What Is Down Payment Assistance?

Down Payment Assistance (DPA) refers to any form of financial aid grant, loan, or matched savings that helps buyers cover part or all of the required down payment when purchasing a home. DPA is designed to bridge the gap between what buyers can afford upfront and what mortgage lenders require to close the deal.

There are several common types of DPA programs available in Washington:

- Grants – These are outright gifts, meaning the buyer does not have to repay them. These are rare and typically only offered in targeted city or nonprofit programs.

- Deferred Payment Loans – These are zero-interest loans with no monthly payments, due only when the home is sold or refinanced.

- Forgivable Loans – These loans are gradually forgiven over a period of years, typically five to ten, if the buyer remains in the home.

- Second Mortgages – These come with fixed interest rates and structured repayment, and are often used to supplement FHA or VA first mortgages.

By combining the right mortgage type (such as FHA, VA, or USDA) with one of these DPA tools, many Washington buyers can reduce their upfront costs from tens of thousands of dollars down to just a few thousand or even zero.

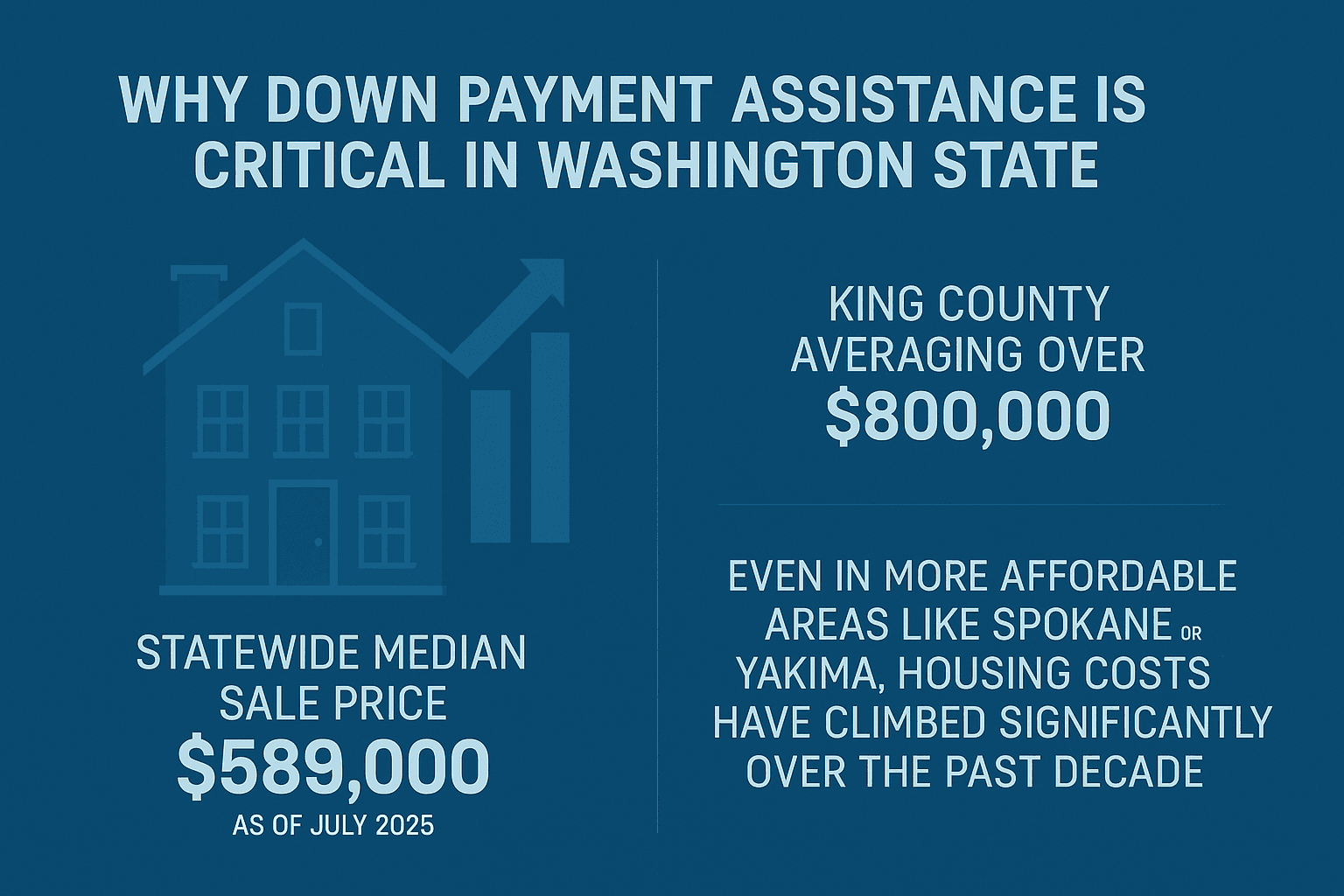

Why Down Payment Assistance Is Critical in Washington State?

Washington is one of the fastest-appreciating housing markets in the United States. According to data from Redfin, the statewide median sale price reached $589,000 as of July 2025 with King County averaging over $800,000. Even in more affordable areas like Spokane or Yakima, housing costs have climbed significantly over the past decade.

For many buyers, especially those without generational wealth, saving up a 5–20% down payment is the biggest barrier to homeownership. A typical first-time buyer might spend years trying to save while also navigating rent increases, inflation, and student debt.

This is where Washington’s layered DPA infrastructure steps in:

- The Washington State Housing Finance Commission (WSHFC) offers foundational statewide support.

- Cities like Seattle, Tacoma, and Spokane offer supplemental or city-specific down payment programs.

- Buyers can layer DPA with government-backed loans like FHA (Federal Housing Administration), USDA (rural), or VA (military) for more flexibility.

- Specialized aid is available for nurses, teachers, single mothers, and other key segments.

