What Is the Washington State Housing Finance Commission?

The Washington State Housing Finance Commission or WSHFC is a state-run agency helping low- to moderate-income residents become homeowners through affordable financing options.

Their down payment assistance programs (DPAs) reduce the upfront costs of buying a home by offering low-interest or deferred-payment loans.

Why Down Payment Assistance Matters in Washington State?

With median home prices well above the national average, especially in Seattle, Bellevue, and Tacoma, a modest starter home can require $20,000–$50,000+ upfront.Down payment assistance can:

- 🚀 Lower the entry barrier for homeownership.

- 💵 Let you keep more cash in savings.

- ⏳ Speed up your buying timeline.

📊Example: A $500,000 home with 3% down needs $15,000 upfront. WSHFC assistance could cover much of this, helping you buy sooner without draining savings.

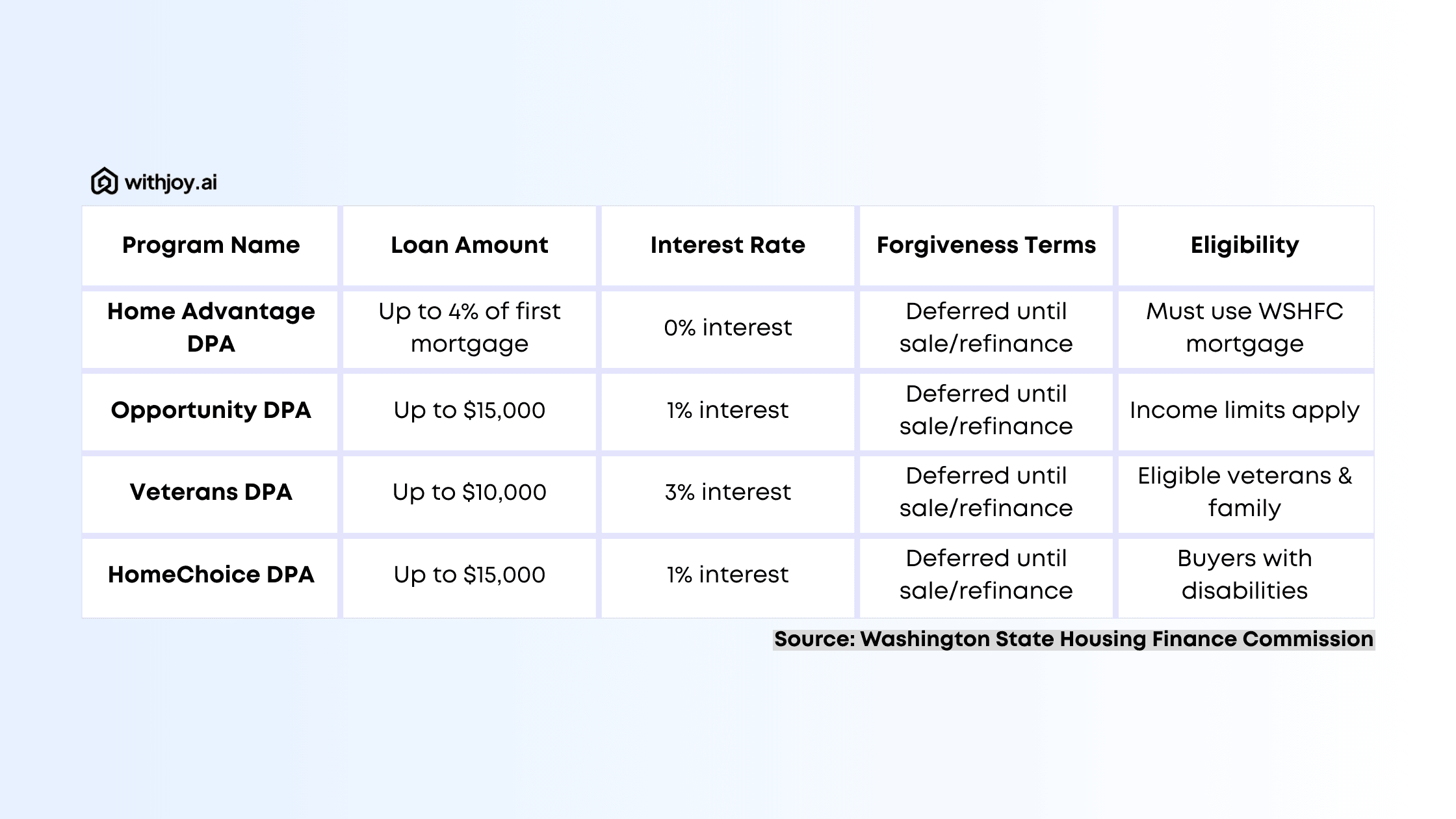

Ranked List: Best WSHFC Down Payment Assistance Programs🥇

(This section is in plain text for SEO ranking — table is included below for visuals.)

