Types of Home Loans Available in Washington State

Different homebuyers have different needs. Here’s a breakdown of the most common loan options available in Washington:

1. Conventional Loans

- Backed by Fannie Mae or Freddie Mac

- Minimum down payment: 3–5%

- Typically requires a credit score of 620+

- Private Mortgage Insurance (PMI) required if down payment < 20%

Best for: Buyers with solid credit and steady income, especially in areas like Seattle where high prices may exceed FHA limits.

2. FHA Loans

- Insured by the Federal Housing Administration

- Down payment as low as 3.5%

- More lenient on credit history (580+)

Best for: First-time buyers or those with limited savings or credit blemishes.

3. VA Loans (Veterans Only)

- Backed by the U.S. Department of Veterans Affairs

- 0% down and no mortgage insurance

- Competitive rates and flexible credit requirements

Best for: Eligible veterans, active-duty military, and certain surviving spouses.

4. USDA Loans

- Designed for buyers in rural and suburban areas

- 0% down for income-qualified applicants

- Low PMI and competitive rates

Best for: Buyers in eligible WA regions like Yakima, Walla Walla, or Chelan.📌Eligibility Tool: Use the USDA Property Eligibility Map to check if your target area qualifies.

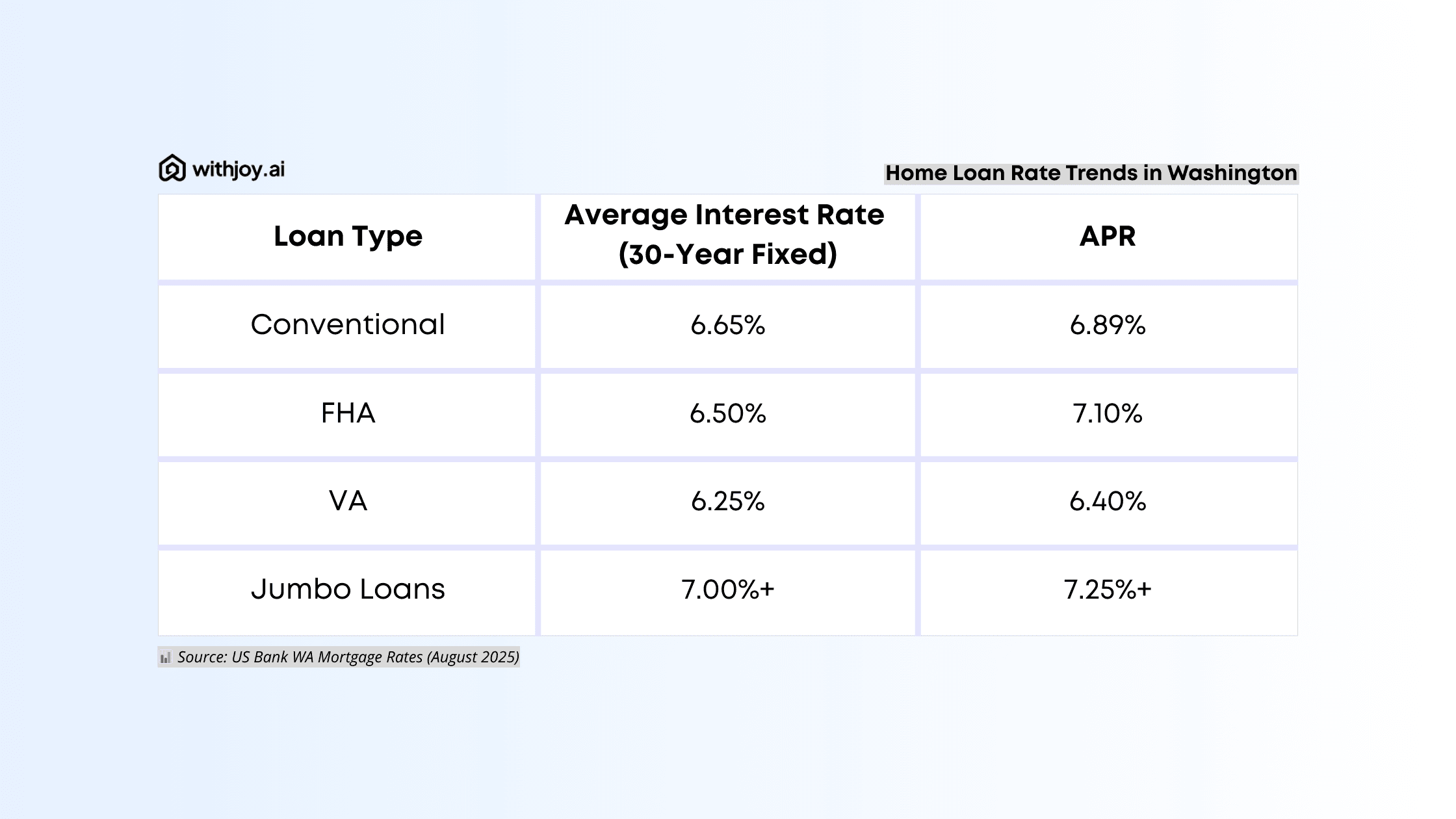

Home Loan Rate Trends in Washington (2025 Snapshot)

📊Source: US Bank WA Mortgage Rates (August 2025)

Rates vary by credit score, loan amount, property type, and lender.

First-Time Buyer Programs in Washington State

Washington offers some of the most supportive homeownership programs in the country. These programs can help reduce upfront costs and monthly payments.

🔹 Home Advantage Program (WSHFC)

