1 minute read

Real Estate Agent Commission in Washington State

The average real estate commission in WA is 5.18%, why not keep more for yourself?

KB

Kyler Bruno

07/26/2025

Washington Real Estate Commission Overview

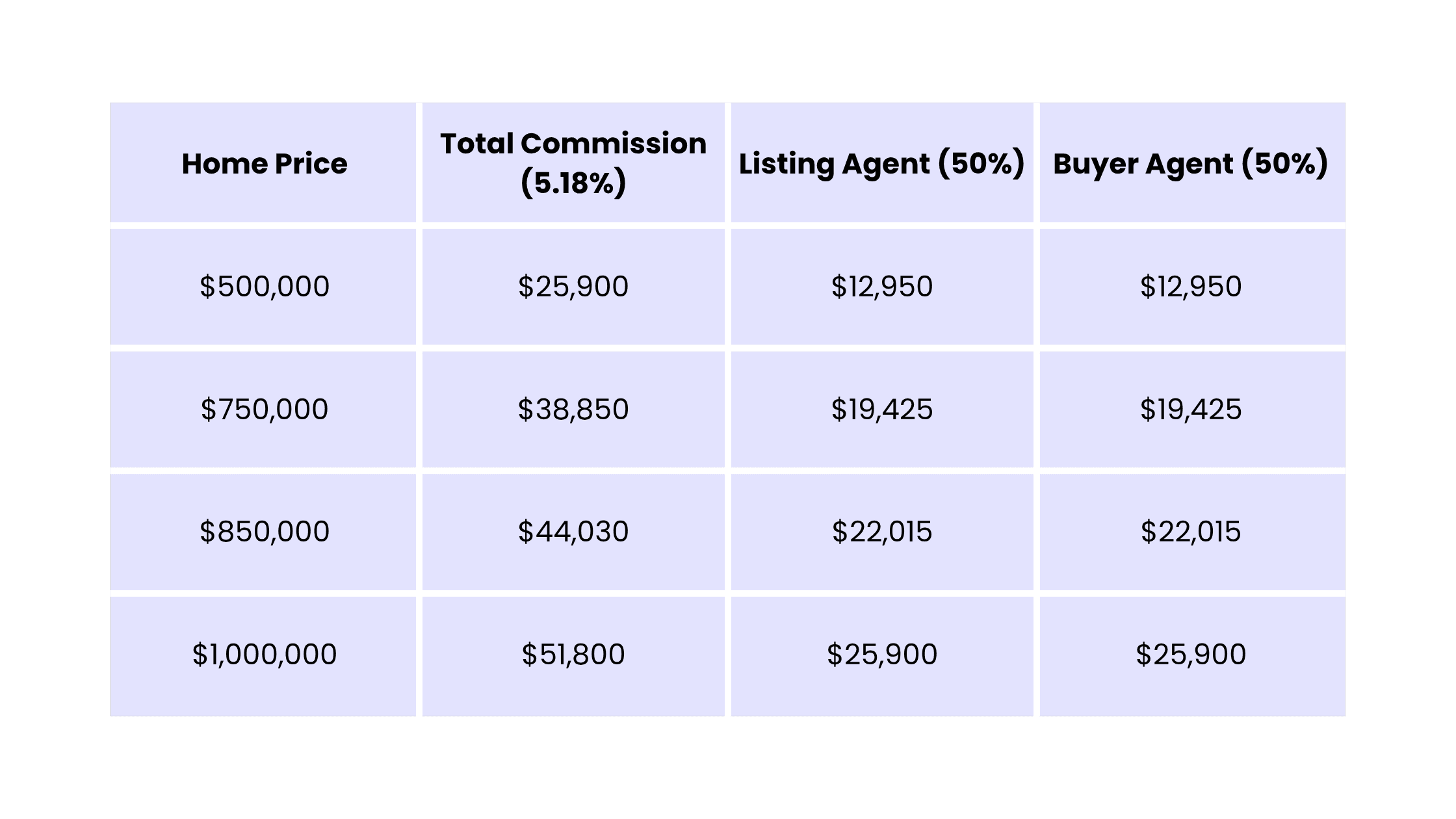

In Washington State, the average total real estate commission is 5.18% (as of February 2025), typically split evenly between the Listing Agent and the Buyer’s Agent. That means for most transactions, each agent earns around 2.59% of the home’s final sale price.