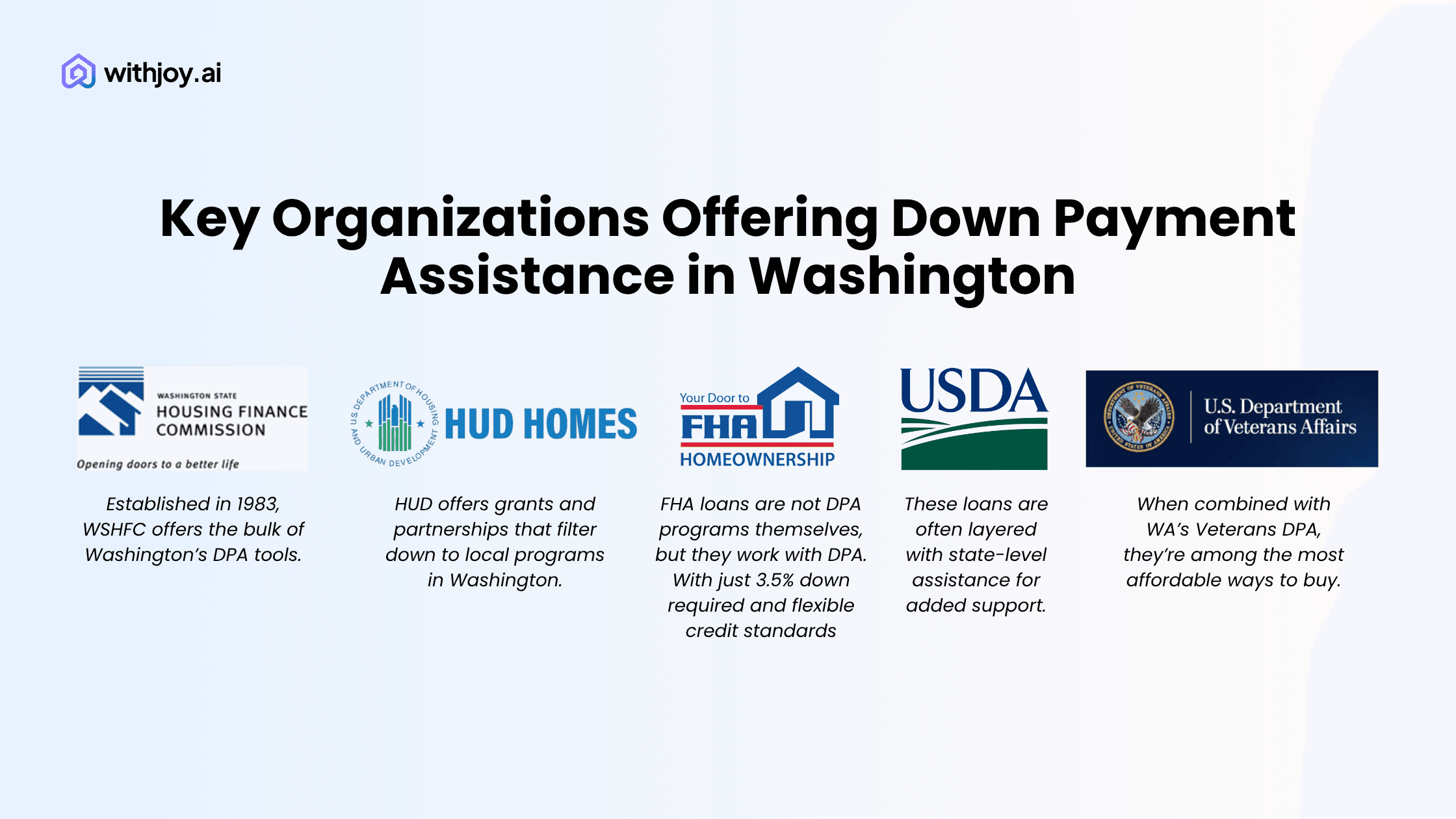

Key Organizations Offering Down Payment Assistance in Washington

Washington State Housing Finance Commission (WSHFC)

The Washington State Housing Finance Commission is a state-run agency that administers affordable housing programs, including homebuyer assistance. Established in 1983, WSHFC offers the bulk of Washington’s DPA tools.

Their programs include the Home Advantage Program, the House Key Opportunity Program, and specific assistance for veterans. These offerings are paired with mortgage products through approved lenders and often include deferred loans or forgivable second mortgages.

More: https://www.wshfc.org/

U.S. Department of Housing and Urban Development (HUD)

HUD offers grants and partnerships that filter down to local programs in Washington. HUD also oversees FHA loans, a common path for DPA use.

More: https://www.hud.gov/

Federal Housing Administration (FHA)

FHA loans are not DPA programs themselves, but they work with DPA. With just 3.5% down required and flexible credit standards, FHA loans are compatible with most WA assistance offerings.

More: https://www.hud.gov/federal_housing_administration

U.S. Department of Agriculture (USDA)

For buyers in designated rural areas, USDA loans offer 0% down payment options. These loans are often layered with state-level assistance for added support.

More: https://www.rd.usda.gov/

U.S. Department of Veterans Affairs (VA)

