5 minutes read

How To Save For A House Down Payment?

Smart rules to save for your down payment. Start building your home fund today!

KB

Kyler Bruno

07/11/2025

Saving for a down payment on a house is a marathon, not a sprint.

It takes planning, disciplined habits, and an understanding of how you can maximize your resources.

There are powerful financial principles and budgeting strategies that can help you save for ayour down payment faster.

Let's break down the six key rules to give you a clear, actionable roadmap to homeownership.

Six Rules To Help You Save Up For Your Down Payment Faster

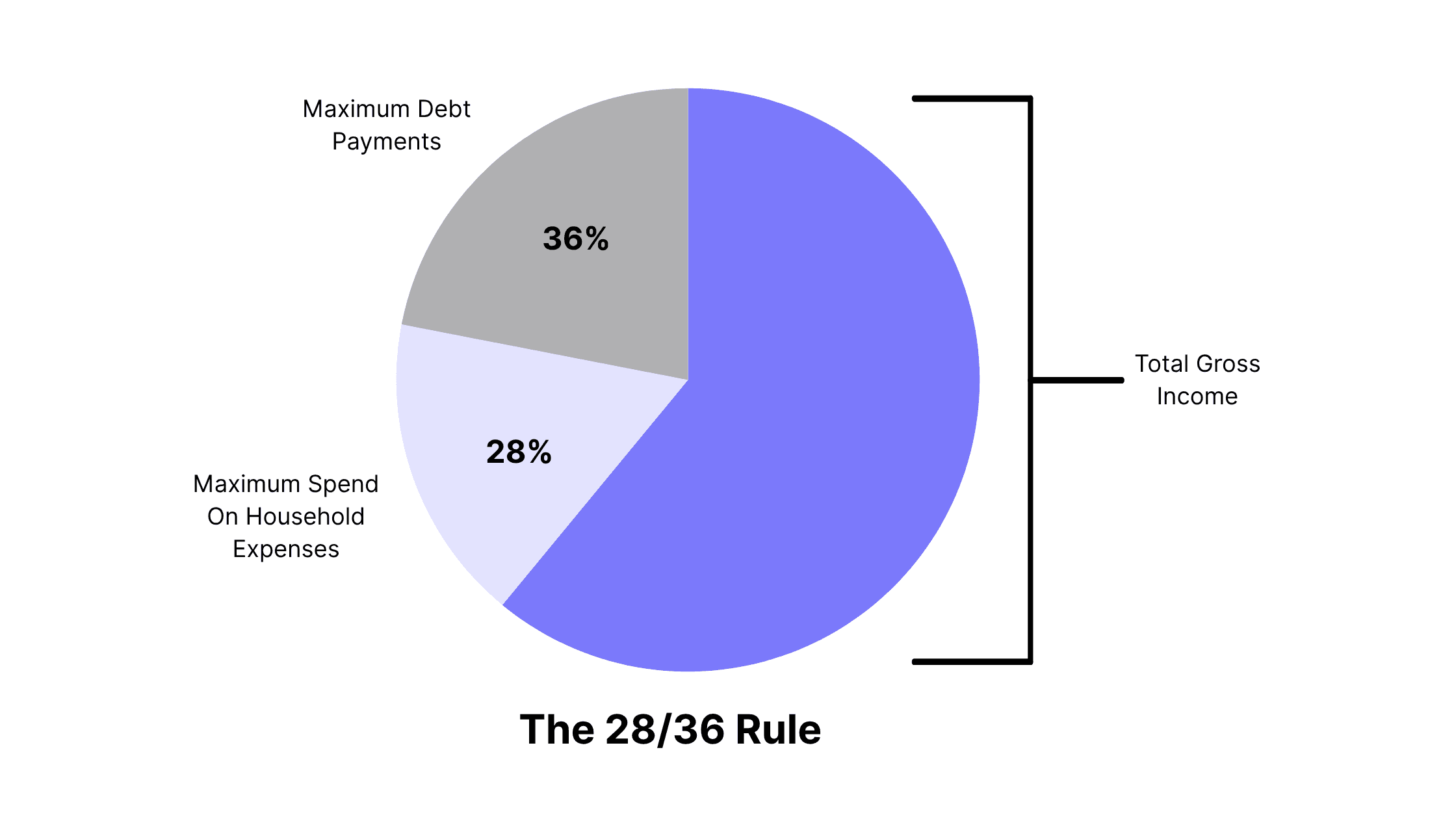

1. The 28/36 Rule

Lenders use the 28/36 rule to figure out how much house you can afford. You can use this rule too.