Let’s break that down:

Who Pays the Real Estate Commission?

In most Washington home sales, the seller pays the full commission, which is then split between the agents. This commission is built into the final sale price of the home, so it still affects buyers indirectly.

While it’s negotiable, 5-6% has remained the national norm. Sellers are often unaware they’re able to negotiate these rates or choose brokerages that offer more cost-effective solutions.

What You’re Really Paying For?

Here’s what typical agent commissions are expected to cover:

- Home valuation and pricing strategy

- Professional listing on MLS

- Photography & marketing

- Home tours and open houses

- Negotiation expertise

- Paperwork, contracts, and compliance

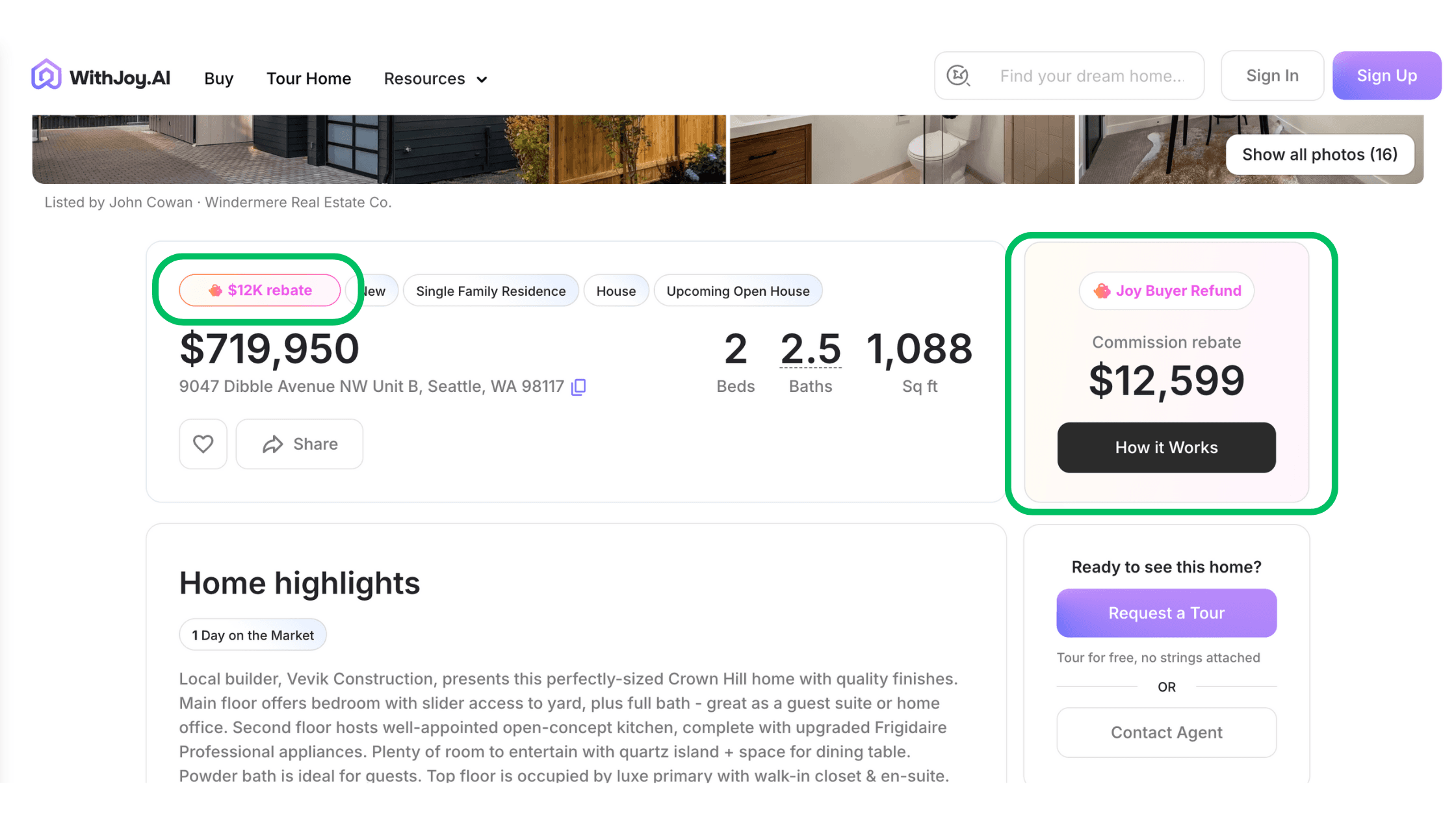

But with AI-powered platforms like WithJoy.AI, many of these services can now be streamlined, reducing overhead and allowing buyers to benefit from rebates without losing out on quality representation.

Real-Life Example: Buying a Home with WithJoy.AI

Imagine you’re buying a home in Seattle for $850,000. At a 5.18% commission, the buyer’s agent earns $22,015. WithJoy.AI gives buyers a 70% commission rebate.

💰 That’s $15,410.50 back to you at closing.

What Can You Do With That Money?

✅ Pay off closing costs (title fees, escrow fees, etc.)

✅ Buy down your mortgage interest rate.

✅ In some cases can apply towards down payment.

