What Is a VA Home Loan?

A VA home loan is a mortgage option backed by the U.S. Department of Veterans Affairs (VA), designed specifically for eligible military borrowers. VA loans are provided by private lenders (such as banks or mortgage companies) and partially guaranteed by the VA, reducing risk and unlocking significant benefits for buyers.

Key VA Loan Benefits:

- Zero Down Payment: No need to save for a 20% down.

- No PMI (Private Mortgage Insurance): Unlike FHA or conventional loans.

- Competitive Interest Rates: Lower average rates compared to traditional loans.

- Lenient Credit Standards: Flexible FICO score requirements.

- Limited Closing Costs: Capped fees and the ability to negotiate who pays what.

VA Loan Eligibility in WA

You may be eligible if you meet at least one of the following:

- Served 90 consecutive days of active service during wartime

- Served 181 days of active service during peacetime

- Have more than 6 years in the National Guard or Reserves

- Are a surviving spouse of a service member who died in the line of duty

To confirm eligibility, you'll need to obtain a Certificate of Eligibility (COE) from the VA.

Tip: If you're unsure of your eligibility, connect with an expert real estate agent at Withjoy.AI to know more details.

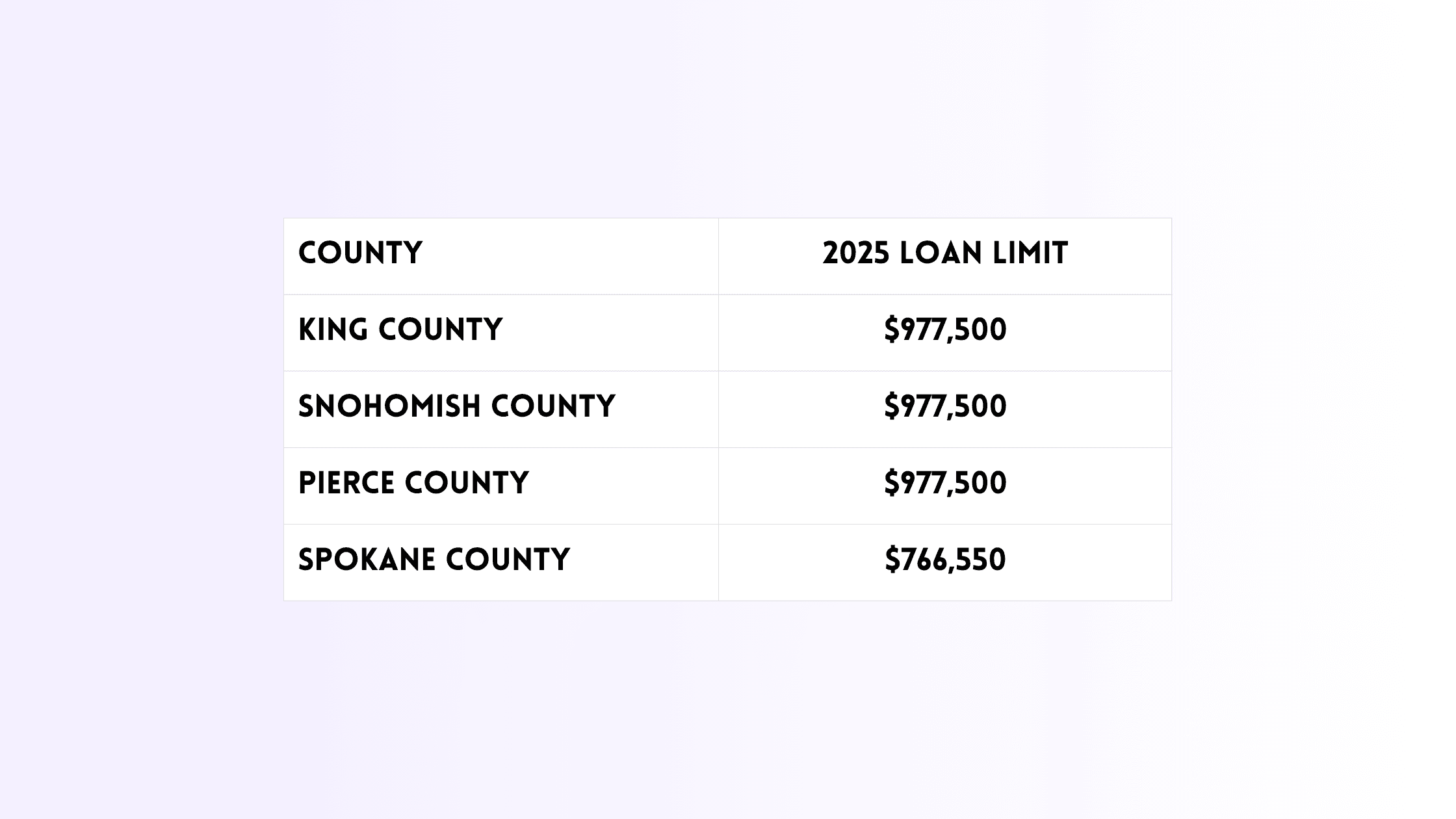

VA Loan Limits in Washington State (2025)

While VA loan limits were removed in 2020 for borrowers with full entitlement, they still apply if you have an existing VA loan or partial entitlement.