VA-backed home loans allow eligible veterans to purchase homes with zero down and no mortgage insurance. When combined with WA’s Veterans DPA, they’re among the most affordable ways to buy.

Statewide Down Payment Assistance Programs in Washington

Home Advantage Program (WSHFC)

The Home Advantage Program is Washington’s flagship DPA offering. Buyers receive a second mortgage of up to 4% of the first mortgage loan amount, offered at 0% interest with deferred payments. It can be used for both down payment and closing costs.

Highlights:

- No monthly payments

- Must be repaid when the home is sold, refinanced, or paid off

- Paired with fixed-rate first mortgage from WSHFC-approved lender

- Credit score: minimum 620

- Available statewide

House Key Opportunity Program

Targeted toward lower-income buyers, this program combines a first mortgage with specially designated down payment support. The program offers access to below-market interest rates and multiple layers of secondary assistance.

Eligibility includes:

- First-time homebuyer (no home owned in past 3 years)

- Income and purchase price limits (based on county)

- Homebuyer education completion required

Add-ons include:

- Needs-Based DPA

- Veterans DPA (up to $10,000)

Veterans Down Payment Assistance Program

Exclusive to military veterans and active-duty personnel, this program offers a second loan of up to $10,000 at 3% simple interest, deferred until resale or refinance.