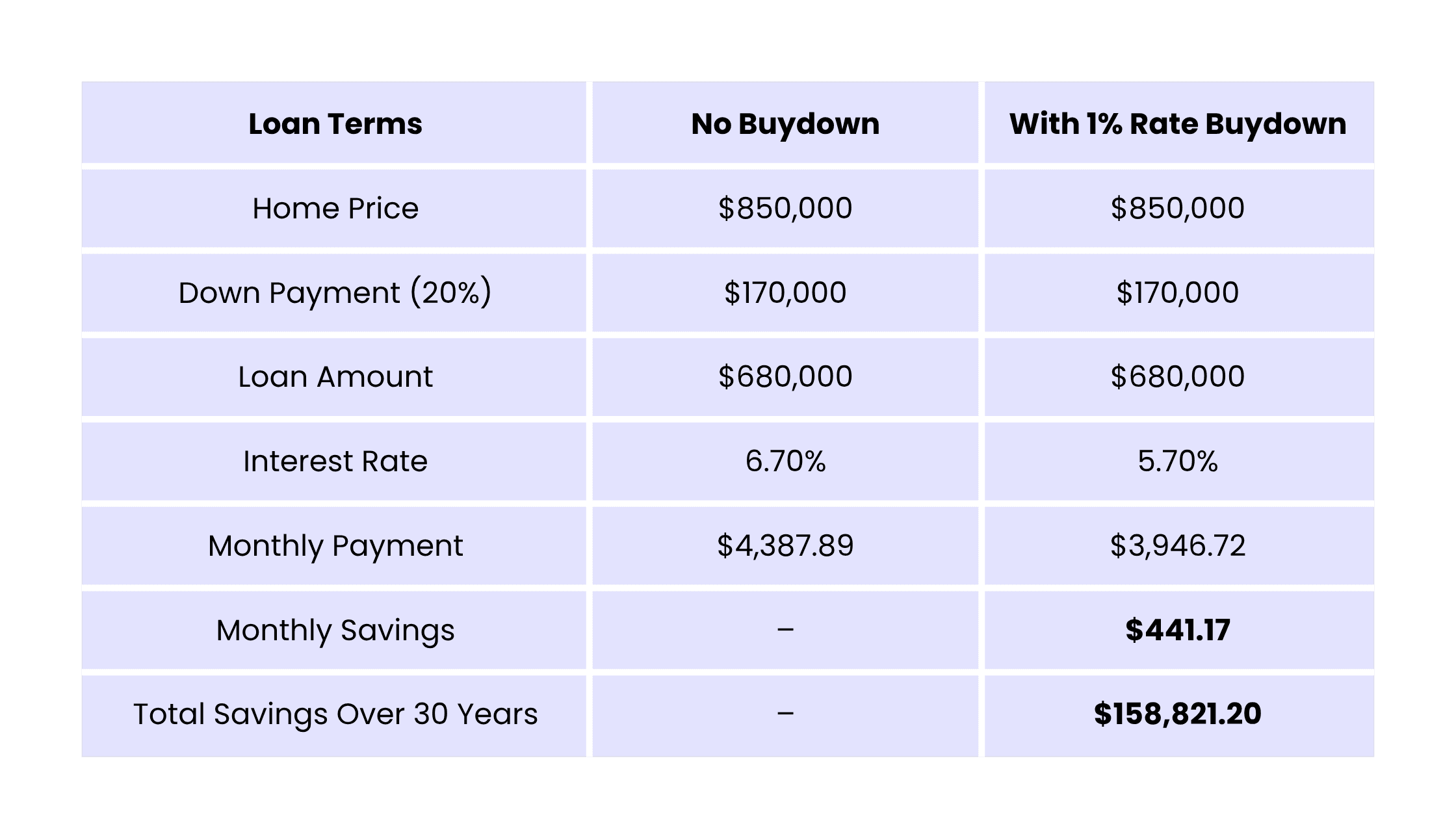

Lower Your Monthly Mortgage Payment with a Rate Buydown

Here’s how your WithJoy.AI rebate can translate into long-term mortgage savings: That’s the power of a smart rebate.