VA Loan Limits in King County and Surrounding High-Cost Areas

For amounts above these thresholds, loans are classified as VA jumbo loans.

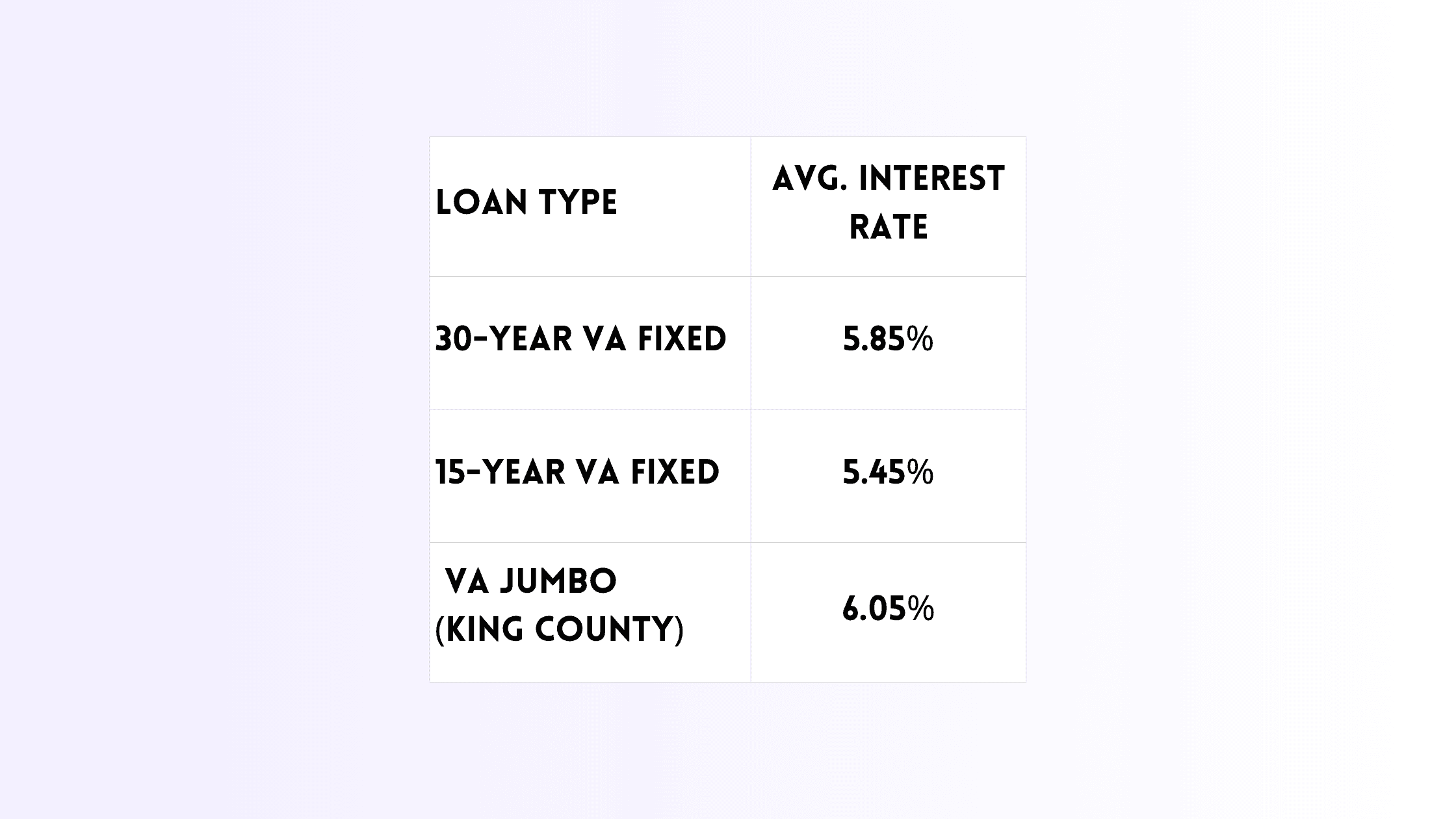

Current VA Mortgage Rates in Washington (June 2025)

Rates may vary by lender, but here’s a general guide, VA loans typically offer lower interest rates than both FHA and conventional loans. Get custom rate quotes from VA-approved lenders or chat with an expert real estate agent from WithJoy.AI.

