5 minutes read

Washington’s Rental Market vs. Buying: What’s the Better Investment?

Which is the better investment, buying or renting a house in Washington?

KB

Kyler Bruno

03/18/2025

If you expect to stay 7+ years in Washington State and can handle upfront costs (down payment + closing costs), buying a house in Washington usually beats renting in Washington State on long-term wealth, thanks to home equity growth, potential appreciation, and payment stability with a fixed-rate mortgage.

If you need flexibility, are testing neighborhoods in Seattle, Bellevue, Redmond, or Tacoma, or want lower upfront friction, renting may be the smarter short-term choice. Read further to find for a detailed analysis of renting vs. buying a home in Washington state.

Washington at a Glance

Washington’s housing market is shaped by:

- Dynamic job centers (Seattle, Bellevue, Redmond) that support housing demand and longer-term price resilience.

- Lifestyle diversity (city, suburb, mountain, coast) that draws both renters and buyers.

- Local variability (Spokane vs. Tacoma vs. Seattle) in price-to-rent ratios, taxes, HOAs, and appreciation.

This context drives the rent-versus-buy decision more than any national “rule of thumb.”

Why People Choose to Rent vs. Buy in Washington?

Why People Rent in Washington?

- Flexibility & optionality. Perfect for newcomers exploring neighborhoods before settling.

- Lower upfront costs. No down payment or closing costs; landlords usually handle maintenance and repairs.

- Cash-flow predictability (short-term). For a 6–24 month horizon, rent can be simpler especially if you may switch jobs or cities.

Why People Buy a House in Washington?

- Home equity = wealth engine. Monthly payments build principal over time.

- Relative payment stability. A fixed-rate mortgage shields you from annual rent hikes.

- Customization. Energy-efficient upgrades, remodels, or adding livable space improves utility and potential resale.

- Tax advantages. Many owners deduct mortgage interest (subject to federal caps and whether you itemize), and property taxes can sometimes be deductible, ask a tax professional for your situation.

“Buying a house in Washington is a better investment” is generally true when the holding period is long enough to overcome transaction costs and realize equity compounding.