- Offers a 0% interest down payment assistance loan

- Available to buyers with incomes under county limits

- Requires homebuyer education course

🔹 House Key Opportunity Program

- Below-market interest rates + DPA

- Ideal for low-income, first-time buyers

- Income and purchase price limits apply

🔹 City-Specific Programs

- Seattle HomeWise: Up to $55,000 in deferred DPA

- Tacoma DPA Program: Forgivable loans after 5 years

- Spokane SHIBA: Income-based down payment help

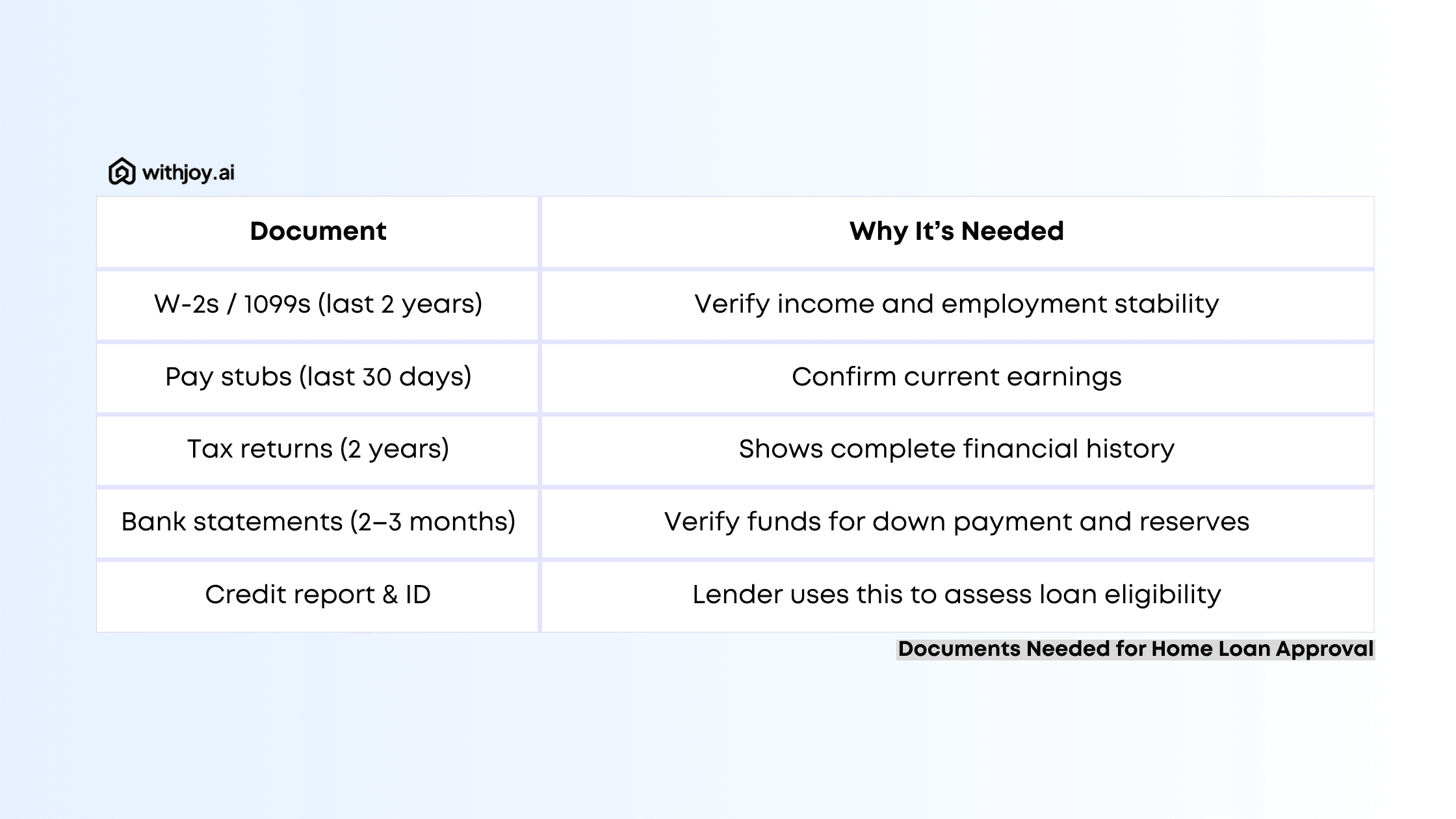

Documents Needed for Home Loan Approval in WA

Here’s what you’ll typically need to submit during your mortgage process. Prepare these early to avoid delays. Many Washington lenders allow secure digital uploads for faster underwriting