Types of VA Loans in Washington State

1. VA Purchase Loan

Buy a primary residence with 0% down. Ideal for first-time and repeat buyers alike.

2. VA Jumbo Loan

Buy homes above conforming loan limits (e.g., homes in Seattle, Bellevue, or Redmond). These require slightly stricter underwriting.

3. VA Construction Loan

Finance a custom-built home with 0% down. Must work with VA-approved builders.

4. VA Renovation Loan

Buy and renovate a fixer-upper using a single VA loan.

5. VA IRRRL (Streamline Refinance)

Refinance an existing VA loan to a lower interest rate with less paperwork.

6. VA Cash-Out Refinance

Access home equity, even if switching from a conventional loan to a VA loan.

VA Construction Loans in Washington

Want to build your dream home? VA construction loans in Washington State allow eligible borrowers to finance the building process. These loans are harder to find but offer 100% financing, no PMI, and access to lower rates.

Common requirements:

- Licensed VA-approved builder

- Detailed construction plans

- VA appraisal after home completion

Find VA construction loan lenders in Washington who work in King, Pierce, and Snohomish counties.

Using a VA Loan in Washington’s Major Markets

Seattle & King County

Seattle’s high home prices make jumbo VA loans common. Luckily, lenders here are very experienced with military buyers.

- Conforming limit: $977,500

- Access to VA-approved homes for sale in Seattle

- Frequent use of commission rebate agents in Washington

Tacoma & Pierce County

Home to Joint Base Lewis-McChord (JBLM), Tacoma is a hub for active-duty buyers.

- Great for VA loans in Tacoma and surrounding suburbs

- Access to Pierce County downpayment assistance

Spokane & Eastern Washington

More affordable pricing and access to VA-approved builders make this area ideal for construction or first-time buyers.

Frequently Asked Questions

Can I buy land with a VA loan? Only if you also finance new construction. VA loans can't be used for raw land alone.

Can I use a VA loan more than once? Yes! You can reuse your benefits, even with partial entitlement.

What is the VA funding fee? A one-time fee (typically 2.15% of loan amount) to offset taxpayer costs. Can be waived for disabled veterans.

Can I refinance a non-VA loan into a VA loan? Yes, through the VA Cash-Out Refinance option.

📬 Stay Informed: Home Loan Updates + Buyer Perks

For latest updates on loan rates, housing rebates, and exclusive insights

Why WithJoy.AI is the Best Partner For Your Home Buying Journey

Buying a home with your VA loan benefit should be seamless. That’s where WithJoy.AI shines. We combine smart technology with top-tier human support.

Homebuyers Love Us!

- ✨ AI Home Search Tailored for VA Needs: filter homes eligible for VA financing.

- ⏱️ Fast Tours: Book same-day tours across Washington.

- 💸 Smart Offers + Rebates: Our commission rebate agents in Washington put money back in buyers pocket at closing.

- 📊 Seamless Closing: From inspection to appraisal, we guide the entire process.

Work with a Discount Real Estate Brokerage That Saves Thousands for Homebuyers'

WithJoy.AI is more than a home search tool. We’re a:

- Discount real estate brokerage Washington homebuyers trust

- Discount real estate agent Washington homebuyers recommend

- Commission rebate agent Washington that saves you thousands at close

🏡 Buy smarter, faster, and cheaper with WithJoy.AI the AI powered real estate platform built for modern homebuyers. Reach out now to know more about commission rebate.

Commission Rebate

Adjust slider to see your rebate amount! Based on a 3% commission.

Home price:

$700K

$100K

$500K

$1M

$1.50M

$0

Trusted by Homebuyers at

Logos displayed do not imply corporate endorsement. All logos are trademarks or registered trademarks of their respective owners.

Related Articles

Washington State 1031 Exchange

For real estate investors in Washington,

Washington State FHA Loans: Everything You Need to Know

Navigating the home buying process can be overwhelming especially for first-time buyers. Thankfully,

USDA Loans Washington State

Looking to buy a home outside the hustle of Seattle or Spokane? USDA home loans in Washington State might be your golden ticket. With zero down payment, flexible credit requirements, and competitive rates, these government-backed loans are ideal for qualifying buyers in designated rural and suburban areas.

Frequently Asked Questions

Check out our explainer video for an overview of Joy