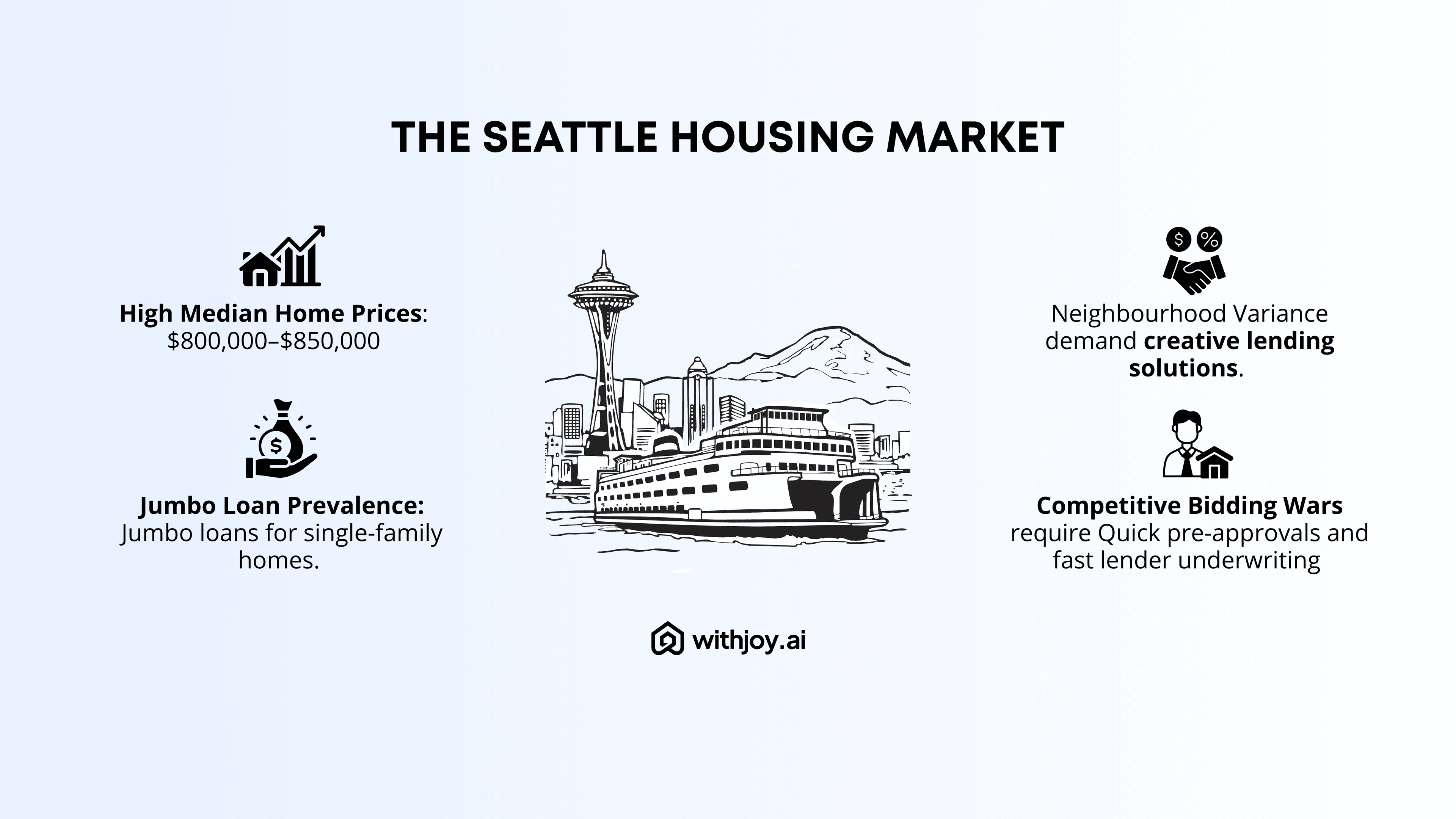

The Seattle Housing Market: Why It’s Unique

Seattle’s housing market consistently ranks among the hottest in the country. Demand is driven by tech giants like Amazon and Microsoft, while the city’s limited land supply and zoning laws keep inventory tight. Key factors that shape Seattle’s lending landscape:

- High Median Home Prices: As of 2025, the median home price in King County hovers around $800,000–$850,000, requiring either larger down payments or specialized loan products.

- Jumbo Loan Prevalence: Because conforming loan limits in King County are $977,500 in 2025, many Seattle buyers need jumbo loans for single-family homes.

- Competitive Bidding Wars: Quick pre-approvals and fast lender underwriting can be the difference between winning or losing a property.

- Neighbourhood Variance: While a West Seattle bungalow may be affordable with conventional financing, luxury condos in South Lake Union demand creative lending solutions.

👉 In short: working with the right mortgage lender in Seattle means more than getting a good interest rate, it’s about having a lending partner who understands the local market.

