What Are FHA Loans?

FHA loans are government-backed mortgages insured by the Federal Housing Administration. They’re specifically designed to make homeownership more attainable for people with lower credit scores or minimal savings for a down payment.

In Washington State, FHA loans are a popular option due to their:

- Low 3.5% minimum down payment

- Flexible credit score requirements

- Broader debt-to-income (DTI) ratios (a key factor in high-cost cities like Seattle)

FHA Loan Requirements in Washington State

To qualify for an FHA loan in Washington, one needs to meet the following:

- Minimum credit score of 580 (500 with 10% down)

- Down payment as low as 3.5%

- Steady employment and income verification

- Debt-to-income ratio (DTI) generally under 43%, though 50% may be allowed with strong compensating factors

- Property must be a primary residence

- Appraisal by an FHA-approved appraiser

- Adherence to FHA private road requirements, if applicable

FHA loan requirements Washington State are relatively forgiving, making them ideal for first-time home buyers Washington.

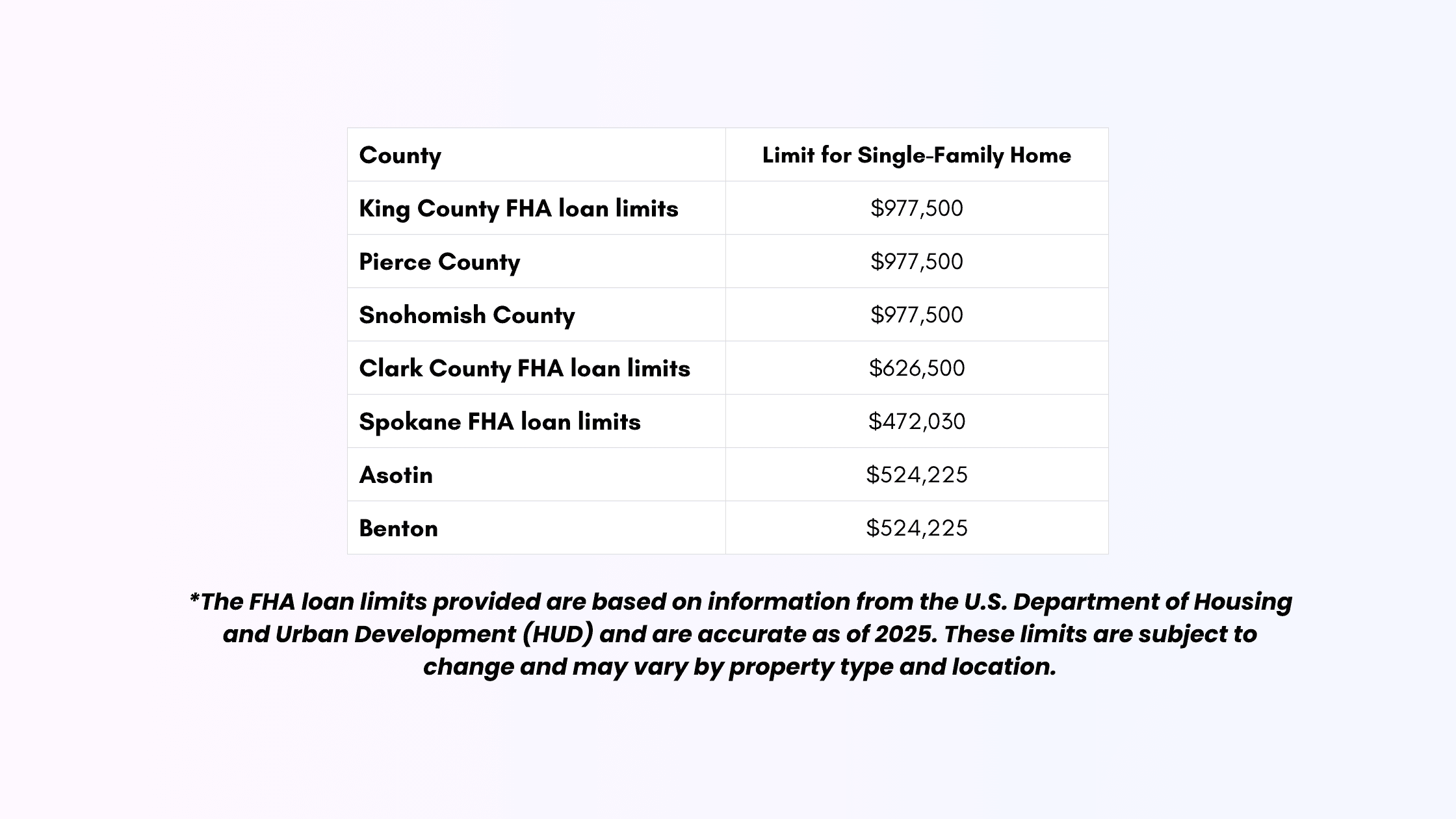

FHA Loan Limits in Washington State for 2025

Loan limits vary by county and are updated annually. Here's a snapshot of FHA loan limits Washington State. These limits ensure borrowers stay within FHA guidelines while accommodating local housing market prices. Leverage these insights, if you're seeking a FHA loan Seattle, FHA loan Spokane WA, or in any region across Washington State.

