7 minutes read

Top 5 Myths About Buying a Home That Could Cost You Thousands

Discover the top five myths about buying a home that could end up costing you big

KB

Kyler Bruno

10/12/2025

Buying a house sure is a big financial decision. If you’ve been scrolling late at night, mortgage calculators open, twelve tabs deep and you’ve probably seen confident advice that sounds simple… until it isn’t.

From buying the wrong house to choosing the wrong mortgage option, one mistake can cost thousands of dollars. Don’t worry. We won’t let this be you.

Think of this as a friendly walk-through with a pro who’s already flagged the squeaky floorboards. We’ll debunk the most common myths and show you how homebuyers make smart, calm decisions that help them find their dream homes without burning their savings.

We also explore how many homebuyers are leveraging from commission rebate model, where homebuyers get a huge percent of buyer's agent commission as rebate at closing, helping them offset their closing costs or help them buy the interest rate down!

Myth 1: Buy the most expensive house you can afford

Truth: Buy a house that meets your needs and allows you to have a comfortable financial stability.

Story: Annie could “technically” qualify for a higher price point. On paper it worked. In life, it didn’t. The monthly mortgage payment plus utilities, commuting, and daycare turned her dream home into a monthly squeeze. After six months, she stopped contributing to savings and the stress showed. Why the myth hurts:

- Your budget isn’t just PITI (principal, interest, taxes, insurance). It’s utilities, maintenance, commuting, childcare, and a life you still want to live.

- Markets move. If property values dip, a stretched purchase can feel even tighter.

What to do instead? : Choose the home that fits your non-negotiables (like, location, layout, commute) and leaves room for savings.

Click the below link to calculate home budget before making an offer. This helps for first-time homebuyers to segregate the expenses and see the savings clearly to have an understanding over what is affordable, you can also speak to a qualified agent for more personalized advice.