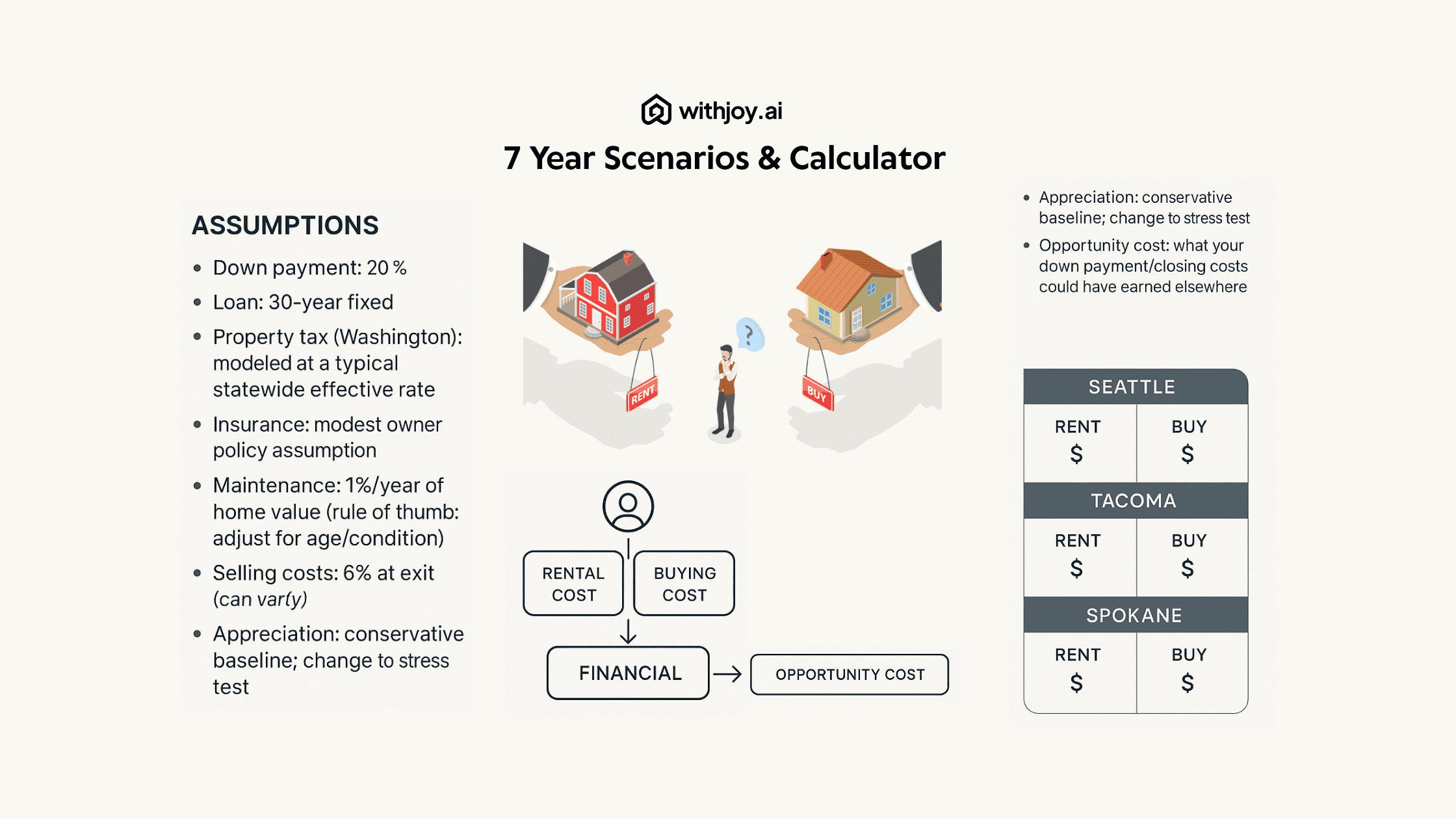

Seven-Year Scenarios & Calculator (Seattle, Tacoma, Spokane)

Here's a basic model with estimates or default assumptions if you want to calculate the costs of 7-year holding period, or how the same investment or opportunity cost could have performed if invest elsewhere is average returns in same duration.

Using these assumptions you can calculate Rent Vs. Buying financial picture based on your earnings, savings and median price of home you may have planned to purchase.

- Down payment: 20%

- Loan: 30-year fixed

- Property tax (Washington): modeled at a typical statewide effective rate

- Insurance: modest owner policy assumption

- Maintenance: 1%/year of home value (rule of thumb, adjust for age/condition)

- Selling costs: 6% at exit (can vary)

- Appreciation: conservative baseline; change to stress test

- Opportunity cost: what your down payment/closing costs could have earned elsewhere

For Some Major Cities, The Calculation May Yield These Inputs

- Seattle: Higher upfront cost, but long-term demand often rewards patience.

- Tacoma: More attainable price points; ownership tends to “catch up” to rent faster.

- Spokane: Lower prices; in family-size units, owning can rival high-quality rentals sooner.

Break-Even Factors (When Buying Pulls Ahead)

Some of the factors that explain the break even factors to decide the better option for renting vs. buying.

- Time horizon: Buying typically needs 5–7 years to overcome closing and selling costs.

- Price-to-Rent ratio (P/R): If purchase price / annual rent ≤ 18–20, buying can pencil out faster (sensitive to rates/taxes).

- Stable income & reserves: Ownership adds maintenance/repair variability; cash buffers matter.

- Local appreciation & supply constraints: Neighborhood-level dynamics drive outcomes in Seattle/Bellevue/Redmond/Tacoma/Spokane.

First-Time Home Buyer Washington State: Loans & DPA

For people who prefer to buy homes but requires additional funding or financial assistance can explore downpayment assistance options, especially in case of first-time homebuyers. If 20% downpayment feels out of reach, explore these first-time home buyer Washington State paths:

- Down Payment Assistance (DPA): Washington State Housing Finance Commission (WSHFC) programs (e.g., Home Advantage, Opportunity) pair fixed-rate loans with DPA; income/price caps and homebuyer education typically apply.

- FHA loans WA: Lower down payments and flexible credit, with mortgage insurance premiums.

- Closing costs Washington: Expect ~2-4% of price or ask lenders for a Loan Estimate to compare scenarios.

- Homebuyer education: Often required for DPA, useful even if not required.

Always confirm exact eligibility, limits, and current terms from the program or lender. For more detailed overview of understanding how these programs work explore the blog below.

Taxes, Equity, and Total Cost of Ownership

Additional costs like taxes and equity can be calculated using the formulas below.

Total monthly owner cost = Principal + Interest + Property Tax + Insurance + Maintenance (+ HOA if applicable).

Total monthly renter cost = Rent + Renters Insurance + Utilities/Parking/Pet rent.

Mortgage interest deduction: Many owners can deduct interest on mortgage debt up to the current federal cap (varies by loan date and filing status). Always consult a tax pro for a cleat understanding of how these costs playout.

Equity growth: Your principal balance declines with each payment, pair that with steady appreciation and you build home equity the key driver of long-term advantage vs renting.

If buying is on the radar as per your calculations, get in touch with an expert real estate agent who can help you get started with the process.

When Does Renting Wins?

These are the factors that help to determine if renting is the right option as compared to buying.

- Short horizon (≤ 3–4 years). You likely won’t recoup closing/selling costs.

- Uncertain job/location. Flexibility can be more valuable than equity growth.

- Tight cash flow. If a surprise roof or water heater would strain your budget, rent until reserves are healthy.

- High P/R pockets. Some micro-markets have prices so far above rents that renting is rational even long-term.

Homeownership allows you to build equity over time, and, compared to renting where the prices can go up each year, a fixed-rate mortgage payments remains constant over time.

Plus, home values in Washington are increasing significantly over the past decade, according to the Washington Center for Real Estate Research.

That’s why buying a home is a smart investment, especially in a market with a strong track record in home sales like Washington state.

