranks it among the top 10 most expensive U.S. cities.

Affordability Metrics

- Income-to-Price Ratio: The median household income in Seattle is ~$105,000, requiring a home price-to-income ratio of 8.5:1, far above the affordable threshold of 3:1.

- Mortgage Rates: As of June 2025, 30-year fixed mortgage rates hover around 6.5%, increasing monthly payments for a $898,000 home to ~$5,600 (20% down).

- Rental Market: The Seattle rental market is also tight, with average rents at $2,200 for a one-bedroom apartment, up 3% year-over-year.

Housing Affordability Seattle is further strained by low inventory. Posts on X highlight growing affordability challenges, with experts noting that even high earners struggle to enter the market.

Seattle Real Estate Market Forecast for 2025

Market Outlook

The Seattle real estate market forecast for 2025 is cautiously optimistic but tempered by challenges:

- Price Growth: Experts predict 1–3% growth in Seattle home prices, slower than the 2021–2022 boom but stable.

- Inventory: Seattle housing market predictions suggest inventory will remain low, with supply-demand gaps signaling price pressure.

- Interest Rates: High mortgage rates may deter some buyers, potentially softening demand.

- Tech Industry: Continued growth in tech could sustain demand, though remote work trends may shift preferences to suburbs of Seattle.

Risks and Opportunities

- Risks: A potential Seattle real estate bubble is a concern, with some analysts citing overvaluation in premium neighborhoods. Recent month-over-month price declines (-2% in June 2025) raise caution.

- Opportunities: Seattle real estate forecast highlights opportunities in affordable neighborhoods and the condo market. Builders offering financing incentives (e.g., 1% below market rates) create win-win scenarios.

Subscribe to WithJoy.AI for Seattle Housing Insights

Subscribe to WithJoy.AI for expert Seattle housing market updates, home price trends & More.

Seattle Housing Market Trends and Insights

Current Trends

- Low Inventory: Seattle housing market trends show inventory growth lagging behind demand, exacerbating price pressure.

- Suburban Shift: Suburbs of Seattle real estate, like Bellevue and Renton, are gaining popularity due to lower house prices in Seattle suburbs.

- Foreclosure Rates: Seattle foreclosure rate remains low, indicating market stability.

- Home Appreciation: Seattle home appreciation rates average 1–2% annually, with some neighborhoods like Queen Anne seeing higher gains.

The Seattle housing price index outperforms the national average but shows signs of stabilization.

Why Choose WithJoy.AI for Your Seattle Home Purchase?

Navigating the Seattle housing market can be daunting but WithJoy.AI makes it smarter, simpler, and significantly more affordable. We’re a next-generation discount real estate brokerage in Washington, empowering homebuyers with expert guidance, powerful proprietary tools, and an industry-leading commission rebate of up to 70%.

Why WithJoy.AI?

- 🧭 Seattle Real Estate Experts Our local agents specialize in the Seattle housing market, delivering insights on neighborhood trends, home values in Seattle, WA, and emerging real estate forecasts so you can buy with confidence.

- 💸 Up to 70% Commission Rebate Unlike traditional brokerages, we give buyers up to 70% of our commission back at closing. That’s serious savings on a home priced at $898,000, your rebate could be as much as $18,858. More cash in your pocket, less paid in fees.

- 🧠 Proprietary AI-Powered Platform Our end-to-end platform is built in-house not based on third-party tools like Zillow so you get accurate, real-time insights from our Seattle home value estimator, plus a smarter way to search, compare, and close.

- 💼 Buyer-First, Always Whether you're buying a house in Seattle or investing in the Seattle condo market, our process is built around you not commissions. Expect personalized service, zero pressure, and maximum value.

Buy Smarter. Save More.

WithJoy.AI isn’t your average brokerage. We’re your tech-enabled, commission-saving partner in the competitive Seattle housing market.

Related Articles

4 Reasons to Move to Queen Anne in Seattle

Stunning views and a true sense of community, Queen Anne might just steal your heart.

How Do Real Estate Commissions Work

Learn how Joy, the AI agent, rebates 70% of her commission, helping buyers save thousands.

Is It a Buyer’s or Seller’s Market? How to Tell & What It Means for You

Is it a buyer’s or seller’s market? Learn how to tell and what it means for your homebuying plans.

Frequently Asked Questions

Check out our explainer video for an overview of Joy

Rated by satisfied customers