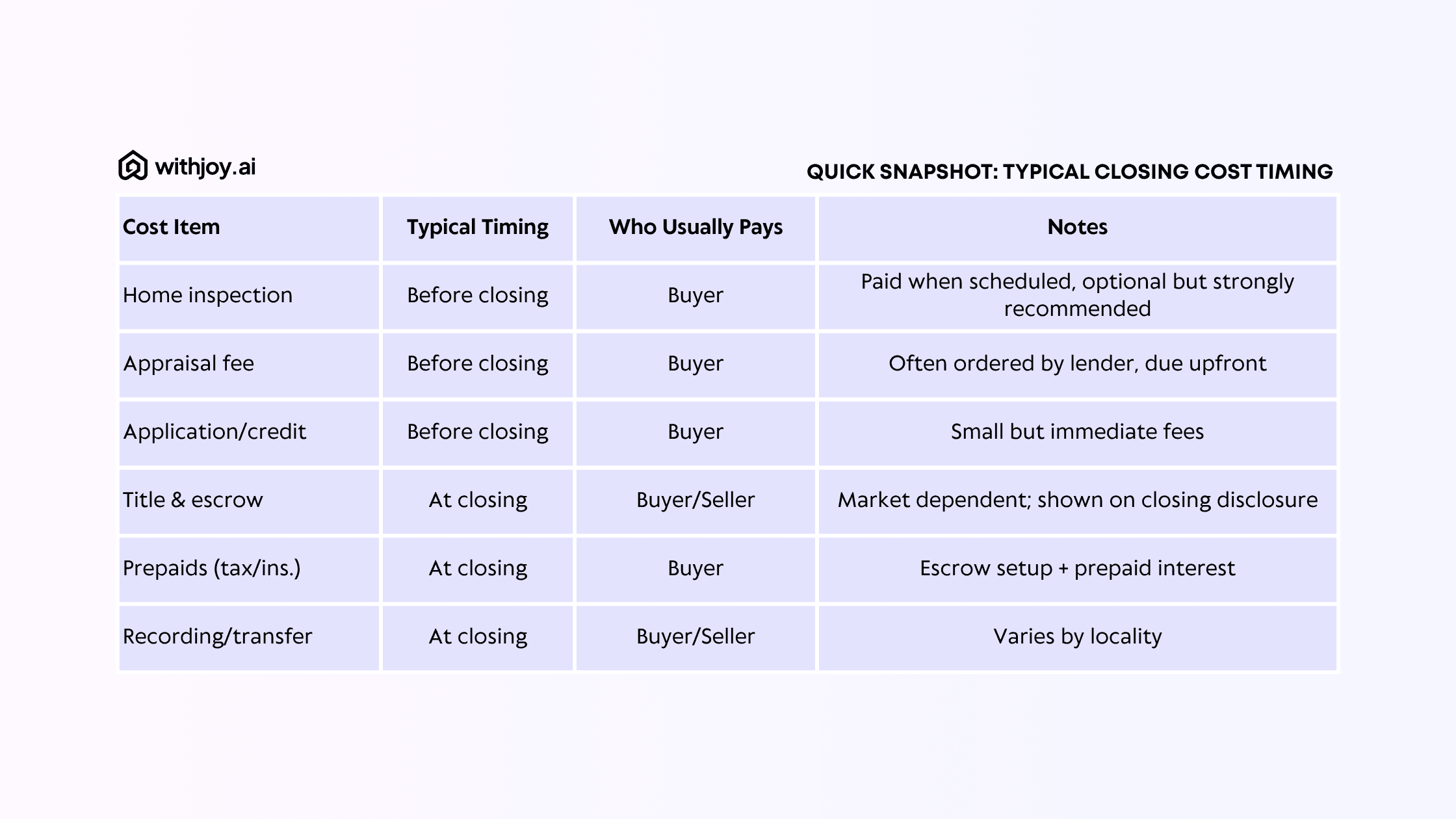

Myth 2: Closing costs are only paid at closing

Truth: Some closing costs, like home inspection and appraisal fee, are paid before the closing.

“Closing costs” sounds like one neat bundle due on closing day. In reality, several items show up earlier and out-of-pocket.

Quick Snapshot: List Of Closing Costs.

What to do? : Ask your agent and lender for a line-item estimate early. Set aside an “upfront” mini-budget so none of this is a surprise.

Want a line-by-line estimate for your price point?

Click below to explore more information about closing-costs & their breakdown

Myth 3: Wait for the best time to buy a house

Truth: There’s no guaranteed best time to buy a house.

Story: Sam waited for “the dip.” Rates ticked up. Inventory tightened. The home he loved? Gone. The replacement cost more with a longer commute. His “perfect timing” plan cost him time and lifestyle.

Reality check: The housing market is influenced by interest rates, inventory, local job growth, and broader economic conditions. Predicting all of that perfectly is a myth.

A better approach:

- Buy when you are financially ready.

- Buy when you’ve found a home that fits your life.

- Negotiate smart, structure matters as much as timing.

Sense-check your timing against your finances and local inventory.

Talk to an advisor about your readiness.