*Please consult the official HUD FHA through their official website or a licensed mortgage professional for the most current and applicable loan limits in your area. This information is for general guidance only and does not constitute financial or legal advice.

FHA 203(k) and Construction Loans in Washington

For homes that need TLC, the FHA 203k loan Seattle and FHA rehab loan Washington State options allow you to roll renovation costs into your mortgage. There are two types:

- Limited 203(k): Up to $35,000 for non-structural repairs

- Standard 203(k): No set limit, includes structural work

Looking to build? FHA construction loan Washington State options can also be explored if you plan to construct rather than purchase.

First-Time Home Buyer Programs in Washington State

If you're a first-time home buyer Washington State, FHA loans are just one of many tools available.

Explore these options:

- Seattle first time home buyer assistance

- Pierce County down payment assistance program

- Seattle first time home buyer grants program

- WA first time home buyer programs

- Low income home buying programs Washington State

Many of these offer zero down home loans Washington State, bad credit home loans Seattle, and generous grants or forgivable loans.

Credit Scores, Interest Rates & More

Understanding the financial criteria for FHA loans is essential:

- Average credit score: Around 715, but FHA loans allow much lower

- Mortgage rates Washington State: As of 2025, FHA rates remain competitive (check with Seattle Washington mortgage lenders)

- Closing costs : Typically 2–5% of purchase price

- Maximum mortgage in WA: Depends on income, DTI, and FHA loan limits

Don't forget to compare options with mortgage loans, mortgage rates in Washington State, and other best mortgage lenders.

FHA Lenders in Washington State

Work only with approved FHA lenders Washington State. Notable options include:

- FHA lenders Seattle

- Seattle Washington mortgage lenders

- Champions Mortgage Seattle Washington

Using a reputable lender ensures smooth processing of your FHA home loans in Washington State and helps you compare offers with conforming loan Seattle or VA/conventional options.