Not more than 28% of your gross monthly income should be spent on housing expenses like your mortgage, property taxes, and insurance. And not more than 36% of your income should be spent on all debts like credit cards, car loans, and student loans.

How to apply this:

- Calculate your gross monthly income.

- Multiply that number by 0.28 to find your maximum housing budget.If you earn $6k per month, your housing expenses should not exceed $1,680.

- Multiply your income by 0.36 to find your total allowable debt. So if you earn $6k per month, 36% of that, which is $2,160, should be the maximum you spend on your debt payments.

Following this rule helps you avoid borrowing too much and makes sure you still have enough budget for other expenses.

If your current housing expenses or debt payments are above, it’s a good idea to tackle your debt first before going all-in on saving for a down payment.

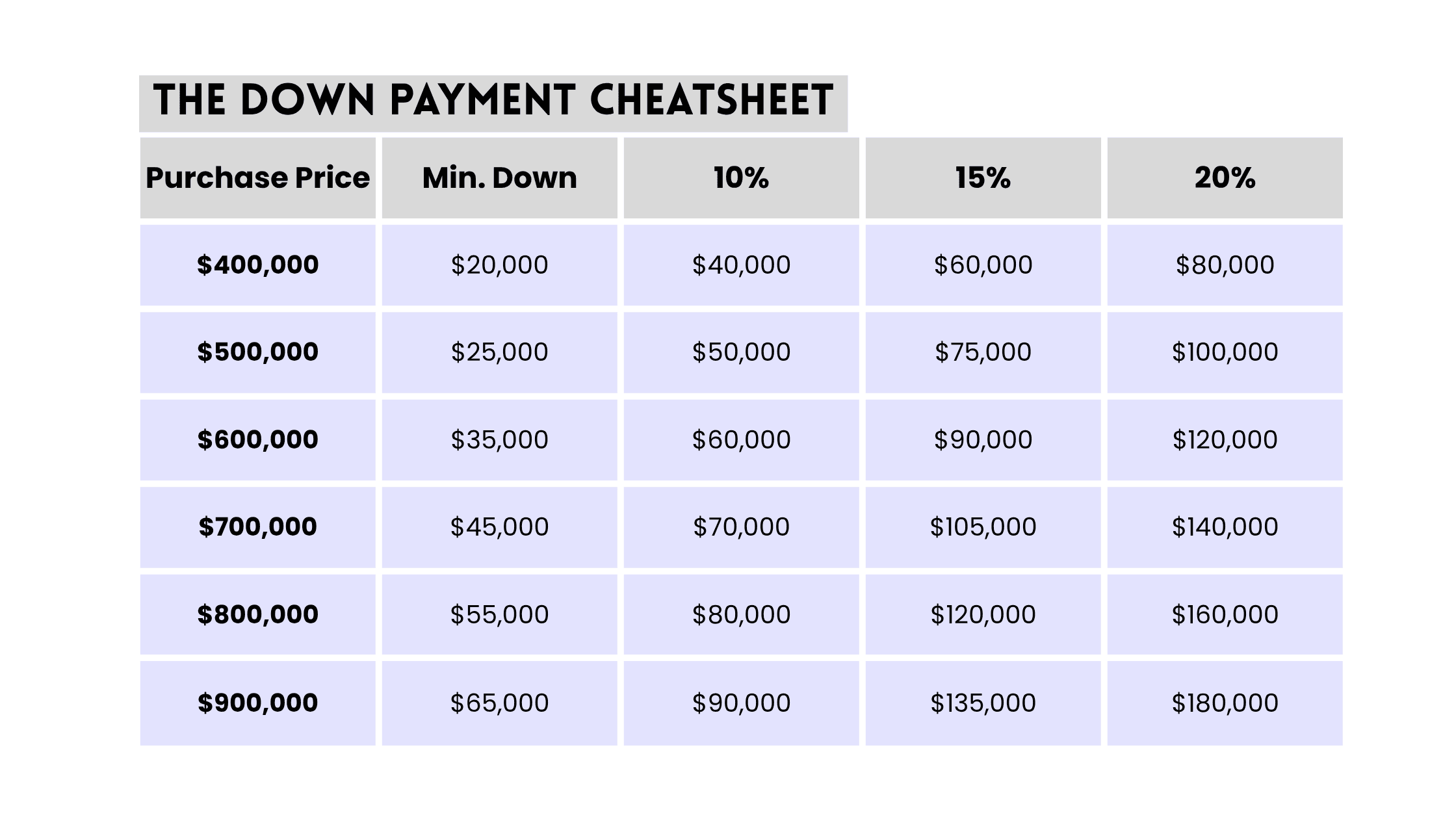

2. The 20% Down Payment Rule

Saving 20% of the home’s purchase price is the gold standard for down payments.

A larger down payment often secures lower interest rates and reduces monthly payments.

How to apply this:

- For a $400k home, aim for $80k down payment.

- Break this into smaller targets. For example, you can save $1,333 per month for 5 years or $2,666 per month for 3 years.

- Use a high-yield savings account or CD ladder to grow your savings without high risk.

3. The “Pay Yourself First” Rule

Treat savings like a non-negotiable bill by automating transfers to your down payment fund before paying for other expenses.

How to apply this:

- Set up a direct deposit split with your employer to route 10%–20% of your paycheck into a dedicated savings account.

- Use a high-yield account to earn passive interest.

- Gradually increase contributions. You start with 5% of your income, and then later onadd 1% every 3 months.

If you make $5,000 a month, try setting aside $250 automatically. In a year, you’ll have $3,000 saved, plus any interest you earn along the way.Automation removes shopping temptation and ensures consistency, even on tight budgets.

4. The 30-Day Rule

A mental checklist to avoid unnecessary spending. Before buying non-essentials, wait 30 days. If you still want it, think again.

How to apply this:

- Identify triggers. Are you shopping out of boredom, stress, or social pressure?

- Create a wish list. Write down desired items and revisit them after 30 days.

- Redirect your savings. Calculate what you would have spent and transfer that amount to your down payment fund.

Skipping a $150 week of cafe habit could save you $600 a month. That’s $7,200 per year! For expensive items like a $2,000 TV, wait 60–90 days because the urge usually fades.