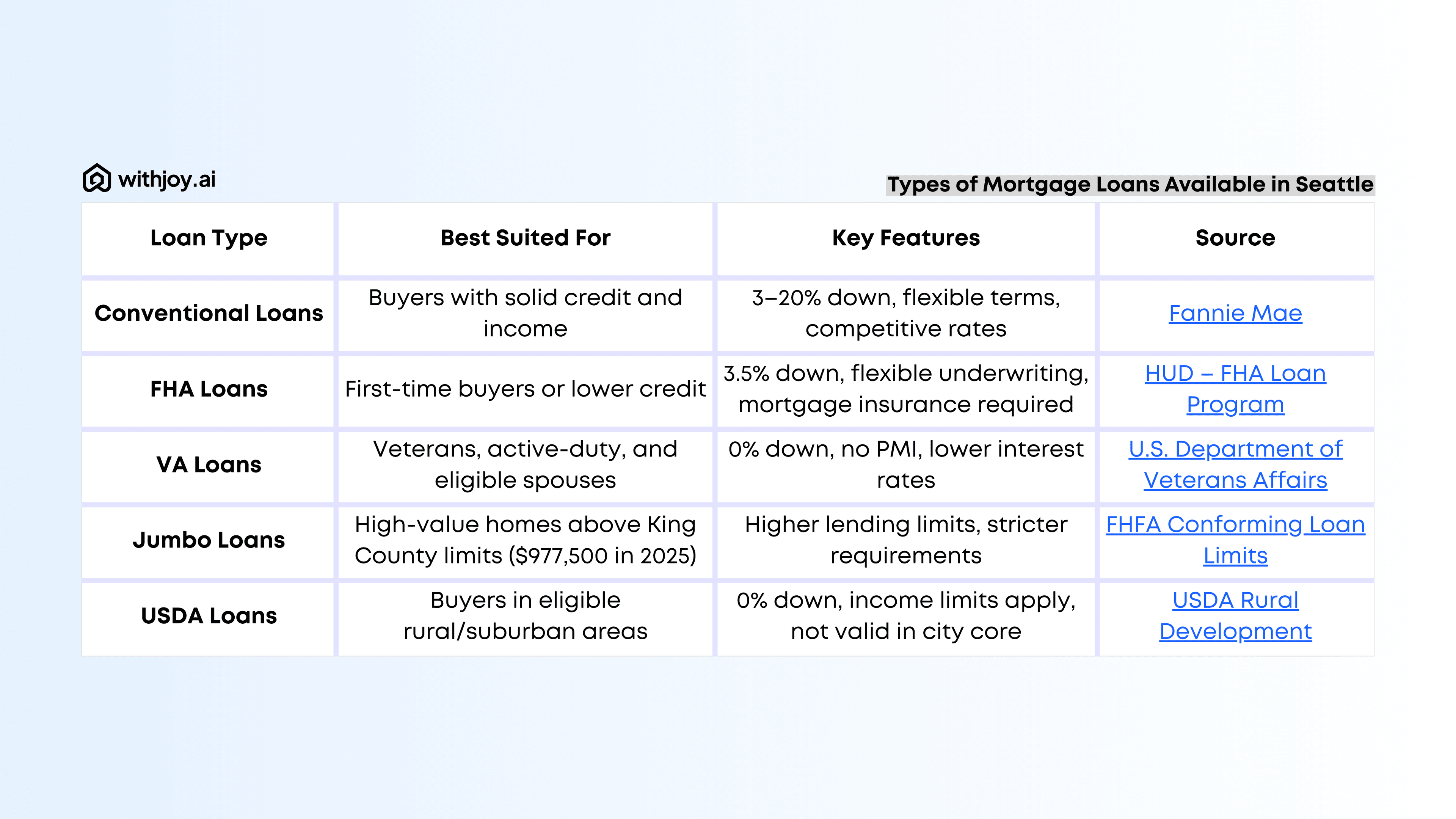

Types of Mortgage Loans Available in Seattle

When choosing a mortgage lender, Seattle buyers must first understand their loan options. Here’s a deeper breakdown:

Seattle’s homebuyers often fall into two main categories: first-time buyers needing flexible programs (FHA/VA) and high-income buyers purchasing luxury or high-cost homes (Jumbo loans).

Best Mortgage Lenders in Seattle (2025 Edition)

Choosing the right lender depends on your financial profile, home goals, and need for speed. Here are some of Seattle’s top-rated mortgage lenders:

1. HomeStreet Bank

- Local Seattle presence and reputation

- Great for jumbo loans and personalized underwriting

- In-house processing makes closings faster

2. Guild Mortgage

- Strong first-time buyer focus

- Offers FHA, VA, and Washington State down payment assistance guidance

- Good mix of in-person and digital services

3. Seattle Credit Union

- Member-focused lending with lower rates and fees

- Flexible terms for buyers with non-traditional credit histories

- Great customer service reputation

4. Caliber Home Loans

- National reach but strong presence in Washington

- Popular for renovation loans and flexible qualification programs

5. Rocket Mortgage / Better.com

- Streamlined digital application process

- Great for tech-savvy buyers

- Downsides: weaker local appraisal and agent relationships

👉Pro Tip: Always compare at least three Loan Estimates (LEs) before making a decision. Look beyond interest rates, compare APR, origination fees, lender credits, and closing timelines.