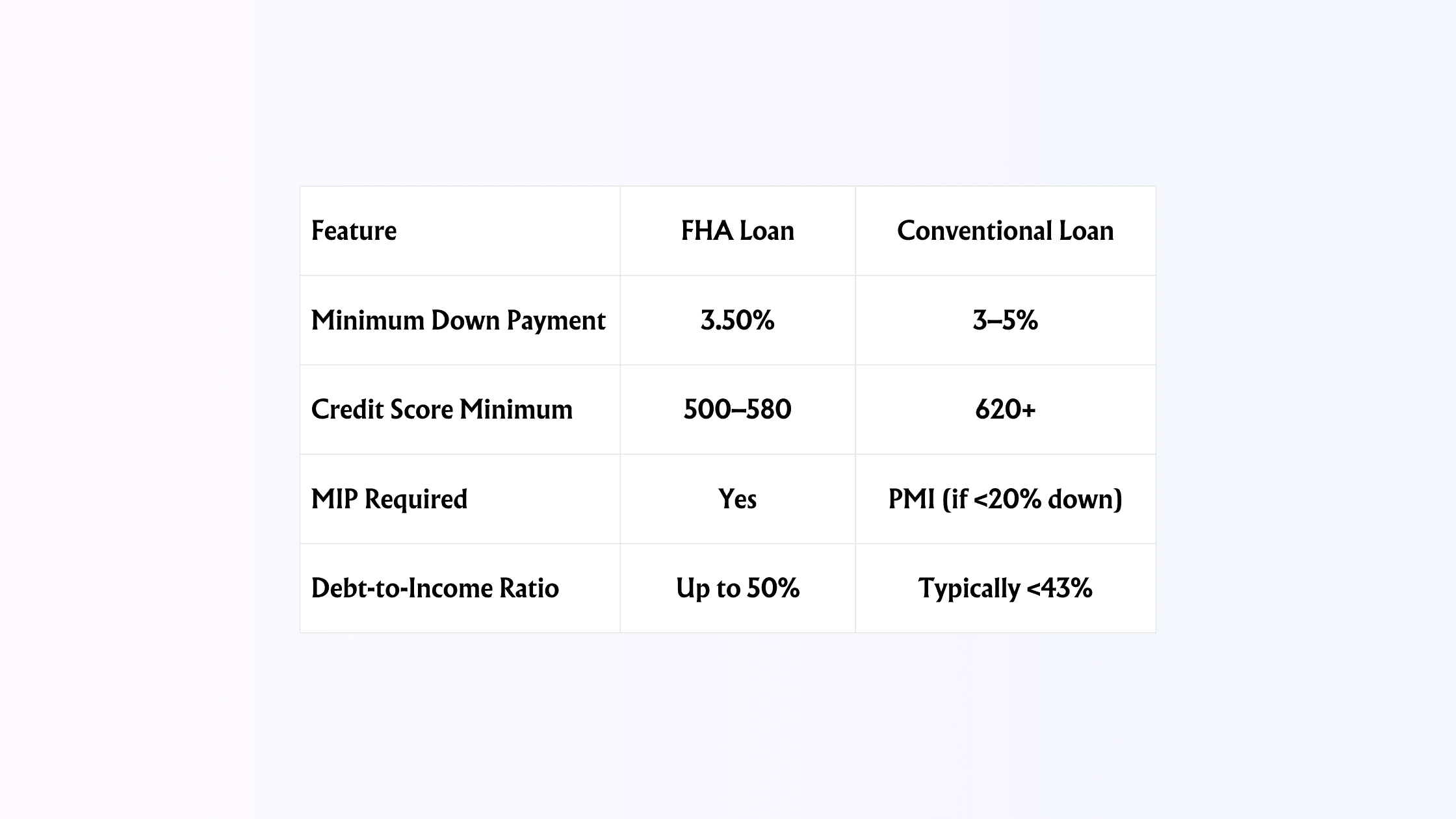

FHA Loans vs. Conventional Loans in Washington

Here’s a quick comparison. Explore conforming loan limits and conventional loan limits for conventional comparisons.

*Please consult a licensed mortgage professional for the most current and applicable loan limits in your area. This information is for general guidance only and does not constitute financial or legal advice.

📬 Get Email Updates!

Get expert insights on FHA loans, market trends, first-time buyer programs, and local lending updates, delivered straight to your inbox.

FHA Related Queries

Here are some most asked questions:

- Do you have to pay back FHA loans? Yes, it’s a mortgage not a grant.

- How to buy a HUD home in Washington State? Work with FHA-approved agents and lenders.

- FHA homes for sale in Washington State: Search HUD listings or work with agents who know the FHA process.

- No cost refinance Washington State: Available through some FHA streamline refinance programs.

FHA vs Other Programs in WA

FHA loans aren't your only option. Compare:

- VA loans (if you're a veteran)

- USDA loans (for rural buyers)

- In house financing Washington State (for unique credit situations)

- Bad credit mortgage Washington

- Low income home loans Washington State

How WithJoy.AI Helps FHA Home Buyers in Washington State

Buying a home especially your first can feel like a maze of forms, lenders, limits, and decisions. At WithJoy.AI, we simplify the entire journey for homebuyers across Washington State. Here’s how we help:

- 🔍 Tailored FHA Listings: See homes that qualify for FHA loans in Washington State, filtered by your budget and eligibility.

- ⚡ Fast Home Tours: Book same-day tours in Seattle, Spokane, Tacoma, and other locations across WA.

- 🧠 Smart FHA Offer Guidance: Get offer recommendations powered by market data and financing strategy.

- 💰 Buyer Rebate: Earn thousands back at closing, money you can use toward moving, renovations, or savings.

Whether you're exploring FHA 203k loans, looking for low income home loans Washington State, or just want to stop doom-scrolling Zillow and start making progress, WithJoy.AI is built for you.

Related Articles

Washington State 1031 Exchange

For real estate investors in Washington,

Homebuyer Rebate: All You Need to Know

Washington's housing market is buzzing, with the average home going for

Washington Housing Market In 2025: Home Prices & Trends

Washington State's housing market in 2025 is strong and giving buyers fresh hope. From the tech-driven energy of Seattle to the peaceful neighborhoods of Olympia, buyers are returning with new plans and smarter tools. Whether you’re a first-time buyer or eyeing a move-up home, this year’s market holds opportunity, if you know where to look!

Popular Washington Homes

$14K rebate

$825,000

4116 52nd Street NE, Tacoma, WA 98422

$262K rebate

$24,985,000

415 Shoreland Drive SE, Bellevue, WA 98004

$23K rebate

$1,350,000

2437 8th Avenue N, Seattle, WA 98109

$24K rebate

$1,399,950

3215 37th Place S, Seattle, WA 98144

$22K rebate

$1,300,000

12046 6th Avenue NW, Seattle, WA 98177

$8K rebate

$395,000

1080 W Ewing Place Unit E1, Seattle, WA 98119

$32K rebate

$1,875,000

11014 Cornell Avenue S, Seattle, WA 98178

$22K rebate

$1,275,000

5015 40th Avenue SW, Seattle, WA 98136

$196K est. rebate

$11,250,000

1625 Federal Avenue E, Seattle, WA 98102

$15K est. rebate

$888,000

3020 4th Avenue W Unit A, Seattle, WA 98119

$12K est. rebate

$699,950

501 Roy Street Unit T303, Seattle, WA 98109

$12K est. rebate

$719,999

121 Stewart Street Unit 1803, Seattle, WA 98101

$5K est. rebate

$339,000

9500 Rainier Avenue S Unit 305, Seattle, WA 98118

$12K est. rebate

$698,000

1900 Alaskan Way Unit 309, Seattle, WA 98101

$6K est. rebate

$385,000

705 E Republican Street Unit 302, Seattle, WA 98102