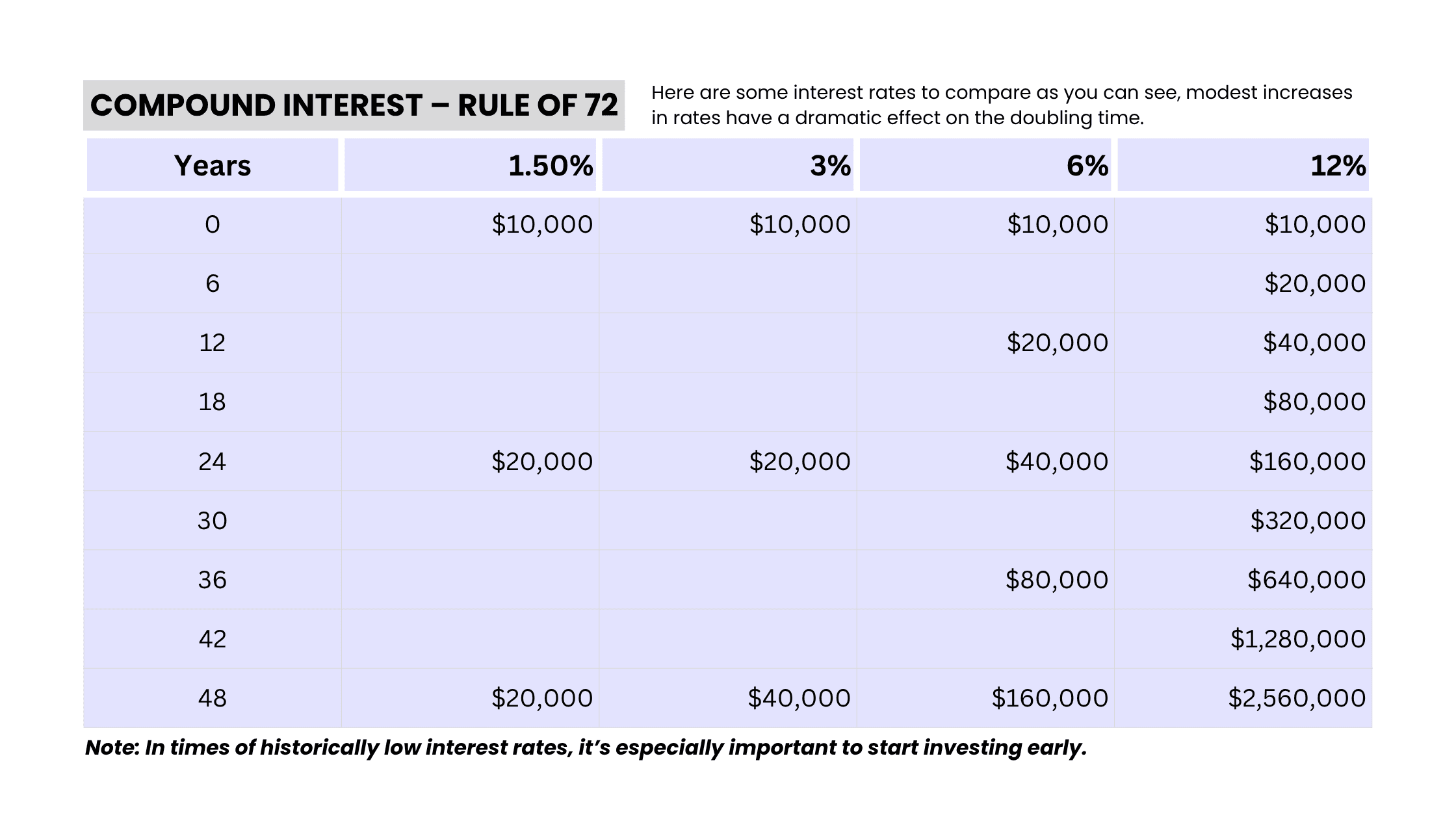

5. The Rule of 72

A formula to estimate how long it takes investments to double: 72 ÷ Annual Interest Rate = Years to Double.

How to apply this:

- Put your down payment fund in a high-yield account.

- Consider low-risk investments like treasury bonds or index fundsif your timeline is over 3–5 years.

