5 minutes read

How Much Money Do You Really Need to Buy a House?

How much you need to save for homebuying from down payments and closing fees to moving expenses.

KB

Kyler Bruno

07/11/2025

If you're wondering "how much should I save to buy a house?" you’re not alone. It’s one of the top questions among first-time homebuyers.

The reality? Buying a home is more than just a down payment. There are several hidden and not-so-hidden costs along the way.

Whether you're wondering how much to save, how to budget, or looking for the cheapest way to buy a house, this guide breaks it all down clearly.

At a Glance: Estimated Costs to Buy a $300,000 Home

📌 Tip: The better you prepare, the less overwhelming this journey becomes.

1. Down Payment: Your Largest Upfront Cost

The most searched homebuying question: how much do I need saved to buy a house?

The answer starts here: your down payment.

- Conventional loan: Typically 5–20% down.

- FHA loan: As low as 3.5%.

- VA/USDA loans: Potentially 0% down (if eligible).

⚠️ A smaller down payment means higher monthly payments and Private Mortgage Insurance (PMI) typically $50–$200/month.

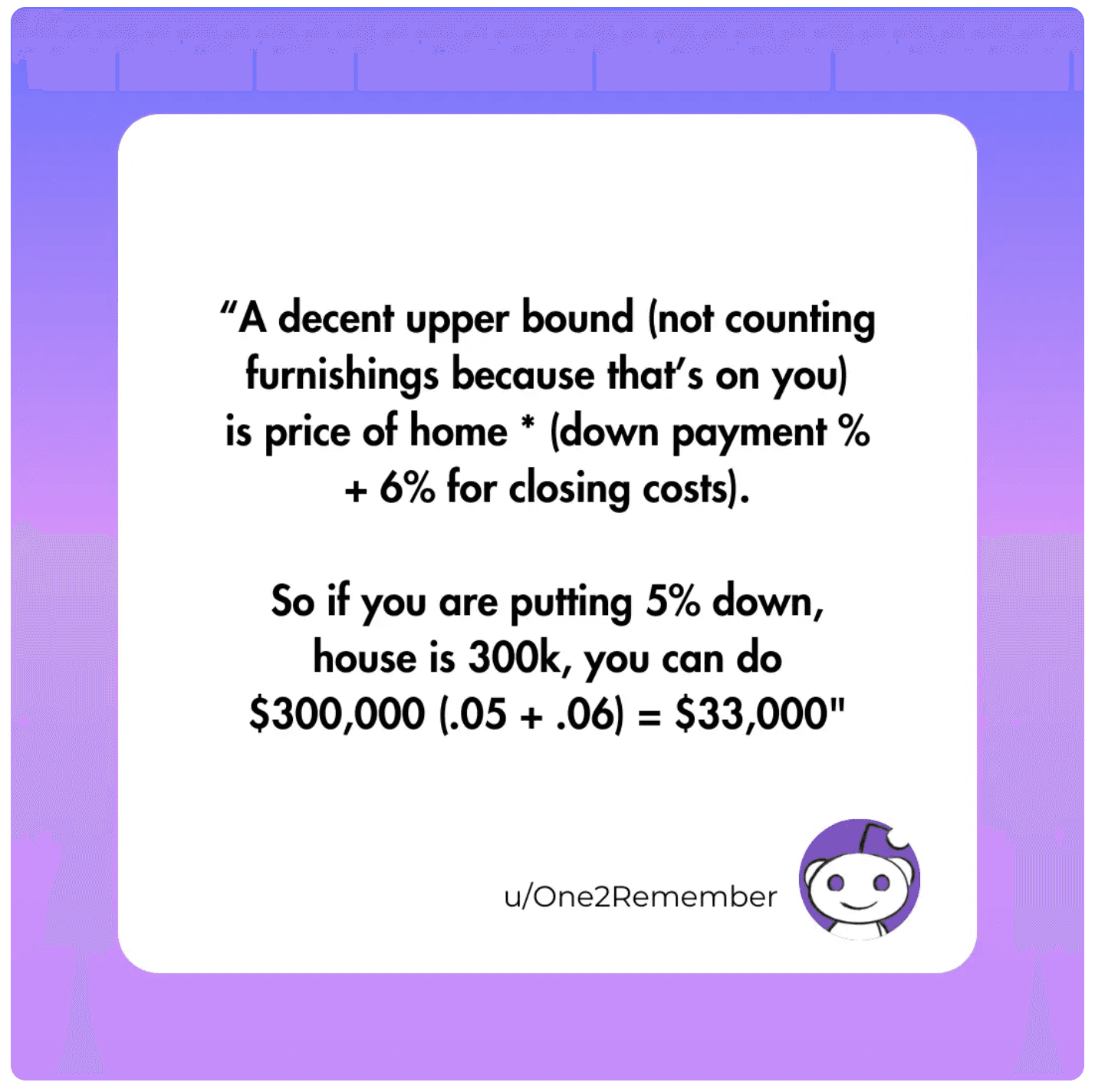

2. Closing Costs: The Silent Wallet Hit

How much in savings to buy a house? Add another 2–5% of the purchase price.

These cover:

- Loan origination fees

- Title insurance

- Appraisal & credit reports

- Escrow & recording fees

💡 Negotiate lender credits or ask your agent about seller concessions to offset closing costs.

3. Pre-Purchase Expenses: Inspections, Appraisals, and Applications

Don’t forget the little but necessary items:

- Home inspection: $300–$600

- Appraisal: $400–$600

- Loan application: $75–$300 (often refunded at closing)

These may not seem like much individually, but together they add up quickly.

4. Moving In: The Hidden Post-Purchase Costs

You’ve bought the home now you have to live in it. These “life setup” costs are easy to overlook. Be ready.

5. Emergency Fund: Your Financial Shock Absorber

Owning a home means unexpected repairs from leaks to HVAC issues.

Experts suggest saving 1–2% of your home’s value per year.

- $250,000 home = $2,500–$5,000/year

- $400,000 home = $4,000–$8,000/year

🔧 Don’t let an emergency turn into a debt crisis. Build this cushion early.

Budgeting for the Entire Home Purchase