Seattle Mortgage Rates in 2025

Mortgage rates have been fluctuating in recent years, making it even more important for buyers to shop around.

- 30-Year Fixed Rates: Around 6.2% - 6.8% (as of mid-2025)

- 15-Year Fixed Rates: Around 5.5% - 5.9%

- Jumbo Loan Rates: Slightly higher than conforming, averaging 6.6%–7.1%

- FHA/VA Rates: Often lower than conventional, depending on credit

👉 Track live Seattle mortgage rates using resources like Bankrate or Freddie Mac.

Down Payment Assistance in Seattle

The high cost of entry is Seattle’s biggest barrier for buyers. Thankfully, several down payment assistance (DPA) programs are available:

Seattle Office of Housing HomeWise Program

- Up to $55,000 in deferred loans for down payments

- 3% simple interest, repayable when you sell or refinance

- Must purchase within city limits

Washington State Housing Finance Commission (WSHFC)

- Statewide programs offering second mortgages or forgivable loans

- Income-based eligibility

- Must complete homebuyer education course

Tacoma DPA Programs (for nearby buyers)

- Forgivable loans up to $20,000

- Five-year occupancy requirement

👉 Full details: Washington State Housing Finance Commission.

FAQs About Mortgage Lenders in Seattle

1. What credit score do I need to buy a home in Seattle?

Most conventional lenders require a minimum 620 credit score. FHA loans allow scores as low as 580 with 3.5% down.

2. Should I use a mortgage broker or a direct lender?

- Direct lenders (banks, credit unions) offer in-house underwriting.

- Mortgage brokers shop multiple lenders for you, sometimes finding better deals.

3. How much do closing costs run in Seattle?

Expect 2–5% of loan amount in closing costs. On an $800,000 home, that’s $16,000 - $40,000.

4. Do I need a jumbo loan in Seattle?

If your loan amount exceeds $977,500 (2025 conforming limit for King County), yes, you’ll need a jumbo loan.

Watch: Understanding Mortgage Lenders in Seattle 🎥

Choosing the right mortgage lender is one of the most important steps when buying a home. With so many options, it can feel overwhelming.

In this video, we’ll walk you through how to research lenders, compare rates & terms, and evaluate lender reputation & customer service, so you can make the best choice for your home loan.

Watch Video or Tap below to connect with our experts.

Final Thoughts: Your Lender + Your Brokerage = Success

A good lender opens the door to financing, but the right brokerage ensures you save money when buying your Seattle home. That’s where we come in.

📩 Subscribe For More Housing Insights

Join our free email list to stay updated on Seattle mortgage rates, housing trends, money-saving strategies & more!

Why More Washington Buyers Are Choosing WithJoy.AI

If you're looking to save thousands on your next home purchase, there's a smarter way to buy: WithJoy.AI.

🏡 A Discount Real Estate Agent That Works for You

WithJoy.AI is a next-gen platform offering discount real estate services in Washington without cutting corners on expertise or service quality. Our technology connects you with expert, local agents while drastically reducing your commission costs.

💸 Real Estate Commission Rebates That Put Cash in Your Pocket

Unlike traditional brokerages, WithJoy.AI offers one of Washington's best home buyer rebate programs, helping you get a significant cashback on home purchase. You can get up to 70% of your buyer agent's commission refunded, that’s thousands of dollars back to you.

🤖 Smart, Streamlined Homebuying

Our AI platform helps you - Discover properties faster, Schedule instant home tours, Craft smarter offers with confidence

💬 Why Buyers Are Making the Switch

Whether you're searching for a discount real estate agent, need a real estate commission rebate, or simply want a better way to buy, WithJoy.AI gives you everything you need without the unnecessary costs.

Rated by satisfied customers

Reviews from our Homebuyers

Frequently Asked Questions

Check out our explainer video for an overview of Joy

Related Articles

Seattle Housing Market

Seattle, Washington, is renowned for its vibrant tech industry, stunning natural landscapes, and dynamic urban culture. However, its housing market has become a focal point of discussion due to high costs, fluctuating trends, and affordability challenges. This article provides an in-depth exploration of the Seattle housing market in 2025, covering median home prices, property values, real estate trends, housing affordability, and market forecasts, supported by data, charts, and expert insights. Whether you're considering buying a home in Seattle, investing, or simply curious about Seattle real estate prices, this analysis offers a detailed roadmap.

Home Loans in Washington State

Buying a home in Washington isn’t just about choosing the right neighborhood or saving for a down payment, it’s about making smart financial decisions around your mortgage.

Buyer Agent Commission Rebate Seattle

Get Up to 70% of the buyer’s agent commission back when you buy in Seattle!