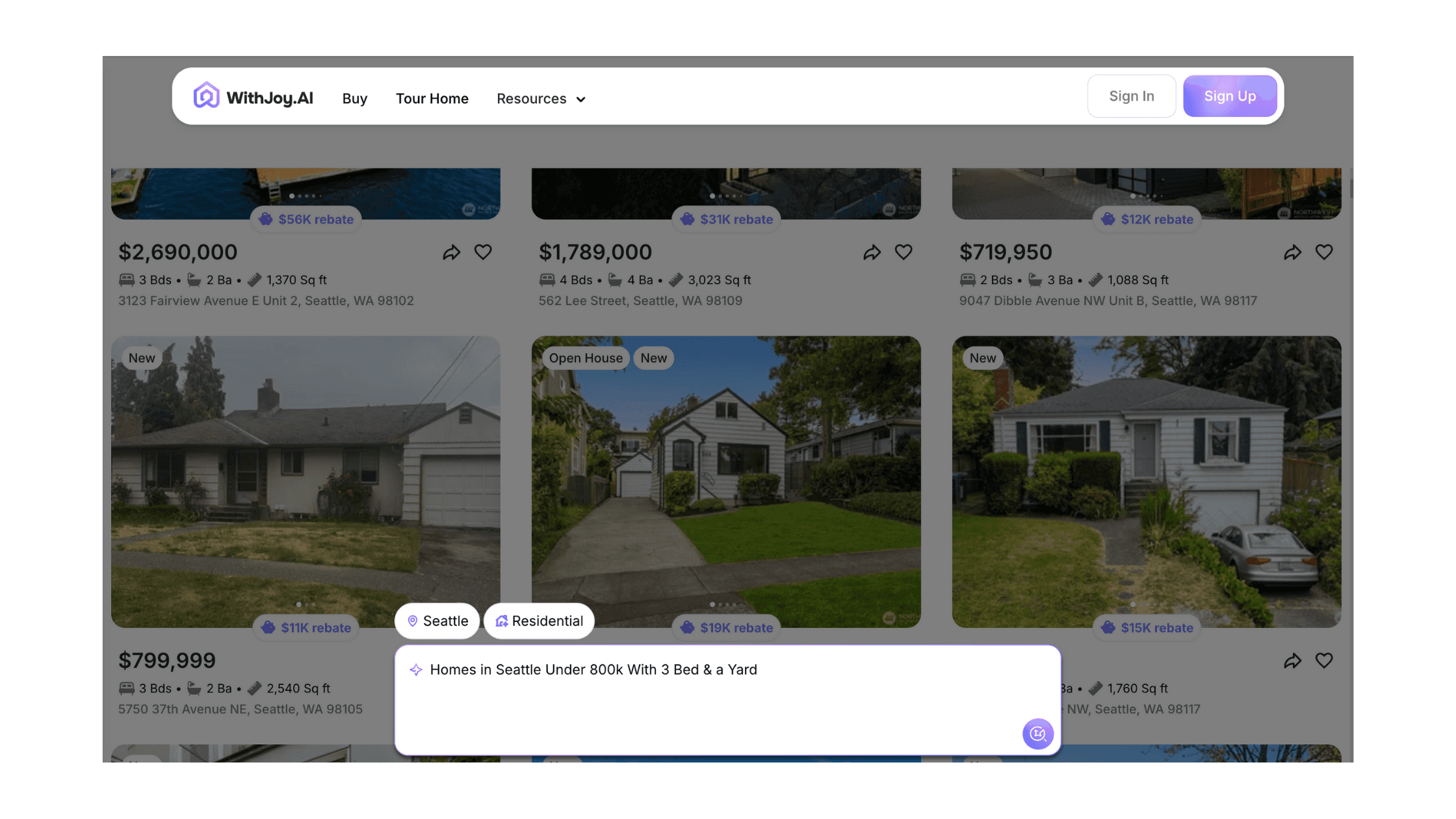

Real AI Search: How to Buy Smarter with WithJoy.AI

Tired of clunky MLS websites with too many filters? WithJoy.AI’s ChatGPT-style AI home search lets you search in plain English.

Try something like:

- “Show me 3-bedroom homes under $700k with a yard in Bellingham.”

- “Find waterfront homes in Tacoma.”

🎯 No filters. No frustration. Just natural conversation.

Pair that with instant tour booking, smart offer guidance, and real-time market insights all inside one seamless AI assistant.