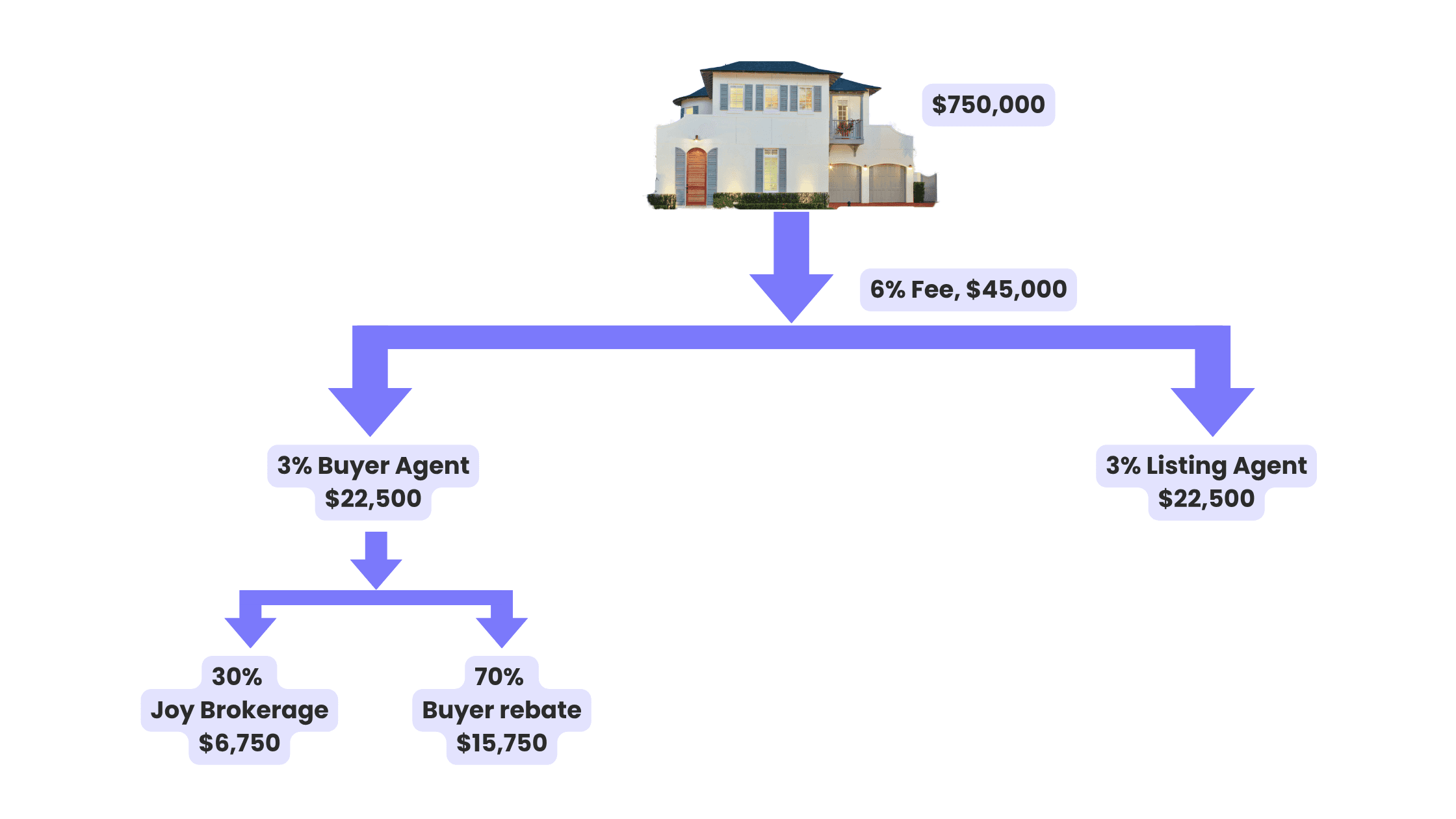

Myth 4: A buyer’s agent doesn't cost the buyer extra money

Truth: Buyer’s agents do cost money. Even when a buyer doesn’t pay their agent directly, there’s still a cost embedded in the transaction.

Real estate commissions are typically built into the home’s price and paid by the seller (commissions and payments are always negotiable). That means the buyer indirectly contributes through what they pay for the home.

Example: For a State like Washington, this is the typical structure of commissions look like

- Purchase price: $750,000

- Total commission: 6% = $45,000

- Listing agent (3%): $22,500

- Buyer’s agent (3%): $22,500

That’s real money.

Where we’ve improved the model : At WithJoy, when you buy a house with our AI-powered real estate platform, homebuyers can get upto 70% of what a buyer’s agent earns back as a commission rebate at closing (subject to lender approval and state rules).

Using the example above, Upto 70% of the commission, On a $750k home purchase that is $22,500 = $15,750 back to homebuyer.

Commission rebate in housing real estate transactions can cover closing costs or helps to buy down the interest rate for homebuyers.

Estimate your buyer’s agent commission rebate on your price range. And Calculate your rebate or use the rebate calculator on our home page.

Note: Commission rebates are subject to lender approval and are available where permitted by law. See disclosures below.