Let’s answer the big question again:

👉 “How much should I save to buy a home?”

Here’s a budgeting breakdown:

💡 Pro Tip: Use Tech to Save Money on Homebuying

Modern platforms like WithJoy.AI are rewriting the rules of homebuying. Instead of paying your buyer’s agent full commission, you get up to 70% back as a rebate.

That’s potentially $6,000–$15,000 back in your pocket, which can help:

- Cover closing costs

- Fund your emergency account

- Buy furniture or appliances

💸 Use WithJoy.AI to buy smart, save big, and unlock real homebuyer advantages.

✉️ Subscribe for Smart Homebuyer Tips

Want clear, actionable tips like this straight to your inbox?

Get insider strategies, new tools, and money-saving hacks for smart first-time buyers.

Smart budgeting

If you're still wondering how to save money for buying a house or want a breakdown of tips that actually work, check out this video we recommend:

🔗 Watch our quick 2-min video on YouTube & Learn:

- Smart budgeting strategies

- Real ways to cut closing costs

- Mortgage tricks that reduce monthly payments

- Bonus hacks that most agents don’t tell you

Final Word: Budget Like a Pro, Buy with Confidence

Understanding how much money you need to buy a house means knowing all the pieces not just the sticker price.

By preparing smartly, exploring ways to cut costs like WithJoy.AI , and budgeting for real-world expenses, your dream of homeownership becomes doable and even enjoyable.

🏠 Your future home is waiting. Make it happen with less stress and more savings! Good Luck!

Related Guides

Homebuyer's Ultimate FAQ on Closing Costs

A guide answering all your questions about closing costs when buying a home.

KB

Kyler Bruno

08/13/2025

Who Pays the Inspection When Buying a House

Home inspection is a visual, non‐invasive check of major systems (structure, roof, plumbing, etc.)

KB

Kyler Bruno

10/22/2025

Can You Buy a House with a Credit Card?

Can you buy a house with a credit card? Learn the risks, expert tips, and real alternatives.

KB

Kyler Bruno

07/11/2025

Full Service Home Buying - WithJoy.AI

Find Your Home Today

The future is here. Buy your next home WithJoy.AI

Trending Neighborhoods

Best Places to Retire

Best Affordable Areas Near Seattle

Best for Young Professionals

Best Family Neighborhood Seattle