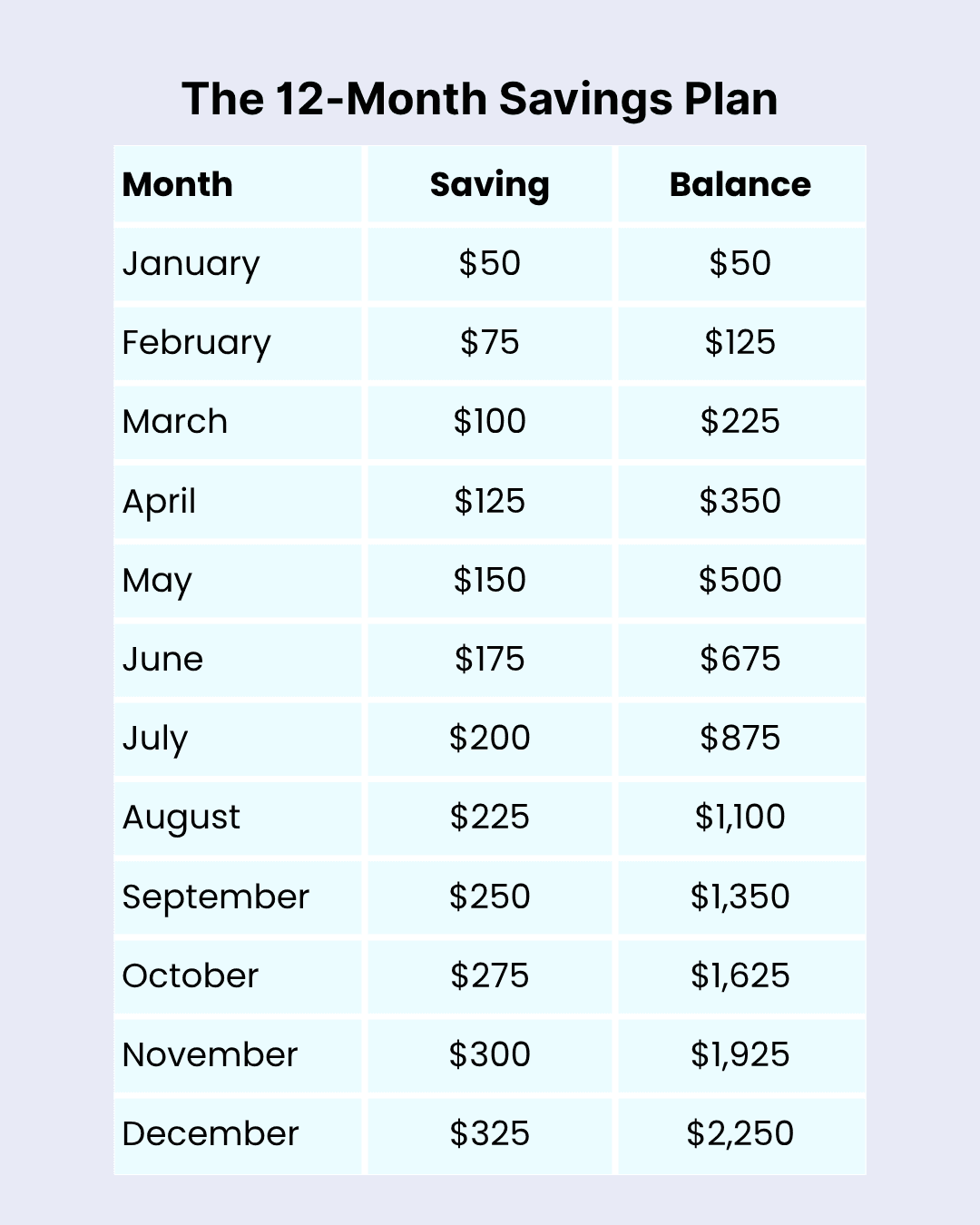

6. The 12-Month Savings Challenge

Increase your monthly savings over a year to avoid burnout.

How to apply this:

- Increase your savings by $25 each month.

- Month 1: Save $50

- Month 2: Save $75

- Month 3: Save $100

- And so on...

- Total saved in 12 months: $2,250

Small, incremental changes feel manageable and build confidence.

Stay Persistent to Your Homeownership Journey

Saving for a house is a dynamic process.Life events like job changes or emergencies, may require adjustments.

If you’re struggling to hit your saving goals, our homebuying platform WithJoy.AI can help bridge the gap.

When you use our AI homebuying platform to buy your house, you’ll receive 70% of the buyer agent commission as a rebate at closing.For example, on a $400k home, that’s up to $8,400 back to you. This rebate can cut months, or even years, off the time it takes to reach your savings goal.

It’s best to revisit your plan quarterly, celebrate small wins, and remind yourself that every dollar saved brings you closer to homeownership.

Wishing you all the best as you work toward your dream home. You’ve got this! 🏡 🙌

Related Guides

Can You Buy a House with a Credit Card?

Can you buy a house with a credit card? Learn the risks, expert tips, and real alternatives.

KB

Kyler Bruno

07/11/2025

How Much Money Do You Really Need to Buy a House?

How much you need to save for homebuying from down payments and closing fees to moving expenses.

KB

Kyler Bruno

07/11/2025

Real Estate Commission Rebates Explained

Almost all homebuyers leave money on the table.. don’t be one of them!!

KB

Kyler Bruno

07/11/2025

Full Service Home Buying - WithJoy.AI

Find Your Home Today

The future is here. Buy your next home WithJoy.AI

Trending Neighborhoods

Best Places to Retire

Best Affordable Areas Near Seattle

Best for Young Professionals

Best Family Neighborhood Seattle