What Are USDA Home Loans?

USDA home loans are mortgages backed by the United States Department of Agriculture. They’re designed to support homeownership in rural and some suburban areas. USDA loans offer 100% financing meaning no down payment is required for eligible borrowers.

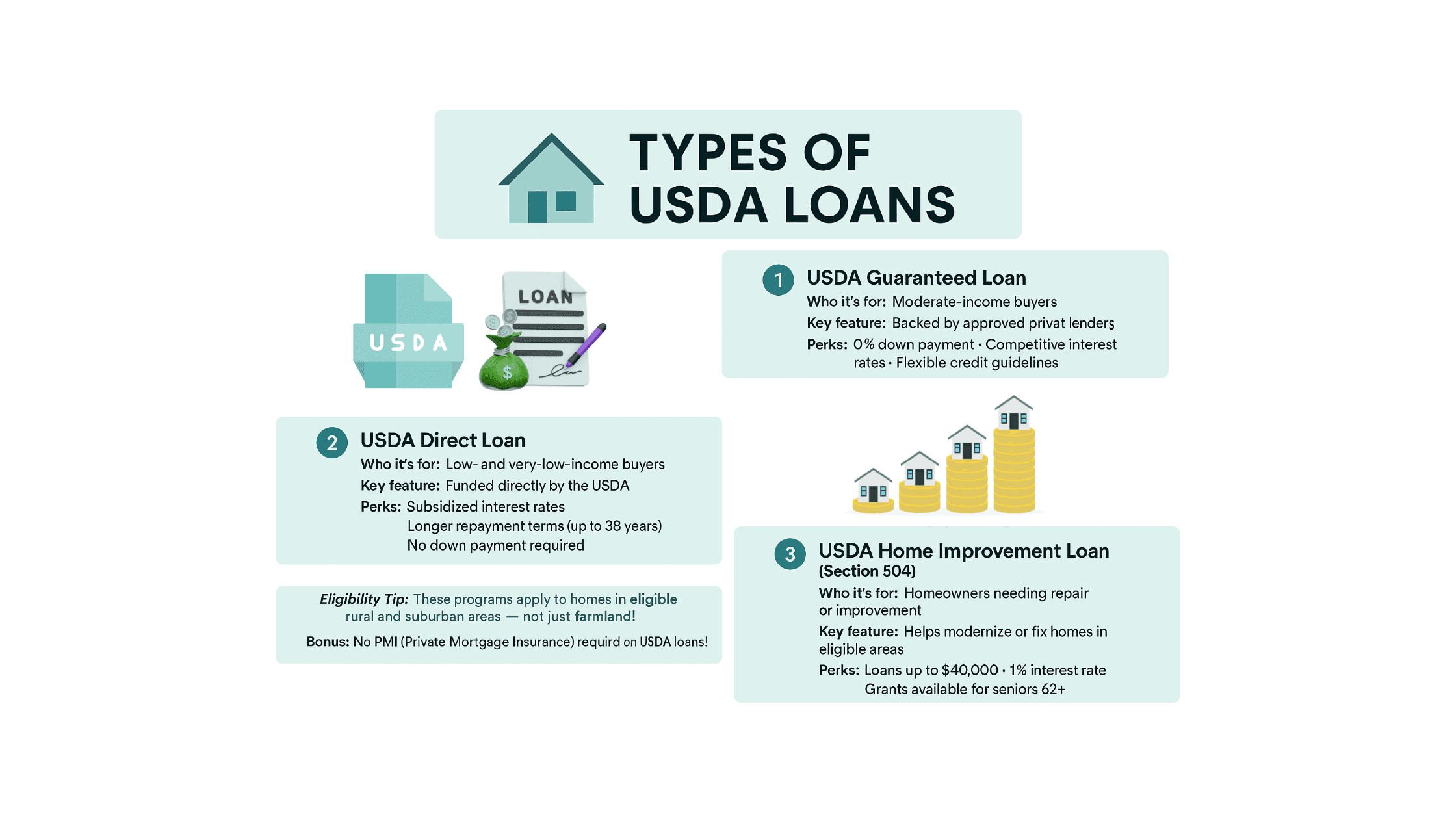

There are two main types of USDA loans in Washington:

- USDA Guaranteed Loans: Issued by USDA-approved lenders in Washington State.

- USDA Direct Loans: Issued directly by the USDA to low and very-low income applicants through programs like the home direct loans initiative.

