8 minutes read

Key Insights from NAR’s 2025 Report

Top 7 takeaways from NAR’s Home Buyers and Sellers Report 2025

KB

Kyler Bruno

07/29/2025

How Generational Trends Are Shaping the Future of Homeownership

Buying a home is one of the biggest financial decisions you’ll ever make and in 2025, the landscape is shifting fast.

The National Association of REALTORS® (NAR) recently released its 2025 Home Buyers and Sellers Generational Trends Report, revealing critical insights into how different generations are buying, selling, and investing in real estate. From Gen Z to the Silent Generation, evolving priorities are reshaping everything from down payments to neighborhood choices.

Whether you're wondering how to afford a million dollar home or trying to understand what does it mean to bottom out in a potential housing recession, this article gives you a deep-dive into the latest trends and shows how to act on them.

📥 Want the full NAR report? click on the link below.

1. Gen Xers Are Quietly Leading the Market Boom

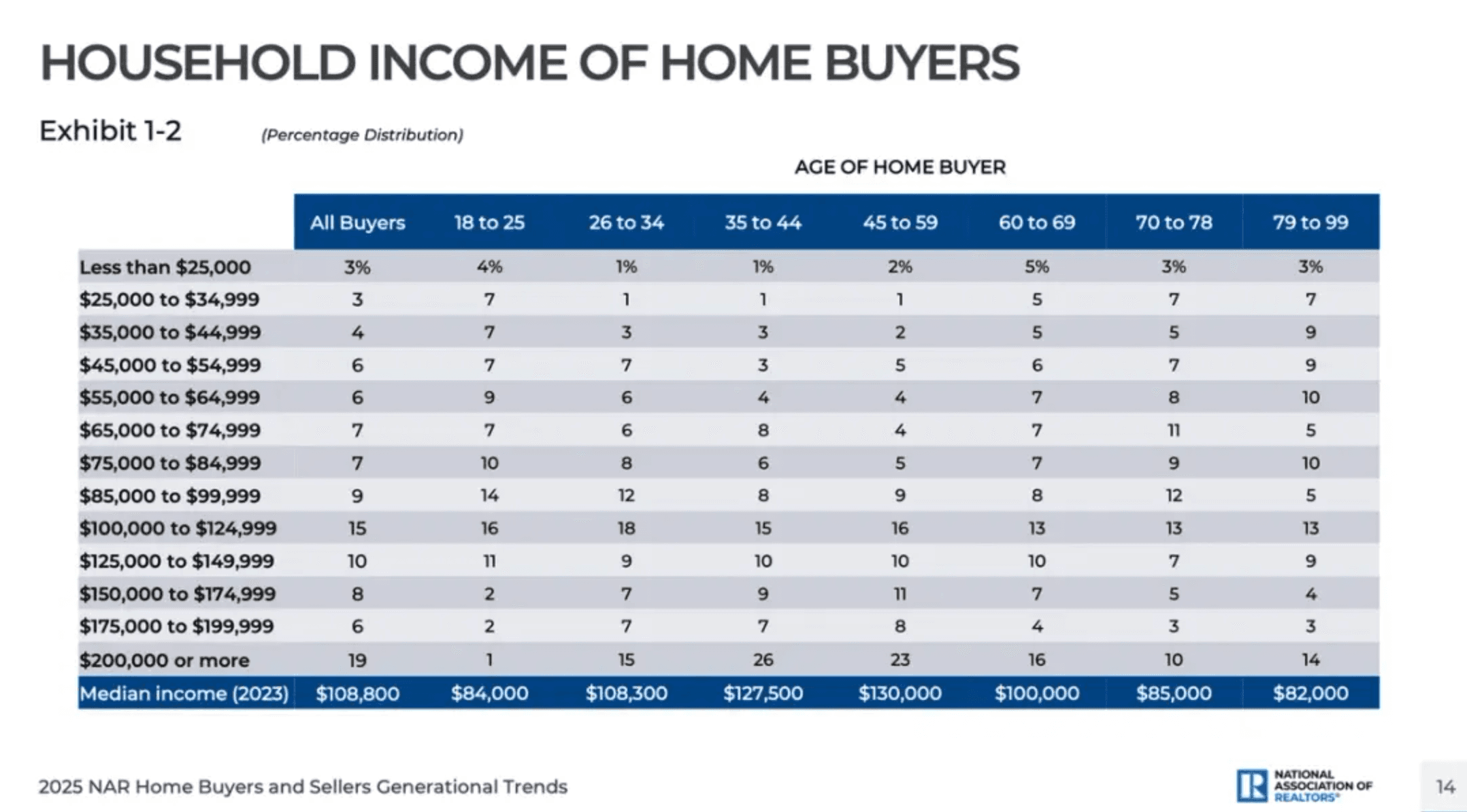

Who they are: Ages 45–59, often dual-income households with median earnings of $130,000+

What the data says: Gen Xers make up 24% of all homebuyers and are purchasing larger homes (2,000+ sq. ft) to support multigenerational living or real estate investment.

These high earners are fueling the midwest boom and buying investment homes for sale in suburban and semi-rural regions. Their financial flexibility allows them to make cash-only offers and come along for sale quickly sometimes over the asking price.

🎯 Buyer Tip:

If you're in this group, consider using your financial leverage to explore off-market house sales or boom properties in up-and-coming neighborhoods. Use tools like WithJoy.AI to find these listings faster and access market analytics before others.

2. First-Time Homebuyers Are Struggling, and It's a Red Flag

What the data says:

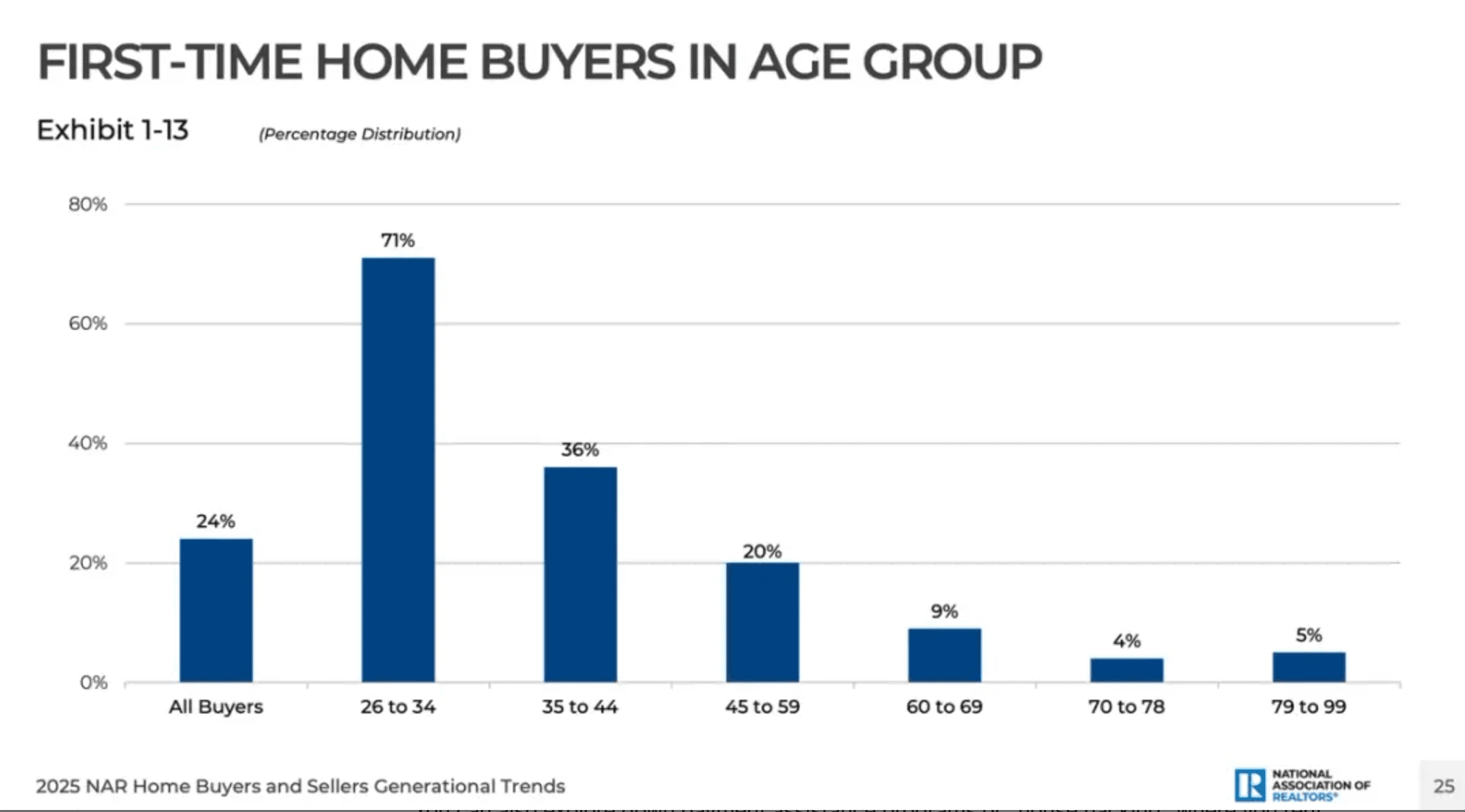

Only 24% of buyers in 2024 were first-timers. Younger Millennials (26 - 34) dominate this segment, while Gen Z remains virtually absent primarily due to affordability issues and debt burdens.

We’re seeing a potential housing market slowdown for this group, where rising home prices and lower savings are pushing people out of the market.

💡 How to Adapt:

- Explore local down payment assistance programs

- Consider “house hacking” renting out part of your home to offset mortgage

- Use FHA loans or other niche financing tools

👉 Recommended Read:

Washington State FHA Loan Guide (2025)

3. Student Loan Debt Is Delaying Homeownership Even for Boomers

What the data says:

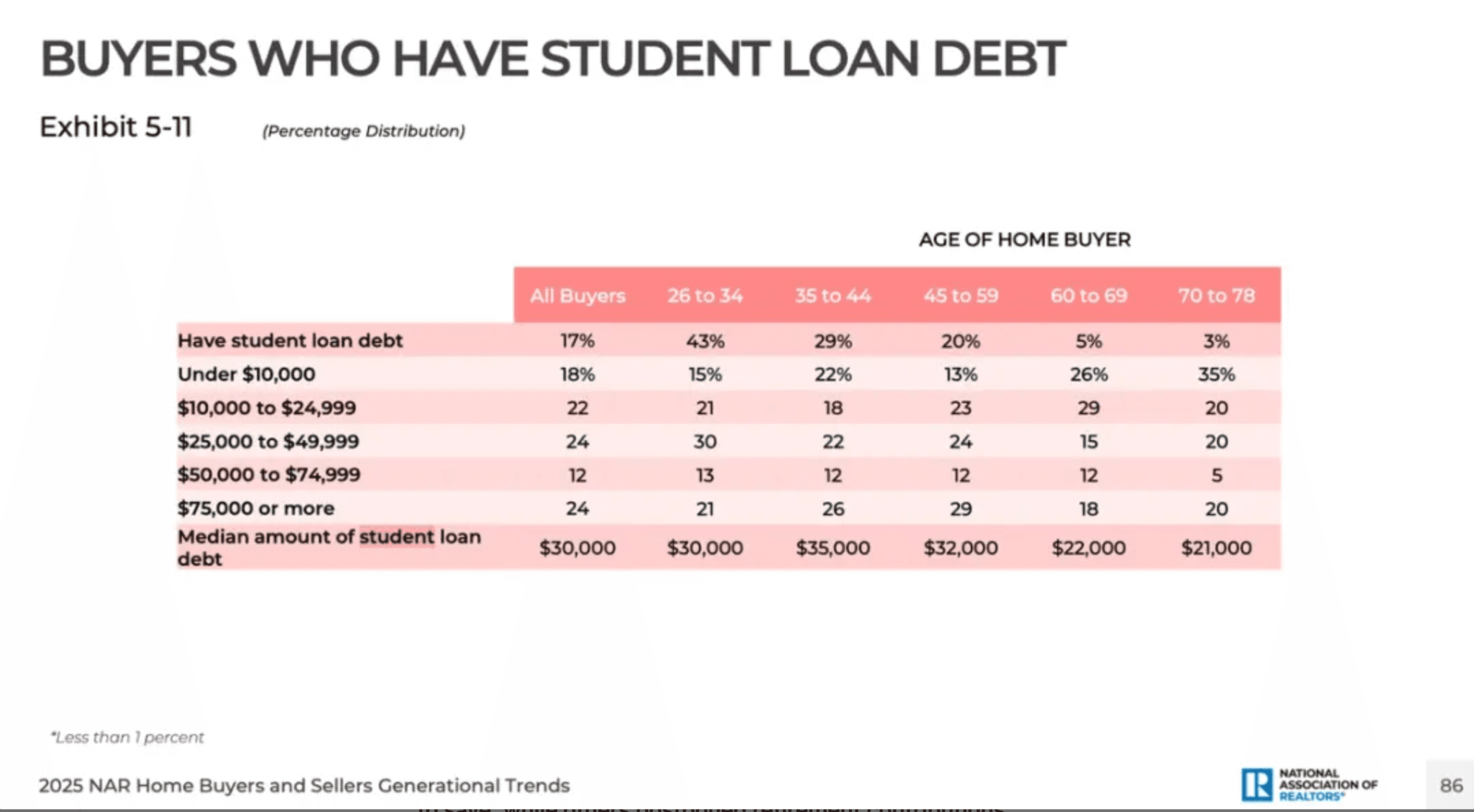

43% of Younger Millennials hold student debt, with a median balance of $30,000. Surprisingly, 5% of Older Boomers (70–78) also carry student loan debt often from co-signing their children’s loans.

This debt reshapes spending priorities. Millennials are cutting back on lifestyle expenses, delaying retirement savings, and postponing buying homes.

What does it mean to bottom out?

This trend reflects a deeper affordability issue, where debt is preventing younger buyers from entering the market and contributing to a long-term recession in real estate participation.

📌 What You Can Do:

- Explore income-driven repayment options

- Consider lenders offering debt exclusion or “debt-shaving” models

- Refinance high-interest loans to free up monthly cash

4. Neighborhood Preferences Are Deeply Generational

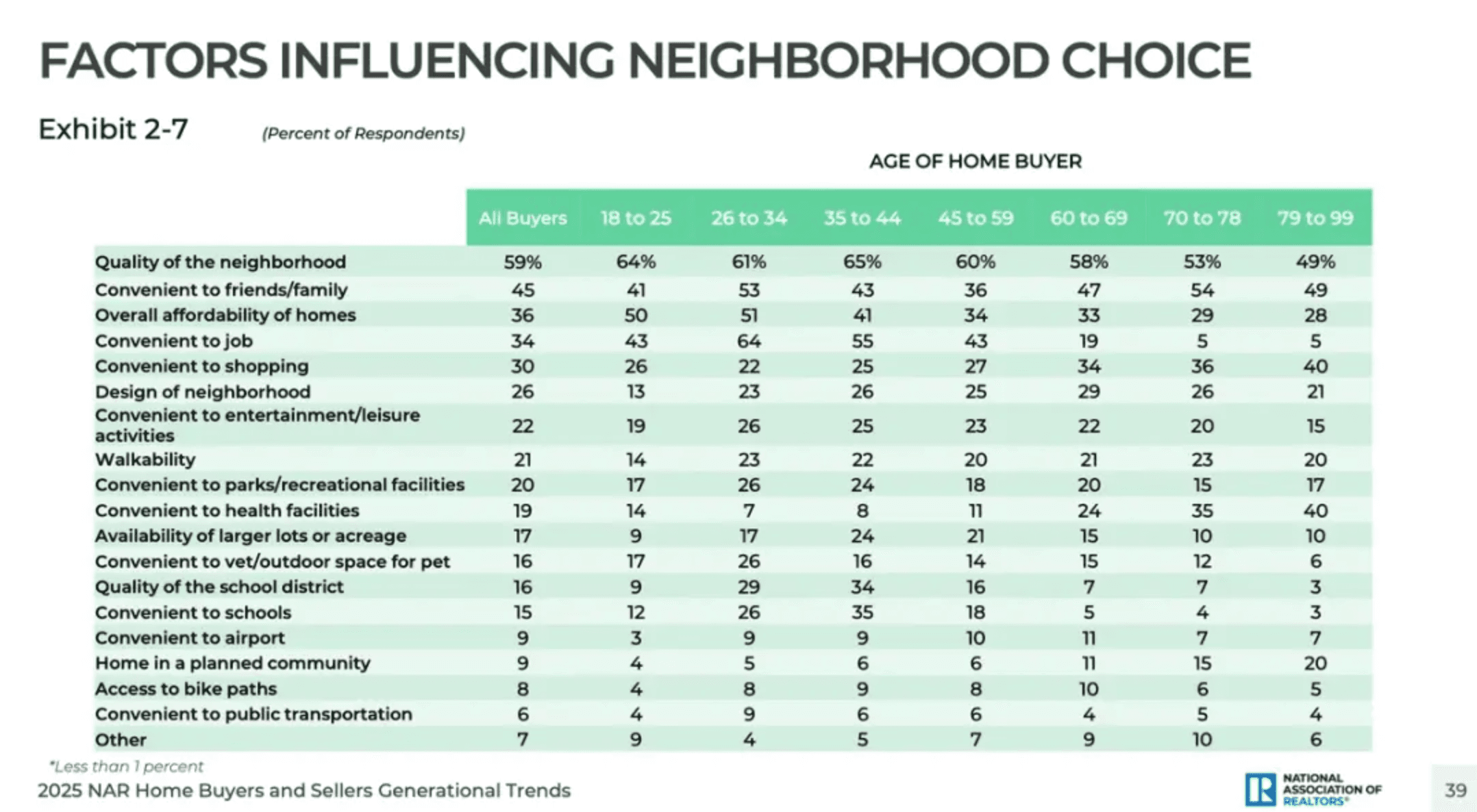

What the data says:

- 64% of Younger Millennials prioritize job proximity

- Families with children (Older Millennials) focus on school quality and amenities

- Boomers and Silent Generation prioritize affordability, peace, and proximity to family

Tools to Use:

- Walk Score® for commute analysis

- WithJoy.AI neighborhood search filters for amenities, price trends, and insights

5. Retirees Are Relocating Far and Fast

What the data says:

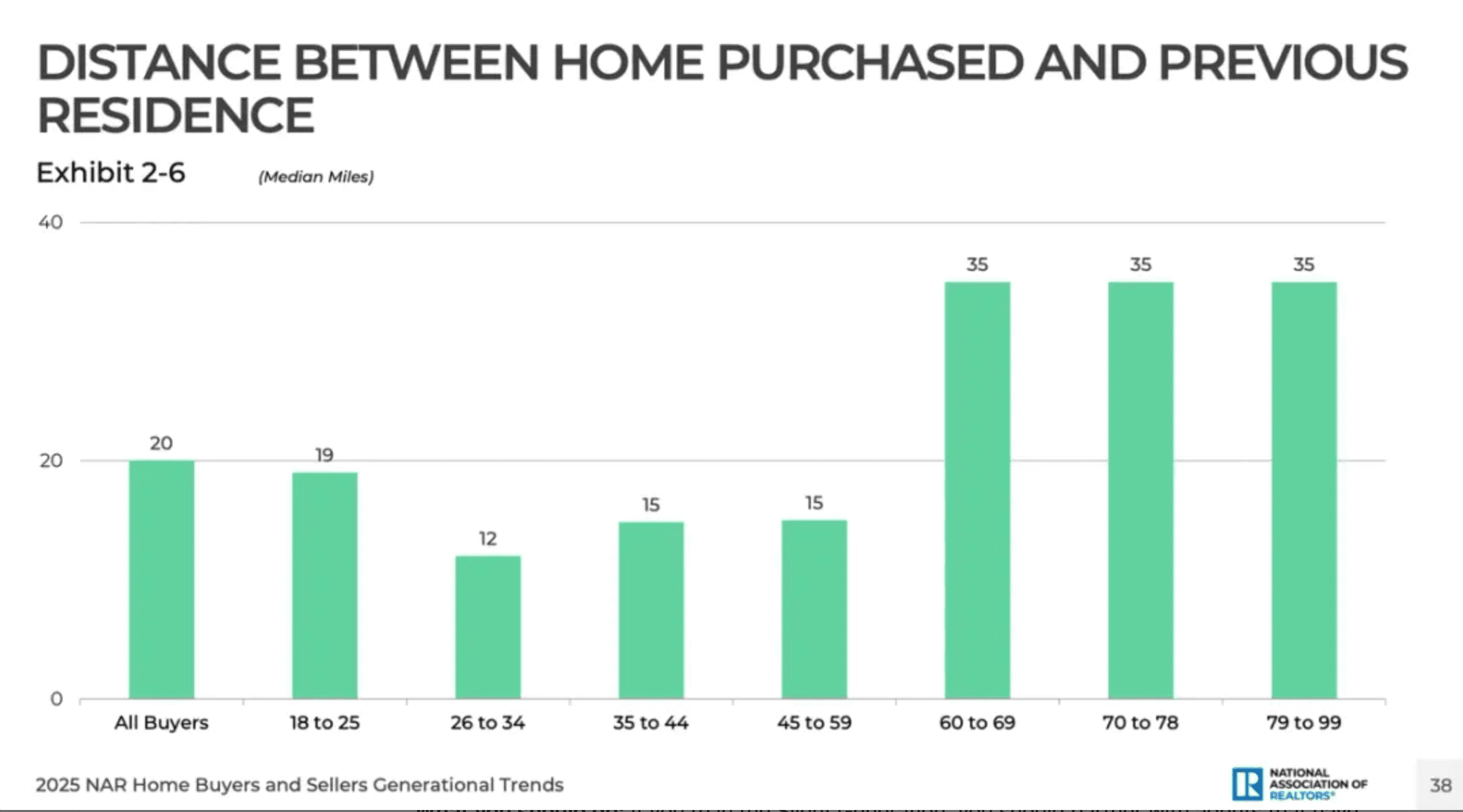

Buyers aged 79–99 moved a median of 35 miles compared to just 12 miles for Millennials. Silent Generation buyers often choose senior housing or cash-only homes for sale in rural towns, finding homes within 8 weeks or less.

This is the demographic least tied to employment and most likely to be cash buyers.

Pro Tip for Younger Buyers:

Don’t underestimate older buyers as competitors. They move fast, buy decisively, and are often targeting hot real estate agent picks or exclusive 55+ listings.

For Retirees:

Look into certified senior real estate specialists (SRES), and use platforms like WithJoy.AI to access retirement-friendly listings and downsizing calculators.