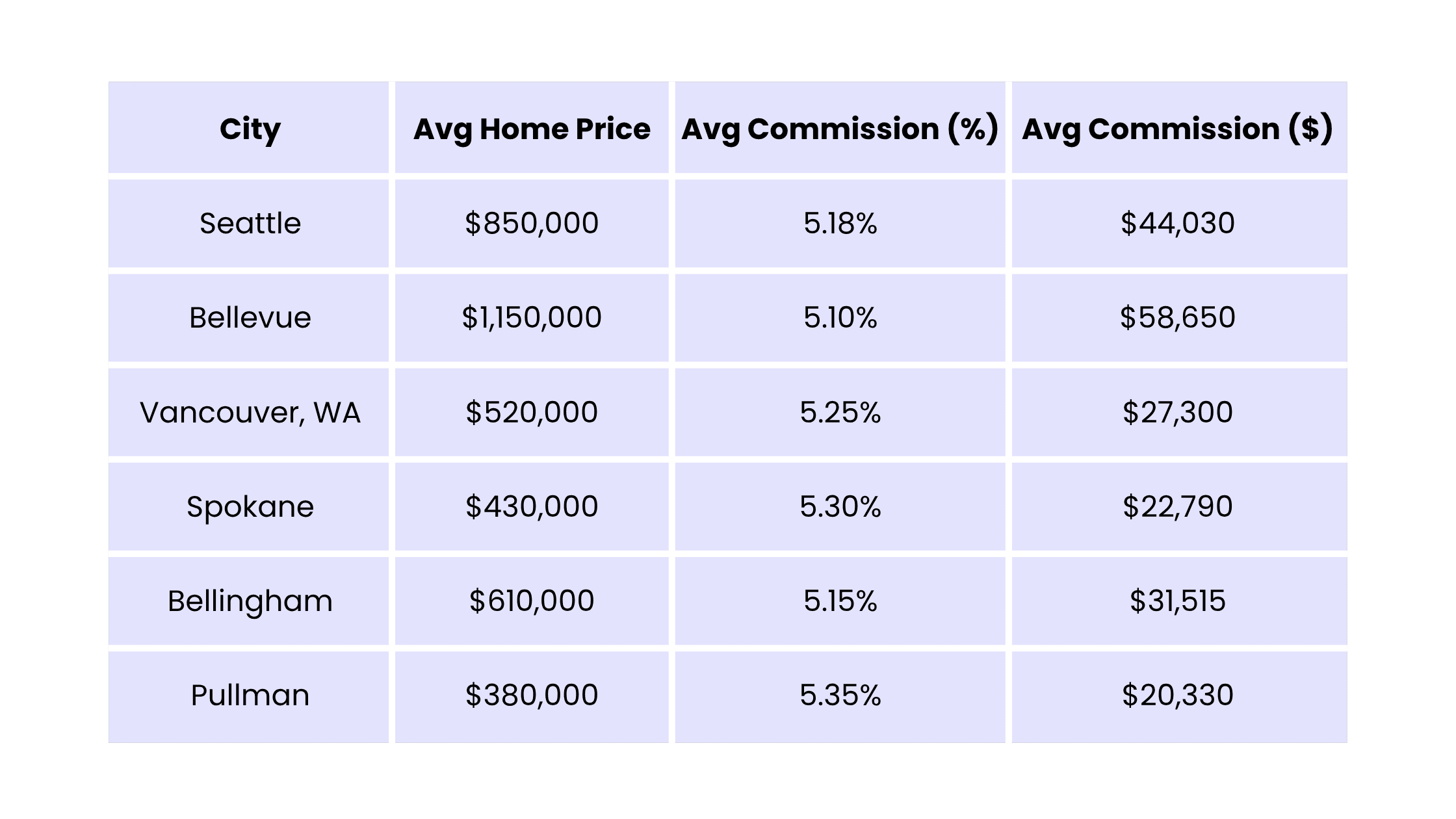

Commission Breakdown by City (2025 Averages)

🔍 Looking in one of these cities? You could save thousands with a commission rebate.

Additional Costs Beyond Commission

Even if you’re not paying the commission directly, buying a home comes with other costs:

- Appraisal: $500 - $800

- Inspection: $300 - $600

- Title Insurance: $1,000 - $2,500

- Escrow Fees: $1,000 - $2,000

- Taxes & Recording Fees: Vary by county

Using your WithJoy.AI rebate, many of these costs can be fully or partially covered.

Subscribe to Our Buyer Brief

Stay updated with market tips, rate drops, home search hacks, and legal insights.

📥 Subscribe to WithJoy.AI’s

Final Thoughts: Should You Still Pay 5%+ Commission in 2025?

In a world where AI is writing offers, booking tours, and even analyzing price trends should you still be paying traditional fees?

With platforms like WithJoy.AI, buyers are getting smarter, faster, and richer real estate experiences.