Whether you’re in Olympia, Yakima, or rural Pierce County, USDA Washington State home loans could be the most affordable way to buy. This includes options like USDA construction loan Washington State and USDA rural housing loans for new builds.

Benefits of USDA Loans in Washington State

✅ No down payment (100% USDA financing)

✅ Low interest rates

✅ Reduced mortgage insurance

✅ Flexible credit guidelines

✅ Available for new and existing homes

These features make USDA home loans WA a great option for first-time buyers and repeat buyers looking in USDA eligible zones. The 0% down payment, low interest rates make homeownership more affordable, especially for low- to moderate-income buyers.

USDA Loan Eligibility in Washington State

1. Location Requirements

Properties must be in eligible rural or suburban areas, as defined by the USDA. You can check this using the official USDA home loan property eligibility map or do a USDA home loan address lookup.

2. Income Requirements

USDA loans have income limits based on location and household size. The USDA income and property eligibility site can help you verify eligibility.

In 2025, the USDA income limits Washington State for a family of four range from $110,000 to $150,000 depending on the county. This is essential if you're seeking Washington State USDA home loans.

3. Credit & Occupancy

- Credit scores of 640+ are ideal, but lower scores may qualify.

- The home must be owner-occupied.

- Can you get a USDA loan for a second home? No, investment or vacation homes do not qualify.