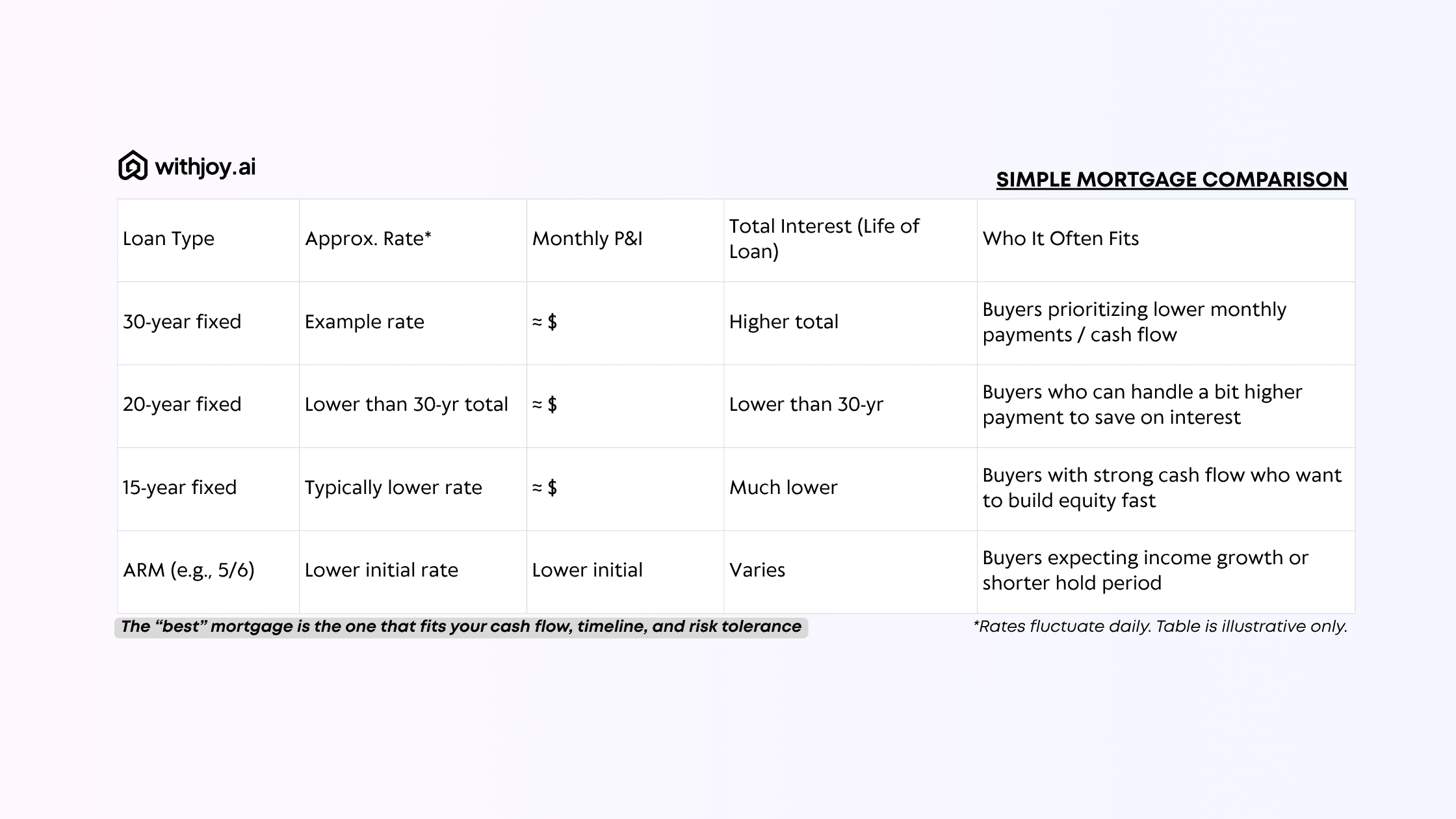

Myth 5: Thinking that the 30-year fixed mortgage is the best option

Truth: Consult an expert to know which mortgage option is best for you.

The 30-year fixed mortgage loan is stable and predictable but not always optimal. Because the loan stretches over three decades, total interest paid can be significantly higher compared to shorter terms.

Simple Mortgage Comparison

Assume: Loan amount $600,000

Rates fluctuate daily. Table is illustrative only.

Key idea: The “best” mortgage is the one that fits your cash flow, timeline, and risk tolerance not someone else’s rule of thumb.

Compare 15, 20, 30-year and ARM side by side for your budget. Get a personalized mortgage fit review. Click below to read more about mortagage options in washington state.

To Wrap Things Up On Homebuying Myths

The process doesn’t have to be overwhelming. As long as you have the right information, you continuously do your own research, and you consult the right professionals, homebuying will be easy, smooth, and less expensive for you.

Your next three smart moves:

- Get a custom affordability plan that protects your lifestyle.

- Request a closing-cost breakdown so you know what’s due and when.

- Calculate your commission rebate with WithJoy and compare mortgage options side by side.

Here’s to finding your dream house without falling for these myths.

Happy house hunting ✨🏠

Related Guides

Why Washington State is so Expensive to Buy a Home in

The first-time homebuyer market share decreased to a historic low of 24% (down from 32% last year)

KB

Kyler Bruno

07/12/2025

What Are the Steps to Buying a House

Five key steps to buy a home, from financing to closing, for a smooth process.

KB

Kyler Bruno

10/10/2024

What Are the Steps to Buying a House

Five key steps to buy a home, from financing to closing, for a smooth process.

KB

Kyler Bruno

10/10/2024

Full Service Home Buying - WithJoy.AI

Find Your Home Today

The future is here. Buy your next home WithJoy.AI

Trending Neighborhoods

Best Places to Retire

Best Affordable Areas Near Seattle

Best for Young Professionals

Best Family Neighborhood Seattle