6. Down Payment Saving Is Still the #1 Hurdle

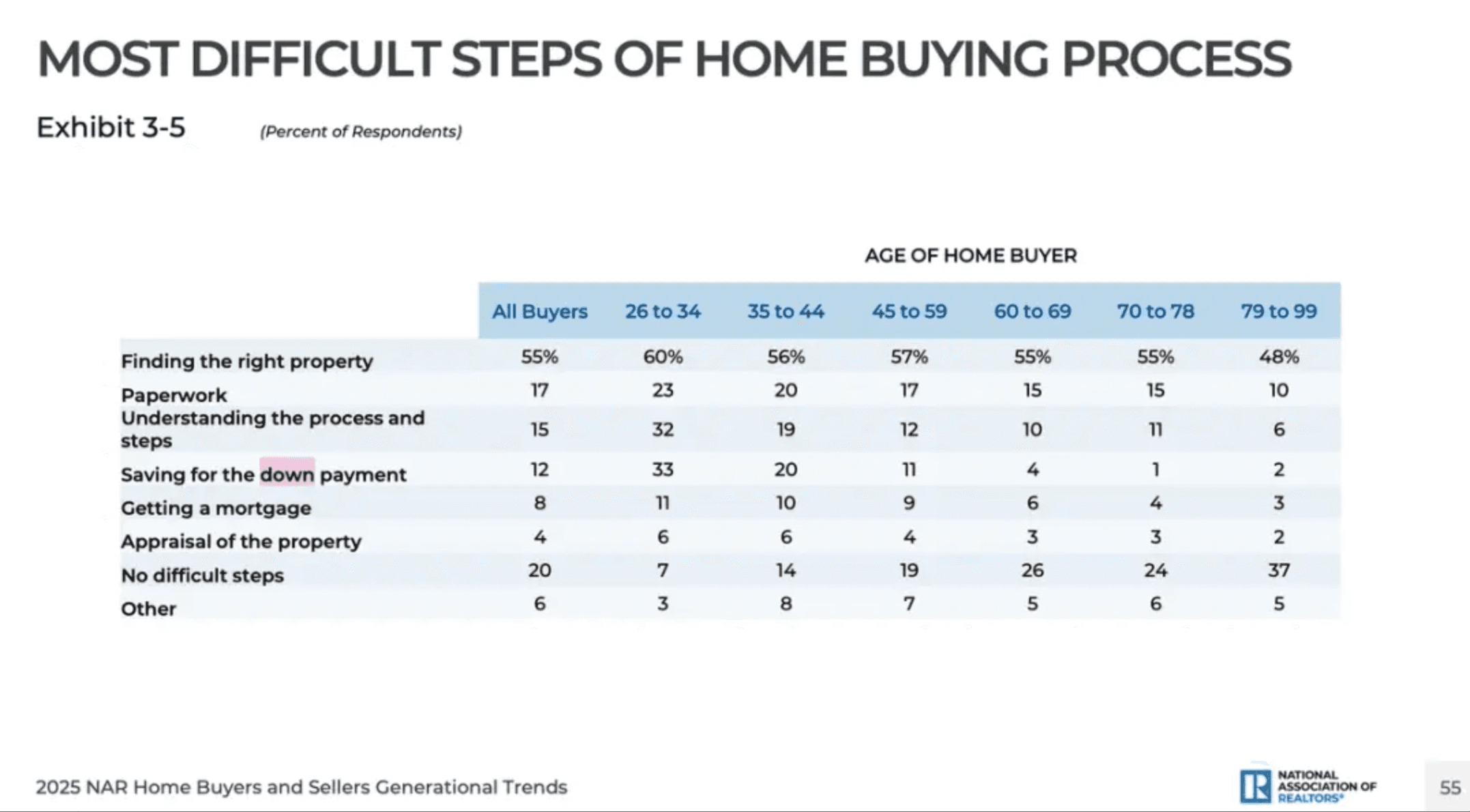

What the data says:

33% of Younger Millennials report saving for a down payment as their biggest challenge. High rents, lifestyle inflation, and limited income growth are holding them back.

With median home prices nearing $650,000 in many metros, this group is increasingly turning to family help, shared housing, or investment homes for sale as alternatives.

Tactics to Try:

- Automate savings with dedicated home-buying accounts

- Use budgeting apps to identify spending leaks

- Research down payment grants available in your ZIP code

7. Real Estate Agents Are Still Invaluable Even in the AI Age

What the data says:

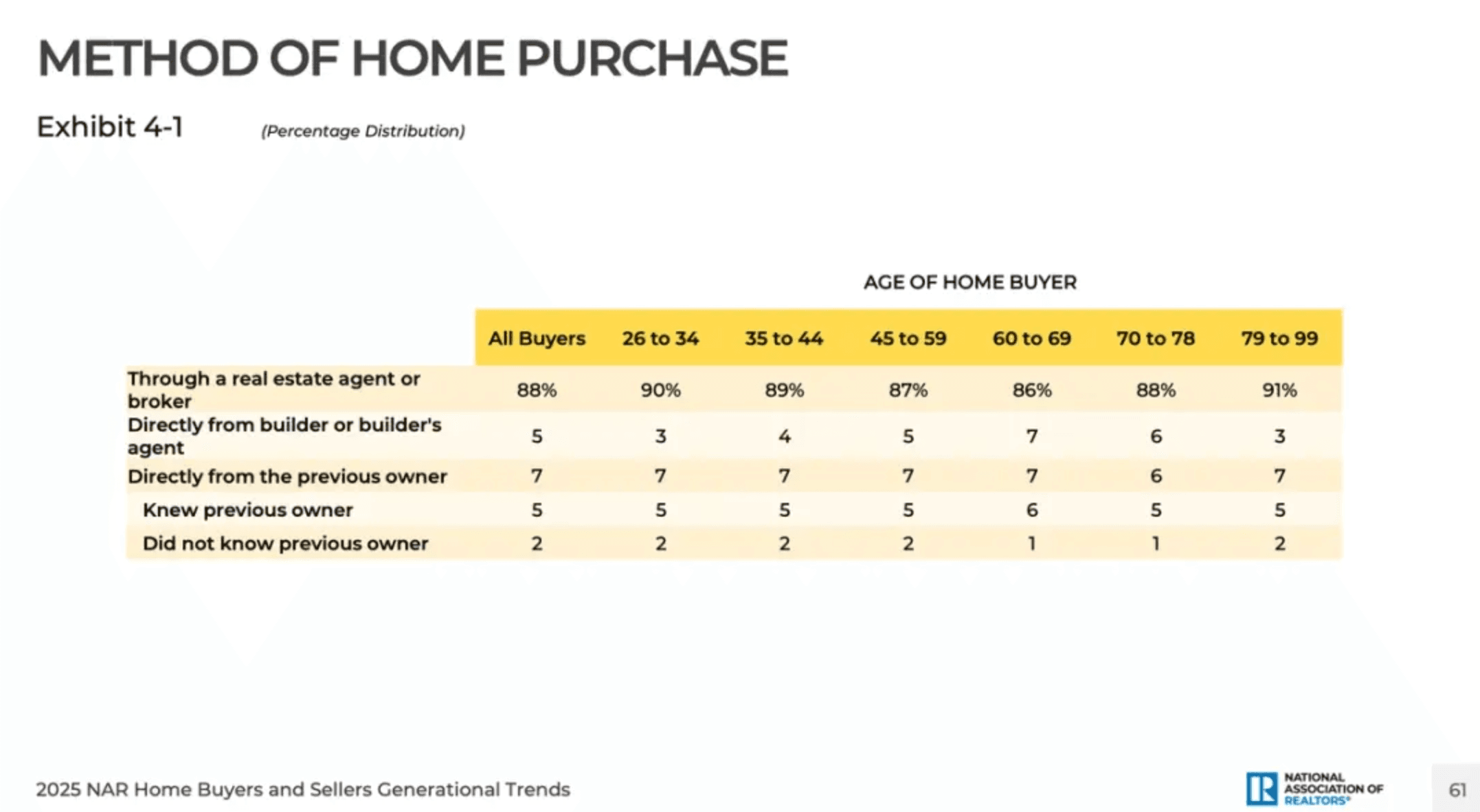

88% of buyers purchased through an agent primarily to navigate paperwork, pricing negotiations, and competitive bidding.

Even with Zillow and Redfin dominating early search, most homebuyers turn to a hot real estate agent to actually close the deal.

📬 Get Weekly Real Estate Insights Straight to Your Inbox

Stay ahead of the market. Sign up for tips, market trends, and more.

Final Thoughts: What This All Means for You

The 2025 housing market reflects economic pressure, generational shifts, and evolving buyer behavior. But the good news? There are still many ways to win.

- If you’re Gen Z or a first-time buyer: Get creative. Rebates, house hacking, and AI tools like WithJoy can help make homeownership a reality.

- If you’re Gen X or a high-income buyer: Invest in long-term value. Multi-gen homes, booming ZIPs, and tax strategies can maximize ROI.

- If you’re downsizing or retiring: Move fast, move smart. Your equity is your advantage use it wisely.

No matter your generation, the key is this: make decisions with clarity, tools, and strategy.

Related Guides

Top 5 Myths About Buying a Home That Could Cost You Thousands

Discover the top five myths about buying a home that could end up costing you big

KB

Kyler Bruno

10/12/2025

Real Estate Commission Rebates Explained

Almost all homebuyers leave money on the table.. don’t be one of them!!

KB

Kyler Bruno

07/11/2025

Contingent Homes Explained: Answers to Common Homebuyer Questions

Contingent Home? Learn What It Means, If You Can Still Offer, And How To Compete.

KB

Kyler Bruno

08/04/2025

Full Service Home Buying - WithJoy.AI

Find Your Home Today

The future is here. Buy your next home WithJoy.AI

Trending Neighborhoods

Best Places to Retire

Best Affordable Areas Near Seattle

Best for Young Professionals

Best Family Neighborhood Seattle