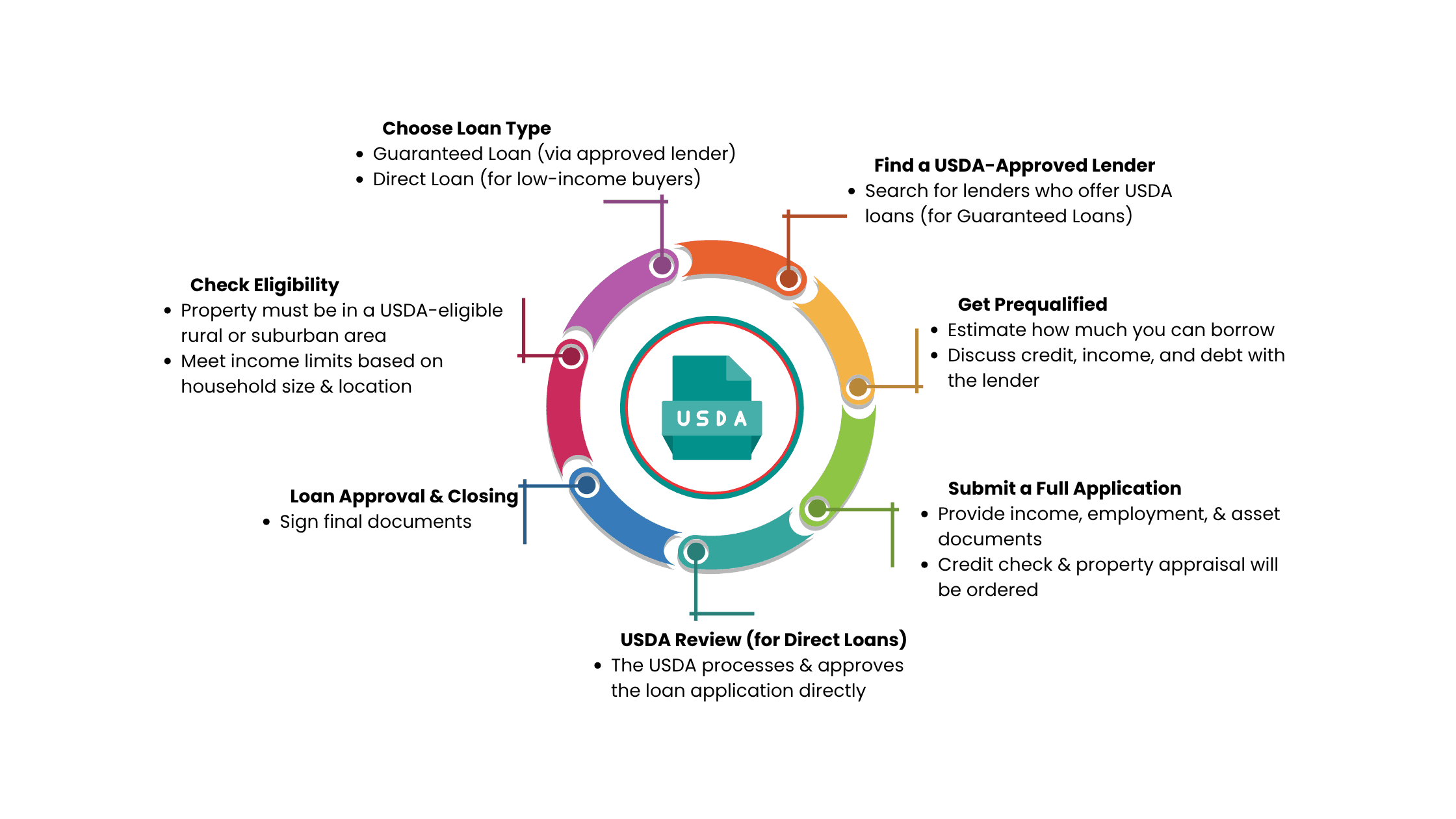

How to Apply for a USDA Loan in Washington?

Step 1: Check Property Eligibility

Use the USDA eligibility map Washington State and confirm eligibility by using tools like:

- Does this address qualify for USDA loan?

- New USDA property eligibility map

- RD eligible area tools

Step 2: Gather Financial Documents

You’ll need:

- Proof of income

- Employment verification

- Credit history

Step 3: Choose USDA Approved Lenders in Washington State

Look for USDA lenders Washington State with experience in USDA Rural Development Washington programs.

Step 4: Get Pre-Qualified

A pre-qualification will help you determine your buying power and spot potential roadblocks.

Step 5: Work With a Knowledgeable Agent

Use a real estate brokerage in Washington that understands rural development and can assist with USDA homes for sale in Washington State.

📨 Get Email Updates!

Get new listings, eligibility updates, and smart homebuying tips straight to your inbox.

USDA Property Search and Location Tools

Here are the best tools for your USDA house search:

- USDA loan map Washington State

- USDA map Washington State

- USDA home loans map Washington State

- USDA home locations

- USDA home loan zones Washington State

- USDA loan zones Washington State

These search terms help determine which homes fall into the rural housing eligible properties category.

USDA Direct & Rural Housing Programs

For those with lower incomes, USDA Direct Loan Washington State may be more suitable. This program offers subsidized rates through the USDA rural development WA office.

Other programs include:

- USDA home grant program for repairs

- USDA rural housing loan map for eligible zones

- Farm loans in Washington through the USDA

Visit your local USDA Washington State office or USDA Spokane WA, USDA Yakima Office, or USDA Rural Development Olympia WA for personalized help.

Frequently Asked Questions About USDA Loans in WA

Q: What does 100 percent USDA financing mean?

A: It means no down payment, 100 USDA financing covers the full home price.

Q: Are USDA loans easy to get?

A: Yes, if you meet credit, income, and location requirements. USDA loans are one of the most accessible financing options.

Q: How do I check the status of my USDA loan?

A: Contact your lender or the nearest Washington USDA office.

Q: Can you use a USDA loan twice?

A: Yes, but only under specific conditions. You must prove you can’t occupy the prior home.

Unlock Rural Living with USDA Loans & Save More with WithJoy.AI

If you're looking at rural home loans Washington State, USDA financing is often the smartest move. It provides a low-cost, no-down-payment path to homeownership in beautiful, quiet parts of Washington.

With the right partner, you can access real-time USDA home loan address eligibility and find eligible USDA properties using the latest maps and search tools.

At WithJoy.AI, we go beyond the basics. Our platform not only connects you with experienced real estate agent Washington professionals, but we also help you save significantly through our commission rebate real estate brokerage Washington model. That means more money in your pocket at closing—without compromising on service.

Whether you're working with a discount real estate agent Washington or a full-service expert, WithJoy.AI ensures you keep more of your equity through our transparent, buyer-focused approach.

Start your USDA loan journey today with tools, agents, and savings all in one place.

Related Articles

Washington State FHA Loans: Everything You Need to Know

Navigating the home buying process can be overwhelming especially for first-time buyers. Thankfully,

Homebuyer Rebate: All You Need to Know

Washington's housing market is buzzing, with the average home going for

First-Time Homebuyer Programs in Washington State

First-time homebuyers in Washington state, have you checked out these programs yet?

Trending Neighborhoods

Best Places to Retire

Best Affordable Areas Near Seattle

Best for Young Professionals

Best Family Neighborhood Seattle