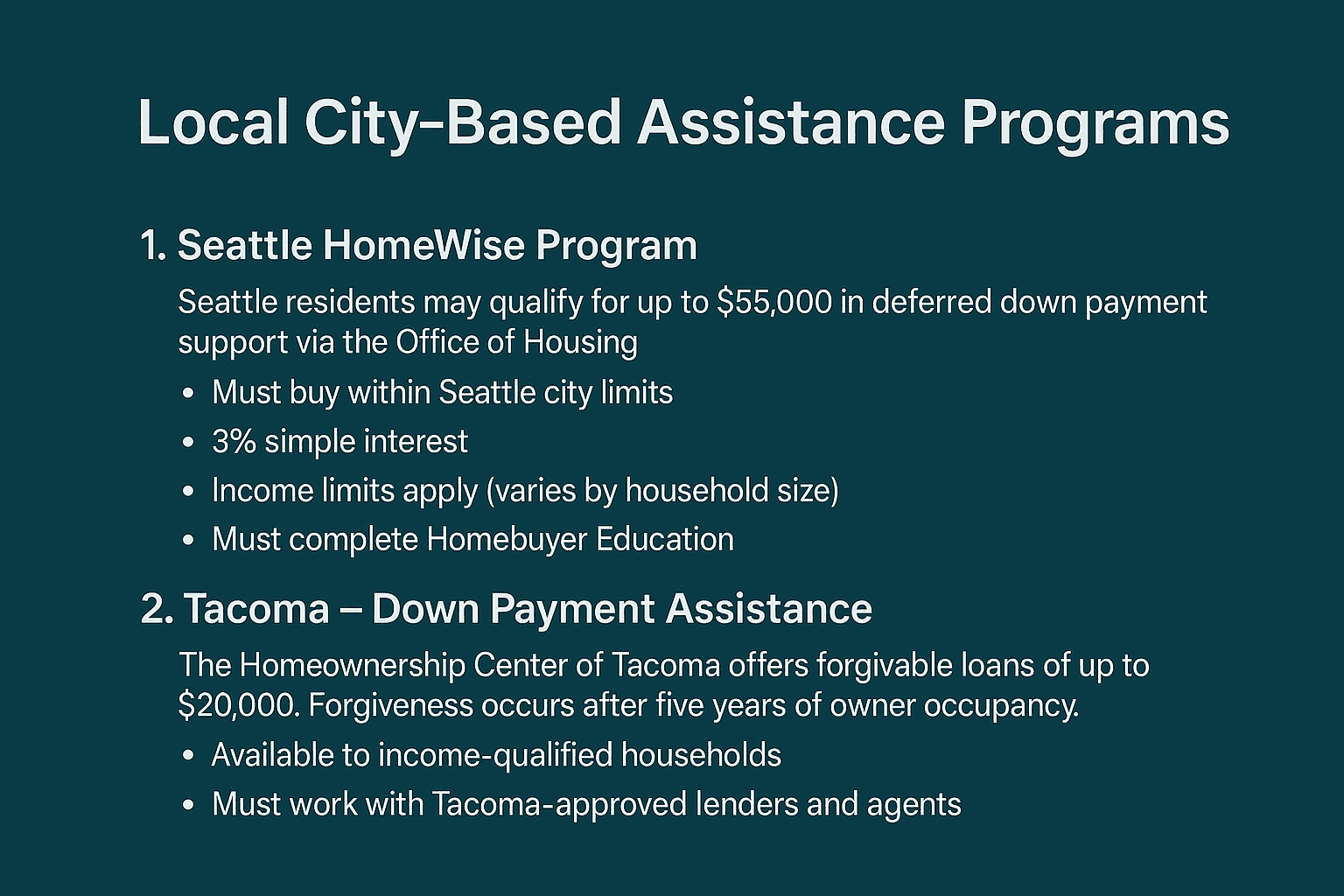

Local City-Based Assistance Programs

Seattle – HomeWise Program

Seattle residents may qualify for up to $55,000 in deferred down payment support via the Office of Housing.

- Must buy within Seattle city limits

- 3% simple interest

- Deferred payment until resale or refinancing

- Income limits apply (varies by household size)

- Must complete Homebuyer Education

Tacoma – Down Payment Assistance

The Homeownership Center of Tacoma offers forgivable loans of up to $20,000. Forgiveness occurs after five years of owner occupancy.

- Available to income-qualified households

- Must work with Tacoma-approved lenders and agents

Other cities (e.g., Spokane, Bellingham, Olympia) have programs that vary by year and budget availability. Always check the local housing authority.