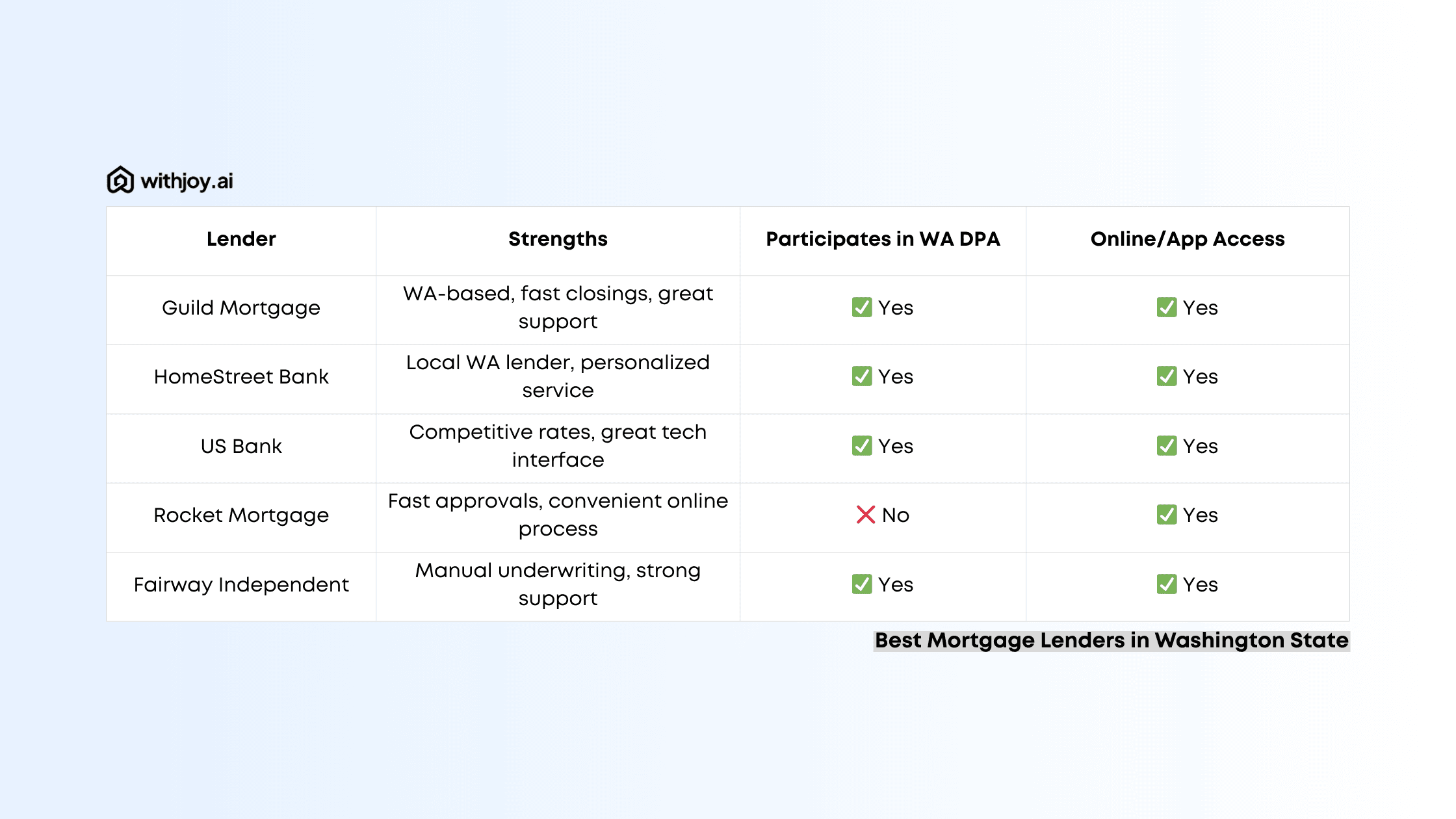

Best Mortgage Lenders in Washington State (2025)

Always compare Loan Estimates to catch hidden fees. For tips, read our article on How to Compare Lenders Smartly.

📺 Watch: Understanding Mortgages in Washington

Buying a home is one of the biggest financial decisions you'll ever make, and understanding mortgages is crucial to making the right choice. In this video, we’ll simplify the mortgage process so you can feel confident in your home-buying journey!

Hidden Fees to Watch For in WA Mortgages

Even with a low rate, fees can balloon your upfront cost. Keep an eye out for:

- Loan origination fees (often 0.5% - 1%)

- Rate lock fees

- Appraisal rush charges

- Title & escrow markups

- Unnecessary document fees

✅ Request a Loan Estimate (LE) from each lender and compare closely.

Maximize Savings with a Commission Rebate

Choosing a smart loan is just one half of your cost-saving strategy. The other? Your real estate agent. At WithJoy.AI , we help Washington buyers save up to thousands through a powerful buyer rebate program.

Here's how:

- 70% of our buyer agent commission is refunded.

- Used to offset closing costs or buy down interest rate

- With any lender or loan program of your choice

📩 Subscribe for Weekly Updates

Get expert guidance on interest rates, loan options, rebates, market insights, and property alerts sent straight to your inbox every week.

Why More Washington Buyers Are Choosing WithJoy.AI?

If you're looking to save thousands on your next home purchase, there's a smarter way to buy: WithJoy.AI.

🏡 A Discount Real Estate Agent That Works for You

WithJoy.AI is a next-gen platform offering discount real estate services in Washington without cutting corners on expertise or service quality. Our technology connects you with expert, local agents while drastically reducing your commission costs.