Home Advantage DPA – Up to 4% of your first mortgage amount, 0% interest, deferred until sale or refinance. Most popular and flexible.

Opportunity DPA – Up to $15,000, 1% interest, deferred until sale or refinance. Designed for moderate-income buyers.

HomeChoice DPA – Up to $15,000, 1% interest, for buyers with disabilities or family members with disabilities.

Veterans DPA – Up to $10,000, 3% interest, for eligible veterans and their families

A Comparative View

(Source: Washington State Housing Finance Commission)

Eligibility for WSHFC DPA Programs

General rules for most programs:

- Income Limits – Varies by program and county. Example: King County limit for Home Advantage is up to $180,000/year.

- First-Time Homebuyer Status – Haven’t owned a home in the past three years (exceptions apply).

- Homebuyer Education – Mandatory completion of a WSHFC-approved course.

- Purchase Price Caps – Homes must be within county-specific limits.

- Approved Lender – Must work with a WSHFC-partner lender.

How to Apply for WSHFC DPAs?

🎓 Complete your WSHFC homebuyer education course.

🤝 Choose an approved WSHFC lender.

🏦 Get pre-approved for a WSHFC mortgage.

🔍 Shop for a qualifying home.

✍️ Close with down payment assistance applied.

Advantages of WSHFC Assistance

No monthly payments until you sell or refinance.

Low or zero interest rates.

Can combine with other grants or assistance programs.

Helps keep savings intact for renovations or emergencies.

Common Misconceptions About DPAs

“It’s only for low-income buyers” — ❌ False. Middle-income buyers can qualify.

“It’s free money” — ❌ False. Most are deferred loans, not grants.

“It slows closing” — ❌ False. An experienced lender can make it seamless.

FAQ: Washington State Down Payment Assistance❓

Q1: Can I combine WSHFC assistance with city programs?

Yes. Many buyers combine WSHFC loans with programs like Seattle’s HomeWise or Tacoma’s forgivable loans.

Q2: Do I have to repay the assistance?

Most programs are deferred loans, you repay when you sell, refinance, or pay off your mortgage.

Q3: How long does it take to get approved?

If you’ve completed your homebuyer education, approval can happen in as little as a few weeks, depending on lender efficiency.

Q4: Is there a minimum credit score?

WSHFC doesn’t set a universal minimum, but most lenders require at least 620–640.

Q5: Can I use DPA for investment properties?

No. These programs are for primary residences only.

📩Sign Up For Email Updates

Insider buying tips for Washington State. Strategies to combine rebates & assistance.

Final Tips For Washington Homebuyers🏠

If saving for a down payment feels overwhelming, WSHFC programs can turn homeownership into a reality much sooner than you think.

💡Pro Tip: Pair WSHFC assistance with a buyer commission rebate from a brokerage like Joy.Homes to maximize your savings.

Why More Washington Buyers Are Choosing WithJoy.AI?

If you're looking to save thousands on your next home purchase, there's a smarter way to buy: WithJoy.AI.

🏡 A Discount Real Estate Agent That Works for You

WithJoy.AI is a next-gen platform offering discount real estate services in Washington without cutting corners on expertise or service quality. Our technology connects you with expert, local agents while drastically reducing your commission costs.

💸 Real Estate Commission Rebates That Put Cash in Your Pocket

Unlike traditional brokerages, WithJoy.AI offers one of Washington's best home buyer rebate programs, helping you get a significant cashback on home purchase. You can get up to 70% of your buyer agent's commission refunded that’s thousands of dollars back to you.

🤖 Smart, Streamlined Homebuying

Our AI platform helps you: Discover properties faster, Schedule instant home tours, Craft smarter offers with confidence

💬 Why Buyers Are Making the Switch

Whether you're searching for a discount real estate agent, need a real estate commission rebate, or simply want a better way to buy, WithJoy.AI gives you everything you need without the unnecessary costs.

✅Save Money. Buy Smarter.Explore homes and claim your realtor commission rebate at WithJoy.AI. Washington’s top discount real estate brokerage is just a click away.

Related Articles

Washington State FHA Loans: Everything You Need to Know

Navigating the home buying process can be overwhelming especially for first-time buyers. Thankfully,

Washington State Down Payment Assistance Programs

Buying your first home in Washington State can feel overwhelming not just because of rising home prices, but because of how difficult it can be to save for a down payment. With median home values in Seattle approaching $750,000 in 2025, even a modest 3.5% down payment on an FHA loan means coming up with over $26,000 not to mention closing costs and moving expenses.

VA Home Loans in Washington State

Veterans, active-duty service members, and eligible surviving spouses have a powerful tool in their path to homeownership: the VA home loan. In Washington State, where housing markets like Seattle, Tacoma, and King County remain competitive, a VA loan can give you a serious edge.

Rated by satisfied customers

Reviews from our Homebuyers

Frequently Asked Questions

Check out our explainer video for an overview of Joy