Compatible Loan Programs: FHA, VA, and USDA

These loans can all be used in conjunction with Washington State's DPA programs. Many DPA-approved lenders are also certified to offer these products. If you are in your home buying journey, or just about to getting started, click below to connect with our expert agents to help you navigate the process efficiently.

Withjoy.AI is Washington's best discount real estate agents, having helped clients across the state finding their dreams homes along with rewarding them with a cash rebate of our commission at closing!

Eligibility & How to Apply

To qualify for most DPA programs in Washington, you must:

- Be a first-time homebuyer (no ownership in last 3 years)

- Complete a WSHFC-approved homebuyer seminar

- Use an approved lender

- Meet income and purchase price limits (varies by county)

- Have a minimum credit score of 620–640

Apply by:

- Signing up for the required Homebuyer Education.

- Getting pre-approved by a WSHFC-participating lender.

- Selecting the right DPA + loan combination.

- Working with a knowledgeable real estate brokerage.

Special DPA Options for Nurses, Veterans & Single Parents

Nurses

- May qualify for employer-sponsored grants

- Nurse Next Door program (up to $8,000)

Veterans

- Combine VA loan + WSHFC Veterans DPA for full 0% down

Single Parents

- Section 8 to Homeownership paths

- Additional credit for child/dependent support in income calculations

📧 Subscribe for Updates & Buyer Tips

Stay ahead of the game with:

- 📈 Market alerts

- 📘 Free buyer guides

- 💡 Financing hacks & More!

FAQs About DPA Programs

Q: Can I use more than one assistance program?

Yes. Many buyers combine city and state programs or stack DPA with seller credits and commission rebates.

Q: Do DPA loans affect resale?

Some deferred loans require repayment at sale or refinance. Others may be forgivable check terms.

Q: Do I need to repay grants?

No. Grants are typically not repayable unless you violate program terms (e.g., flipping the home).

Q: Can I use DPA with new construction?

Yes, but only select lenders and builders participate. Confirm with WSHFC lender.

Get Our Expert Resource Guides For First-Time Homebuyers

Home Buying 101: Master The Home Buying Process With Our Expert Tips.

Winning Offers Blueprint: Craft Competitive Offers With Smart Contingencies.

Closing Checklist: Simplify Closing With A Detailed Document Checklist.

Why More Washington Buyers Are Choosing WithJoy.AI

If you're looking to save thousands on your next home purchase, there's a smarter way to buy: WithJoy.AI.

🏡 A Discount Real Estate Agent That Works for You

WithJoy.AI is a next-gen platform offering discount real estate services in Washington without cutting corners on expertise or service quality. Our technology connects you with expert, local agents while drastically reducing your commission costs.

💸 Real Estate Commission Rebates That Put Cash in Your Pocket

Unlike traditional brokerages, WithJoy.AI offers one of Washington's best home buyer rebate programs, helping you get a significant cashback on home purchase. You can get up to 70% of your buyer agent's commission refunded that’s thousands of dollars back to you.

🤖 Smart, Streamlined Homebuying

Our AI platform helps you: Discover properties faster, Schedule instant home tours & Craft smarter, competitive offers with confidence.

💬 Why Buyers Are Making the Switch

Whether you're searching for a discount real estate agent, need a real estate commission rebate, or simply want a better way to buy, WithJoy.AI gives you everything you need without the unnecessary costs.

Rated by satisfied customers

Reviews from our Homebuyers

Related Articles

USDA Loans Washington State

Looking to buy a home outside the hustle of Seattle or Spokane? USDA home loans in Washington State might be your golden ticket. With zero down payment, flexible credit requirements, and competitive rates, these government-backed loans are ideal for qualifying buyers in designated rural and suburban areas.

VA Home Loans in Washington State

Veterans, active-duty service members, and eligible surviving spouses have a powerful tool in their path to homeownership: the VA home loan. In Washington State, where housing markets like Seattle, Tacoma, and King County remain competitive, a VA loan can give you a serious edge.

First-Time Home Buyer Programs in Washington State

Buying your first home is one of the most significant financial steps you will take in your lifetime. In Washington State, the process is made more accessible thanks to a wide range of assistance programs designed specifically for first-time buyers. From down payment assistance to low-interest loans, and from education programs to tax credits, this comprehensive guide will help you understand the resources available in 2025 and how to take full advantage of them.