💸 Real Estate Commission Rebates That Put Cash in Your Pocket

Unlike traditional brokerages, WithJoy.AI offers one of Washington's best home buyer rebate programs, helping you get a significant cashback on home purchase. You can get up to 70% of your buyer agent's commission refunded that’s thousands of dollars back to you.

🤖 Smart, Streamlined Homebuying

Our AI platform helps you: Discover properties faster, Schedule instant home tours, Craft smarter offers with confidence

💬 Why Buyers Are Making the Switch

Whether you're searching for a discount real estate agent, need a real estate commission rebate, or simply want a better way to buy, WithJoy.AI gives you everything you need without the unnecessary costs.

✅Save Money. Buy Smarter.Explore homes and claim your realtor commission rebate at WithJoy.AI. Washington’s top discount real estate brokerage is just a click away.

Rated by satisfied customers

Reviews from our Homebuyers

Related Articles

USDA Loans Washington State

Looking to buy a home outside the hustle of Seattle or Spokane? USDA home loans in Washington State might be your golden ticket. With zero down payment, flexible credit requirements, and competitive rates, these government-backed loans are ideal for qualifying buyers in designated rural and suburban areas.

Washington State FHA Loans: Everything You Need to Know

Navigating the home buying process can be overwhelming especially for first-time buyers. Thankfully,

VA Home Loans in Washington State

Veterans, active-duty service members, and eligible surviving spouses have a powerful tool in their path to homeownership: the VA home loan. In Washington State, where housing markets like Seattle, Tacoma, and King County remain competitive, a VA loan can give you a serious edge.

Frequently Asked Questions

Check out our explainer video for an overview of Joy