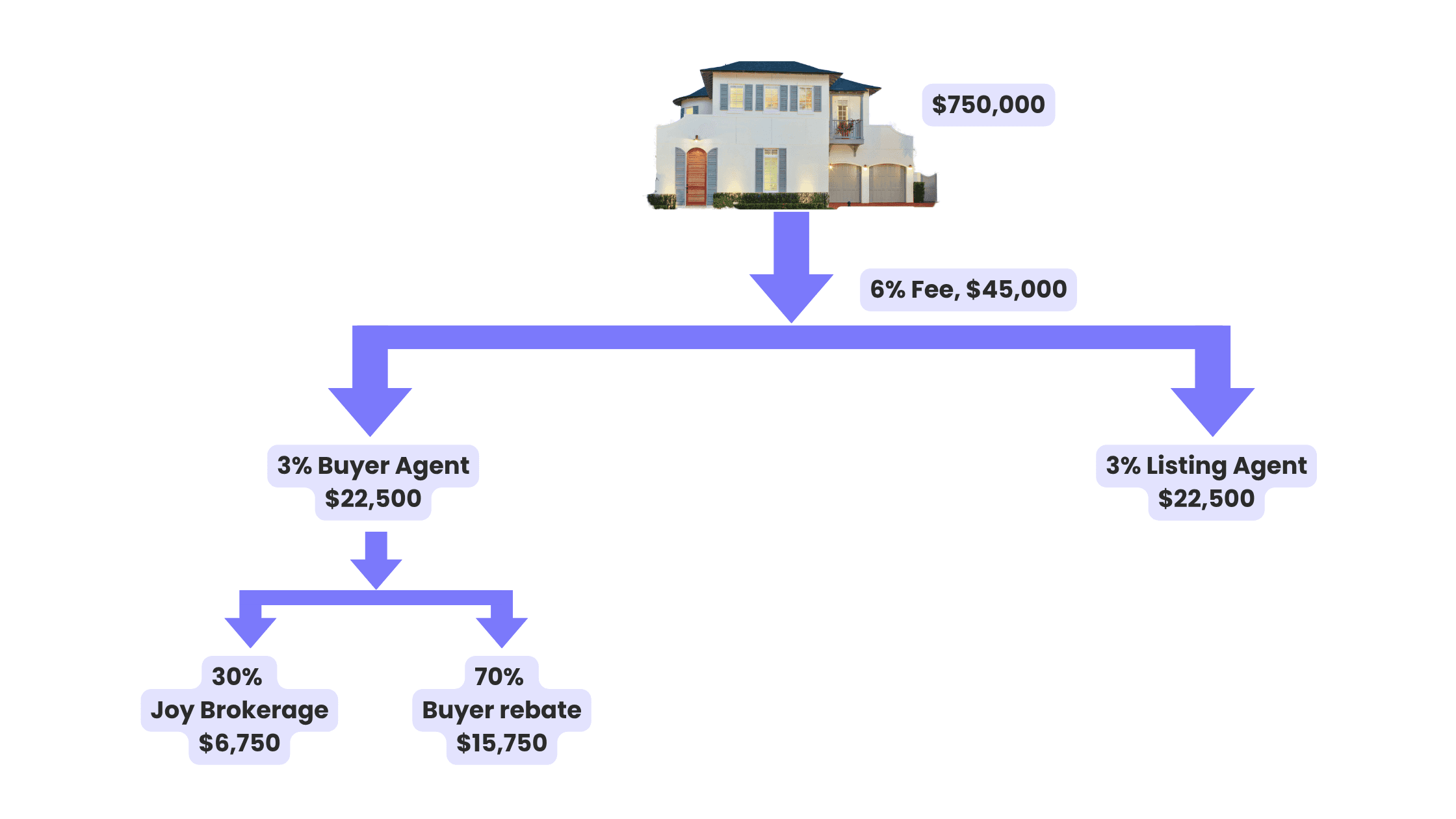

Watch: How Commission Rebates Work

🎥 Watch the YouTube Video

We break down how real estate agents get paid, what rebates are legal in Washington, and how buyers are saving thousands using tech-powered brokerages.

Work with WithJoy.AI

At WithJoy.AI, we’re reimagining how Washington State does real estate:

- AI-powered home search

- Fast scheduling for tours

- Offer insights and negotiation tools

- 70% rebate on buyer agent commission

Buy smarter. Save bigger.

Related Guides

How Do Real Estate Commissions Work

Learn how Joy, the AI agent, rebates 70% of her commission, helping buyers save thousands.

KB

Kyler Bruno

10/10/2024

Why Washington State is so Expensive to Buy a Home in

The first-time homebuyer market share decreased to a historic low of 24% (down from 32% last year)

KB

Kyler Bruno

07/12/2025

Who Pays the Inspection When Buying a House

Home inspection is a visual, non‐invasive check of major systems (structure, roof, plumbing, etc.)

KB

Kyler Bruno

10/22/2025

Full Service Home Buying - WithJoy.AI

Find Your Home Today

The future is here. Buy your next home WithJoy.AI

Trending Neighborhoods

Best Places to Retire

Best Affordable Areas Near Seattle

Best for Young Professionals

Best Family Neighborhood Seattle