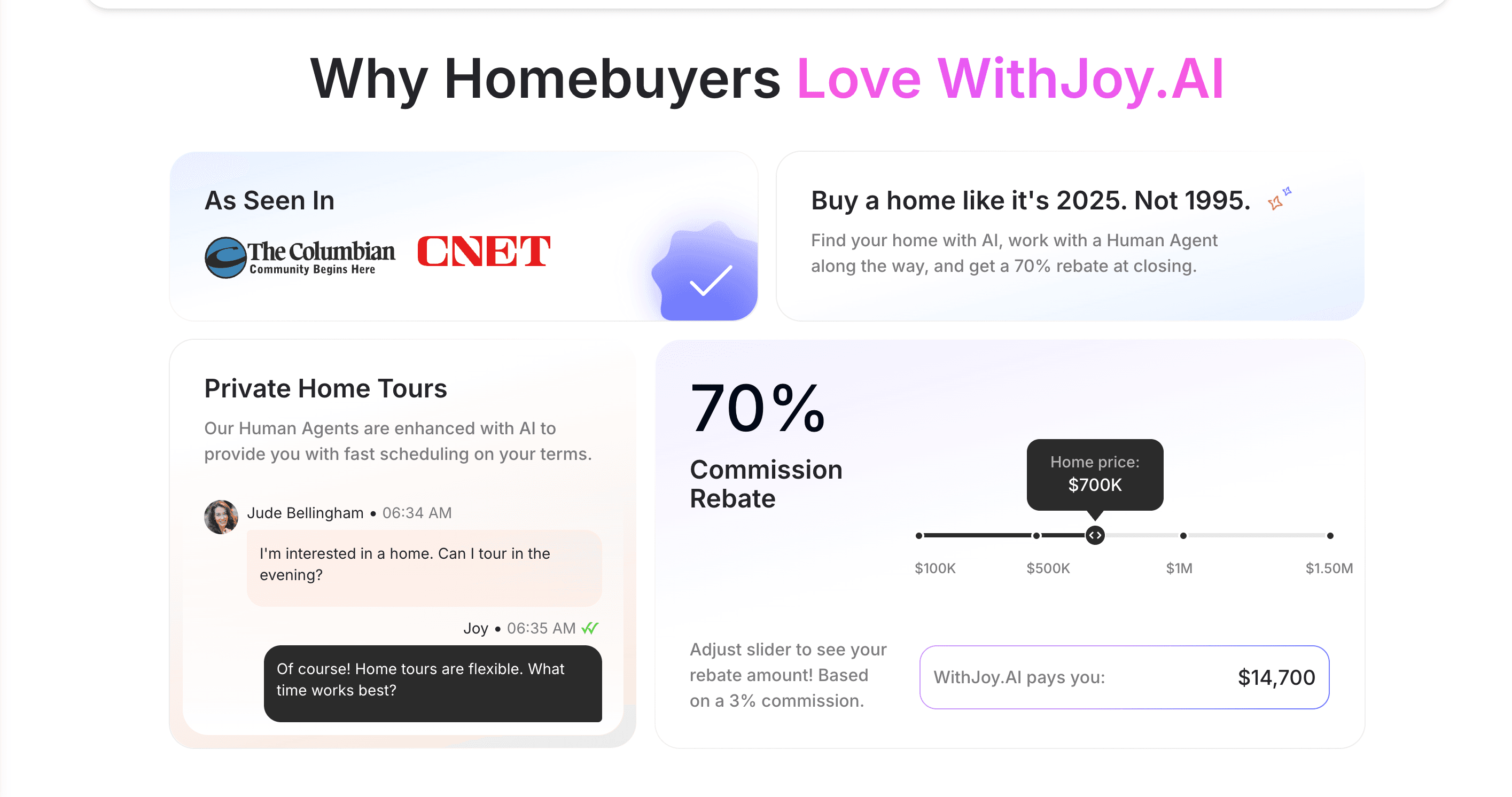

If you’re serious about investing in real estate, owning a home is a great way to build long-term wealth in Washington, and using AI modern real estate platforms like WithJoy.AI can help simplify the homebuying process for you.

WithJoy is a licensed, tech-powered discount real estate brokerage in Washington. Where allowed, qualified buyers receive a commission rebate at closing (rebates depend on price, lender approval, and state rules).

Currently, assisting homebuyers in PA & WA states. In Washington state the rebate at closing can go as high as 70% and besides rebate, we provide lightening speed home tours scheduled with a single click & AI powered-home search along with assistance from best agents for strong and winning offers.

Related Guides

First-Time Homebuyer Programs in Washington State

First-time homebuyers in Washington state, have you checked out these programs yet?

KB

Kyler Bruno

10/13/2025

Real Estate Agent Commission in Washington State

The average real estate commission in WA is 5.18%, why not keep more for yourself?

KB

Kyler Bruno

07/26/2025

Washington's Top 7 Lake House Destinations

Save thousands on the perfect Washington Lake House!

KB

Kyler Bruno

02/10/2025

Full Service Home Buying - WithJoy.AI

Find Your Home Today

The future is here. Buy your next home WithJoy.AI

Trending Neighborhoods

Best Places to Retire

Best Affordable Areas Near Seattle

Best for Young Professionals

Best Family Neighborhood Seattle